Let’s Talk About How to Create a Budget and Stick to It without Living an Utterly No-Fun Life!

Written By Tiffany Woodfield, Financial Advisor, TEP®, CRPC®, CIM®

If you’re anything like most people, Budgeting 101 was not a class that you took in school.

While many of us wish that we could have learned to budget at a much earlier age, it’s never too late to learn to budget.

Unfortunately, the word budget often conjures up negative feelings.

It is like looking in the mirror: you can find out a lot about yourself once you start looking at what you spend on. When I mention budgeting to my clients, they pause and sit up straighter. I think that is because it reminds us of being kids and getting in trouble.

The clients think I am going to come down on them and tell them that they are spending too much or question what they are spending.

Ultimately, talking about budgeting makes us feel vulnerable.

But budgeting may be necessary if you want to build wealth, be rich, and feel true financial freedom.

A Budget Is Just a List of Needs

So, I prefer to tell clients that a budget is a list just for you to begin to understand your needs and what you spend. You cannot move on to the next level until you understand where you are currently at. In my experience, everyone spends differently, and the most important question is the following:

“Is that what you want to spend on?”

In reality, everyone defines the term expensive differently.

What is expensive to me might be worth it to you. Generally, something is considered expensive when we spend on it even though it doesn’t give us value or we don’t value it.

A budget can be as simple or as complicated as you want, but in the most basic form, it is a piece of paper with what you spend in specific areas over a set period. It is most valuable when you track it over time.

If you are ready to understand where your money goes, the best starting point is to create a budget.

Keep in mind that a budget is only good if you are clear and honest with yourself about what you are spending. I suggest doing it first just for yourself so you can really look at what you spend your money on and stop the judgment.

Table of Contents

- What is a basic budgeting process?

- What are some key components of successful budgeting?

- What are the five basic elements of a budget?

- What is good debt?

- What is the 50-30-20 rule?

- What is the 30-day rule?

- What is an example of a simple budget?

- How should a beginner start budgeting?

- What is the difference between saving and budgeting?

- What are some top budgeting tips?

- What is budget management?

- How I Approach Budgeting and Money Money Management in My Own Daily Life

- Budgeting is Crucial

What is a basic budgeting process?

Now that you have gotten over the fear of starting a budget, you may be wondering what a basic budgeting process is.

It is very simple: You first calculate how much money you have coming in each month, and then you look at your expenses and where your hard-earned money is going.

Next, you reflect on these expenses, evaluating whether there were any surprises or this is what you expected.

You may be able to see a spending pattern.

Afterward, you create a long-term goal of more than five years, a medium-term goal of three to five years, and a short-term goal to be achieved within a year.

Once you have created these goals, the next step is to create a plan to reach your short- and long-term goals and, most importantly, keep tracking your spending.

BUDGETING EXAMPLE

I worked with a client who ate out at least eight times a week and was spending an enormous amount of money on food.

She was shocked when she actually looked at the expenses for the month. While she loved eating out, she said she didn’t necessarily love the lunches out and could easily cut these. Dinners were how she treated herself, and she was okay with spending on dinners.

Nevertheless, this may still seem like a lot to you, considering what you perceive as expensive.

My client said she didn’t spend much on clothing or shoes, so going out to eat was her “treat” and an expense she was comfortable with.

Apply this concept to yourself.

What do you LOVE spending on? And what feels expensive and not worth it? Make sure your spending aligns with what you value.

What are some key components of successful budgeting?

The following are some key components of successful budgeting:

- Be honest when looking at your expenses.

- Be realistic when setting your goals.

- Set aside funds in a separate account to help you reach your goal.

- Continue to track your expenses and make yourself accountable.

- Create a reminder in your calendar or an app to check in on the status of your savings. Reward yourself in alignment with what fills your cup.

- If you are comfortable, get an accountability partner who can support you. For example, if you have a friend you always go out to dinner with, share your goal with them and ask if they can help you stay on track. Consider taking turns making dinner instead of going out.

