Breakdown of the 1/3 Rule of Budgeting

The 1/3 third rule of budgeting is a financial planning classic. Let’s go over this simple rule of money management in brief, so you can get started budgeting and saving! And scroll down to the bottom to watch my short video about budgeting.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

Q: What is the 1/3 rule for budgeting?

The 1/3 rule of budgeting is a simple financial guideline that suggests allocating your after-tax income into three broad categories: home, living expenses, and saving and investments.

The ⅓ rule for budgeting will help you avoid overextending yourself, particularly when looking to purchase a new home or when finding a place to rent. The rule is that a third of your take-home income should be used towards your home, a third for living expenses, and the last third should be for savings and investments.

While using the 1/3 rule of budgeting is not always realistic, depending on where you live, it is crucial to understand that if you overextend yourself, you will end up being stressed and not enjoying where you live, regardless of how great it initially seemed.

It’s important to note that housing costs for renters include rent and utilities; for owners, it includes your mortgage, utilities, property taxes, and homeowner insurance.

Budgeting and Money Mindset

How can I force myself to budget?

It is normal to find it challenging to make a change and start budgeting.

But whenever we “force” ourselves to do anything, we feel bad.

Whenever you say, “I can’t spend on this” or “I have to budget,” you feel deprived. Instead, train yourself to use the critical phrase “I choose.” Feel the difference between saying, “I can’t spend on this,” versus, “I am choosing not to spend on this.”

I bet you can feel the change in