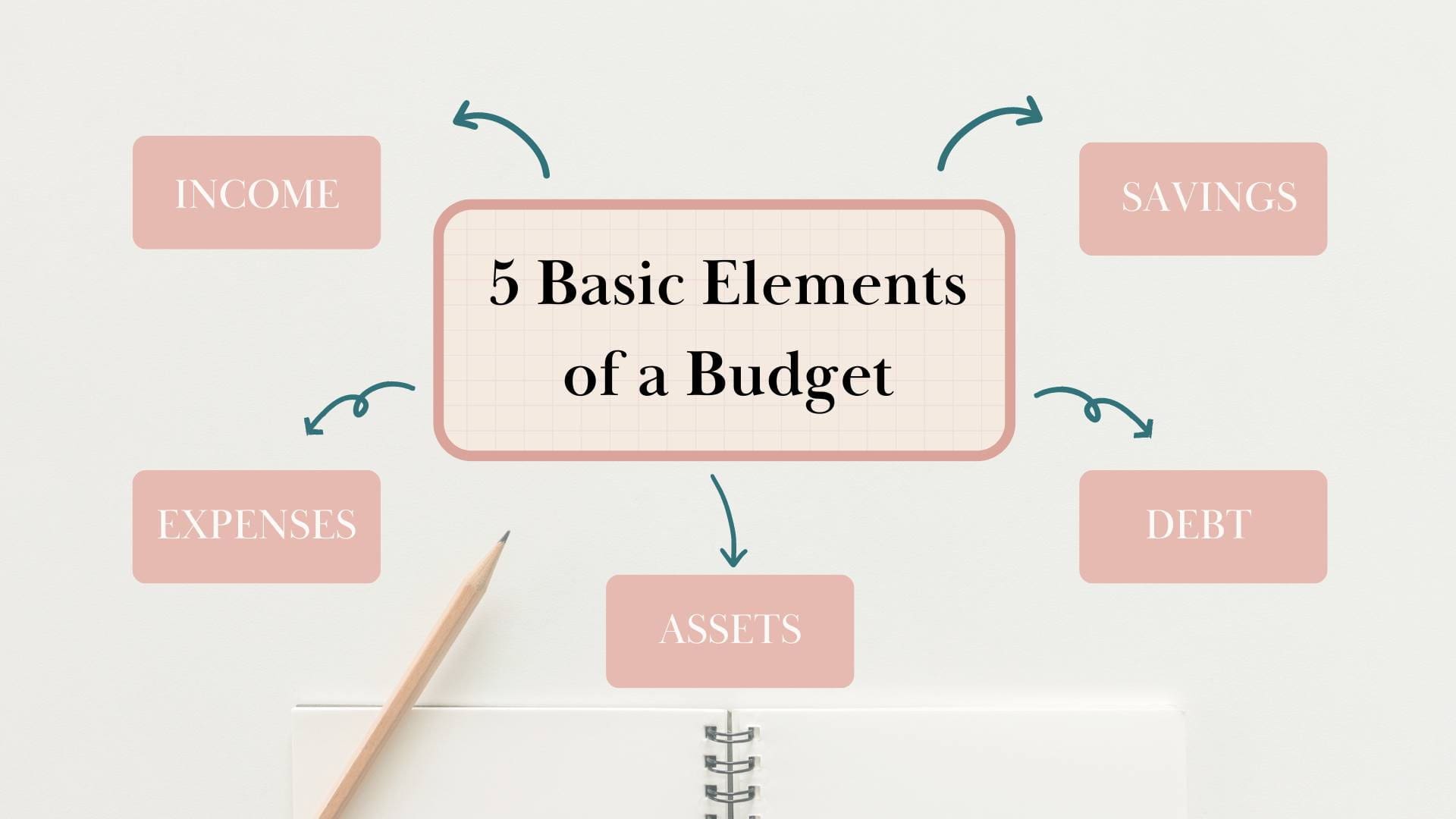

What are the five basic elements of a budget?

These five elements of a budget are critical to consider when you’re creating a financial plan that helps you build towards a work-optional lifestyle and financial freedom.

The following are the five basic elements of a budget:

1. INCOME

The first element of your budget is income, in other words, how much money you are currently bringing in. Consider all sources such as employment income, rental income, investment income, pension income, and/or trust fund income.

2. EXPENSES

Second, look at your expenses and separate them into fixed expenses such as a mortgage, rent, car payments, or anything else that regularly exits your account each month.

Then look at flexible expenses such as gifts, clothing, and entertainment.

Your flexible expenses will constantly change, so it is essential to track them each month as you will find that these expenses are higher in some months than in others. By tracking these, you really get insight into where your money is going and when you tend to spend more. For example, many people spend more on entertainment in the summer when the weather is nice.

Other people spend more in the winter because of vacations.

If you know you have a vacation every year, it is important to estimate at first how much you will spend and update this amount when you get the final bill.

3. SAVINGS

Next, consider your savings and how much money you are putting aside for your future goals, such as retirement, investing in a business, or purchasing or upgrading your home.

One of the biggest mistakes I see people make is spending everything they earn. It is much easier to put your head in the sand, neglecting the future and rewarding yourself today instead.

Perhaps you think to yourself: “I deserve this trip, outfit, concert, new car,” or, “I work so hard and make good money, so I should treat myself.”

We are in a society that is very much saturated with social media, constantly looking for instant gratification and comparing ourselves to others. We get influenced by what others do, what holidays they go on, and so on, and we start wanting the same for ourselves too.

Then, the next new thing comes along, and we want that as well. It is a never-ending loop.

The fact is that it is taboo to talk about money and even more taboo to talk about the lack of it. This leads to so many people trying to impress their neighbours, who are also trying to impress their neighbours, and so on.

Unfortunately, we never stop to look in the mirror, and this is where a budget comes in handy.

I prefer it to be a measure to ensure accountability for what you are doing before it is too late.

We don’t know anyone else’s financial situation and whether they have a trust fund or are knee-deep in credit card debt; hence, you need to understand and focus on your own financial situation and be on track toward your goals.

Also, keep in mind that comparing yourself with others is a loss on both ends: if you think that you are doing better than others, a part of you will feel like a bit of a jerk, and if you yearn for what they have, a part of you will feel inferior. The only way to feel at peace is to compare yourself to yourself and reflect on your own goals because this is all you have control of. The sooner you realize and hone in on this, the happier and freer you will be.

4. DEBT

Next is debt. You may have heard the saying, “There is good debt, and there is bad debt.” This means that if you are carrying credit card debt with interest rates of around 19% or more, you need to pay off this debt as soon as possible.

When creating a budget, you should note how much you will need to pay each month to eliminate your credit card debt.

If you are one of those people just making the minimum payment on your credit card, you need to aim to pay off your balance each month.

Do not treat a credit card as a bank account.

If you take cash out from your credit card, you do not get an interest-free period, and you usually pay more than your regular balance. See the link below for more information.

5. ASSETS

Last, consider what assets you have, including cash, property, investments, stocks, bonds, and trusts. These can be used in an emergency, for future purchases, or when you want a work-optional lifestyle.

What is good debt?

When someone asks me what good debt is, the best example I give is a mortgage.

This is because you need somewhere to live, and the rate is lower than credit card debt because it is secured by a property, and it can be considered forced savings because you have to pay off principal and interest each month.

Another form of good debt is the debt used to create an income, such as when you borrow money to purchase a rental property or make investments to generate income. This is usually tax deductible in Canada; hence the expense can be subtracted from your gross income before calculating your taxable income.

So if you lower your taxable income, you are lowering the number multiplied by your current tax rate.

In the US, some examples of “good debt” that can be deductible are qualifying mortgage interest, student loan interest, interest for income-producing activities, and investment interest.

But before you rush out and think you want to get good debt, first, get rid of any bad high-interest rate debt and then speak to your accountant to confirm that what you are considering taking on for debt qualifies as good debt.

In addition to the more common deductions and, therefore, “good debt,” the IRS allows you to deduct the interest on your home as well as interest on student loans.

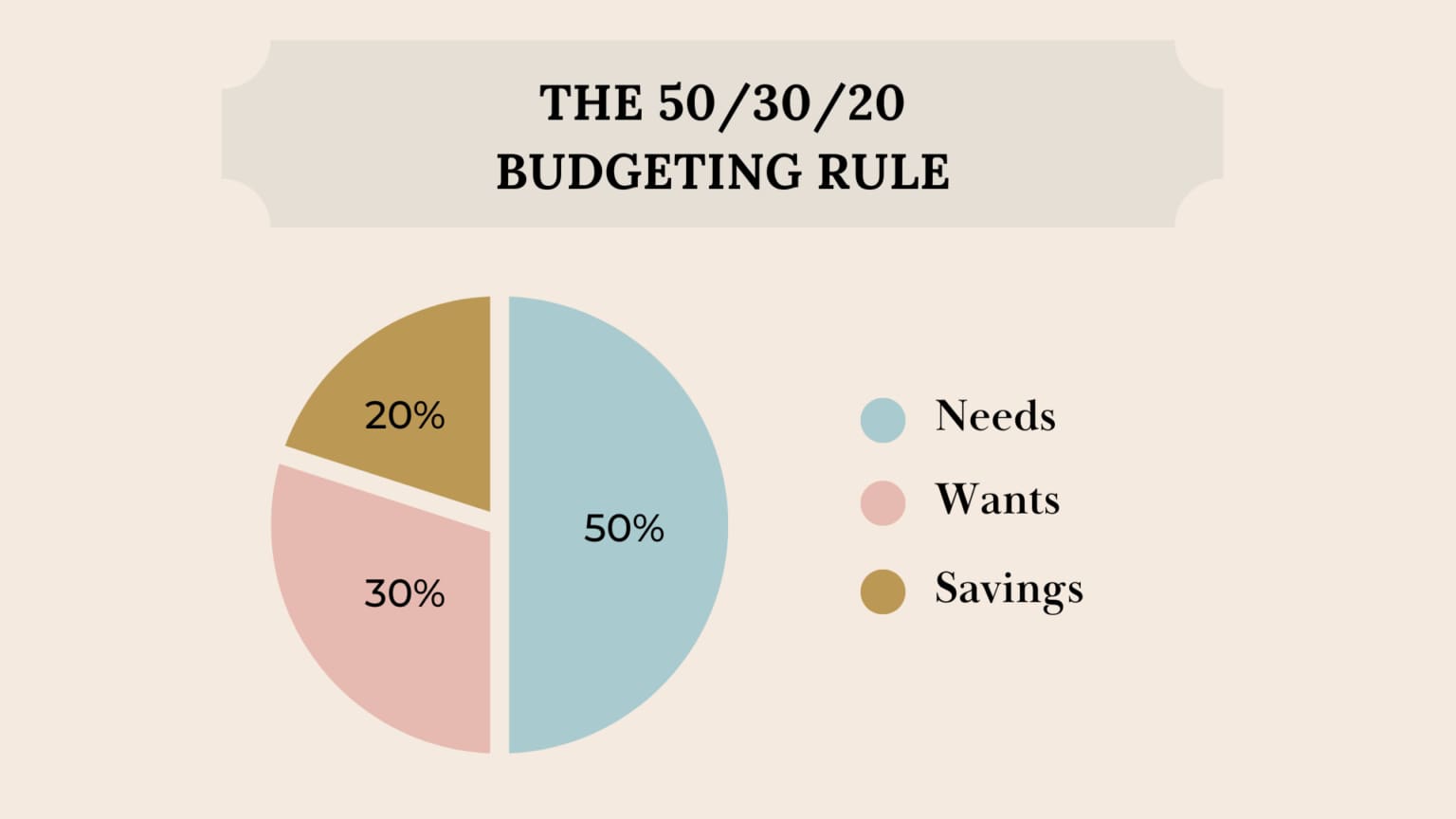

What is the 50-30-20 rule?

You are out for dinner with your girlfriends, and one of them is talking about setting money aside for her big trip to Europe and how she is really watching what she is spending.

You wonder how she always seems to have enough money to be able to do really cool things. She also never seems to question her financial decisions.

When you ask her how she accomplishes this, she tells you that she follows the 50-30-20 budget rule.

The what?

The 50-30-20 rule sets out that you should spend up to 50% of your take-home income on needs and payments you are obligated to make.

You then split the remaining 50% two ways: 20% for savings and any repayment of debt and 30% to spend on anything you want.

This method is effective because it is structured.

You can even have separate bank accounts so that it happens automatically, and you get to enjoy yourself along the way. It also means that when you earn more income, more income goes towards savings or debt repayment, but you can also enjoy the added income to do things you want.

Often, people don’t stick to a plan or budget because either it is too difficult to follow and track or it doesn’t offer anything to reward them at the moment. However, one of the things I love about this plan is that it takes away the guilt we feel when we do something for ourselves, whether that is buying a great pair of shoes or going out for a beautiful dinner with friends.

Imagine… guilt-free spending!

Now, following the 50-30-20 rule can be troublesome if you don’t earn enough money to only use 50% for current fixed expenses, and with current inflation and things costing more than ever, this may be truer than ever.

So make sure you run the numbers and see if this will work for you. If not, adjust the percentages to reflect what will work for your financial reality.

What is the 30-day rule?

Can you follow the 30-day rule? First, let us explore what it actually is.

The 30-day rule tests how much you really want something and whether waiting for it makes you want it more or less. With the 30-day rule, you challenge yourself to hold off any unnecessary purchases and impulse buys for 30 days.

Then after 30 days, if you are still thinking about those shoes or other products, you can go for it!

This is a great method, especially when, after three months, you realize how much more money you have in your bank account to buy something you really want. It also gives a positive boost to your mood because you feel in control of your spending. I guess the old saying “distance makes the heart grow fonder” doesn’t work the same when it’s applied to an impulse buy.

It’s likely that more than 50% of the time, you will not want the item after 30 days.

What is an example of a simple budget?

The most popular simple budget is the 50/30/20 budget I discussed earlier in this article, but it has its limitations.

If you don’t earn enough only to need 50% of your income for fixed costs, then you need to adjust the ratios.

Another simple budgeting method is the following:

- Look at your paycheck at the start of the month and how much money you take home in a month.

- Write this number down.

- Then, write down how much you pay for fixed costs such as transportation, housing, and food.

- Afterward, calculate the difference and write down a goal for how much you would like to have at the end of the month for savings. Make it a round number that is specific and measurable.

- Then, review how you did at the end of the month.

Following this for at least three months is essential to give yourself a good idea of how realistic it is to save this amount. I also recommend choosing the same day each month to review, and I often recommend it to be a Sunday as it sets the tone for the week.

How should a beginner start budgeting?

First, to start budgeting, acknowledge that it always feels a little daunting when you start something new, and you may feel confused about where to start.

Make sure to recognize that you aren’t alone in these feelings; most people cringe even at the mention of the word budget. The good news is that these same people have come to me over the years and said how great the exercise of budgeting was.

It was like they found money!

That is always a good thing, right?

Another positive aspect is that they felt less overwhelmed and more in control of their finances.

Honestly, the fear of the unknown is often worse than looking at your finances.

So take your head out of the sand, get a blank piece of paper or, ideally, a rules notebook, and start.

- Write down the date and how much money you bring home each month.

- Then write down how much goes out a month.

- Don’t worry about perfecting the numbers, especially for the first month, but be realistic. Once you start tracking and looking at your credit card statements and bank balances, you can see how accurate you are.

- Examine when the money is going out and how much goes toward fixed costs such as rent and mortgage.

- Then look at where you spend your remaining money. How much do you have left over each month?

- Ask yourself if you could set aside some for savings and larger goals.

I always emphasize that the biggest benefit to budgeting is taking ownership of where your money is going by first looking at your numbers and putting them on paper along with the relevant dates and then tracking them for a few months.

This is the most important thing to help you change your behaviour.

In this way, you can notice if you are spending too much on coffee out when you could be spending this money on a trip instead. You also stop wondering where your money goes because you know exactly how it is being spent.

Remember, money is about more than how much you earn: how you spend your money is equally important.

What is the difference between saving and budgeting?

Budgeting is a tool to examine your expenses and income and determine how much you can save.

Budgeting works when you are honest and can determine where your money is going.

On the other hand, saving can be viewed as the result of budgeting and the reward.

Would you be surprised to know that people save more once they create a budget and start tracking where their money goes each month?

Budgeting generates freedom because it enables you to keep track of what you are spending; then, you can set a goal for how much to save and tie this to specific rewards.

After creating a budget, most people find out that they are spending on something that they don’t get value from.

When they see how much the monthly and yearly cost is, they realize that they would rather spend that money elsewhere.

What are some top budgeting tips?

To make any change in your life, you must first accept that change is hard and takes time.

Then, you must acknowledge that you need to take the first step and that it will get easier with time.

The following are some of my top budgeting tips:

- Be honest and brave when looking at your current spending.

- Accept that starting is hard, but know that the rewards are great… I promise!

- Don’t worry about getting the perfect tracker or budget. Just start. Take a blank notebook, write the date, and write down what you take home and spend. You can get more detailed as you go along.

- Be consistent and track for at least three months. This is key to success. To make any impactful change, you need to keep doing it consistently.

- Reevaluate what you have spent on and how you are doing.

- The first month is more for you to gain insight, and the next is for what changes you can make.

Quick Video: Zero-Based Budgeting Basics

Zero-based budgeting can be a smart way to ensure you’re saving, investing, and putting money towards credit card or other debts as well as enjoying your life!

What is budget management?

Budget management is implementing your plan after looking at your current spending habits.

What is your goal, and why did you create a budget?

Is it to save more? To pay down debt or to?

A budget creates accountability for yourself.

It also helps you feel more in control of your financial situation and less like a victim. Ultimately, budget management is managing your behaviour toward money and using a tool to allow you more financial freedom.

I am sure you can relate to having a friend who seems to earn the same amount as you but can go on these elaborate trips or always has a new car.

You might wonder why despite both of you earning the same, they seem to have so much more.

Remember, people spend on different things. We don’t all value the same things.

For example, “expensive” is a relative term: what is expensive to me isn’t necessarily expensive to you. Expensive means we are paying more for something that we see value in.

Also, keep in mind that in our current society, many people are more comfortable with debt, so you aren’t always sure if your friend owns the new boat or car or is just leasing.

Are they paying off their credit card each month or just paying the minimum payment?

Are they more risk-tolerant in that they live for the day and don’t worry about the future?

Again, I emphasize the importance of looking within and listening to yourself.

Ask yourself what your goals are and focus on that. And do not compare yourself with others because you really don’t know anyone else’s financial situation.

How I Approach Budgeting and Money Money Management in My Own Daily Life

I am honest with myself.

When I was a university student living away from home for the first time, I remember I had a credit card for expenses such as food and miscellaneous things.

I had a set amount I could spend each month. A few months in, I lost track of how much I spent, and my visa bill was so high I couldn’t pay it off. I was too embarrassed and scared to tell my parents.

I remember crying in my dorm room.

I had done some simple math, calculating how much interest it would cost me if I didn’t pay it off, which meant I would have less each month moving forward.

I was spiralling, and I didn’t want to tell anyone. I thought my parents would be disappointed in me. Finally, I got up the nerve to ask my parents for advice. It was an excellent learning experience because I learned to open my eyes and face reality.

I track my spending and know where my money goes.

In all honesty, my approach to budgeting now is to stay on track, frequently checking where my money is going and if I am spending it on things I value.

I have learned that I don’t need anything fancy to track my money: I keep a notebook where I track what comes in and goes out.

I also look at the spending that isn’t fixed with a more discerning eye, evaluating and asking myself, “Is this okay?”

I am not judgemental.

One of the biggest lessons I continue to remind myself of is not to judge anyone else’s spending.

We all have our lessons, priorities, and baggage when it comes to money. So we must always remind ourselves that we can only control what we spend on, and when we judge others, we are really judging ourselves.

Budgeting is Crucial

In conclusion, budgeting is a crucial skill for anyone wanting to control their finances and work towards their financial goals.

A budget is a simple process that can be customized to fit your needs and lifestyle. You can successfully manage your money and achieve financial freedom by being honest with yourself, setting realistic goals, and consistently tracking your spending.

Remember that budgeting is a tool to help you, not restrict you and that small changes can lead to big results over time.

Summary of Key Points:

- The basic budgeting process involves calculating your income and expenses, reflecting on your expenses, setting long-term, medium-term, and short-term goals, and creating a plan to reach those goals.

- Successful budgeting requires honesty when looking at expenses, realistic goal-setting, setting aside funds for goals, tracking expenses, creating reminders to check savings status, and optionally having an accountability partner.

- The five basic elements of a budget are income, expenses (fixed and flexible), savings, debt, and assets.

- The 50-30-20 rule is a budgeting method where 50% of take-home income is spent on needs and payments, 20% is saved or allocated to repay debt, and 30% is spent on anything you want.

- Budgeting is a tool to examine expenses and income, determine how much you can save, and manage your behaviour around money to allow more financial freedom.

Related Articles on Budgeting

💎 The 1/3 Rule of Budgeting and Saving, And How to Use It

💎 How to Stick to a Budget Even if You Can’t Stand Budgeting

💎 Budgeting with the 50:30:20 Rule

About the Author

TIFFANY WOODFIELD is a senior financial advisor, estate-planning expert, and dual-licensed portfolio manager based in Kelowna, British Columbia. She is the co-founder of SWAN Wealth Management, where she helps Canadian and cross-border families build lasting wealth, reduce tax risk, and create meaningful legacies.

As a TEP (Trust and Estate Practitioner) and associate portfolio manager, Tiffany works closely with successful professionals, business owners, and internationally mobile families who want to enjoy a more flexible, work-optional lifestyle. She combines deep technical expertise in wealth management with a strong focus on mindset, personal development, and purposeful decision-making.

Tiffany has been a contributor to Bloomberg TV and has been featured in major national and international publications, including The Globe and Mail and Barron’s, for her insights on retirement planning, cross-border wealth issues, and estate planning.

Professional designations:

- TEP® – Trust and Estate Practitioner

- CRPC® – Chartered Retirement Planning Counselor

- CIM® – Chartered Investment Manager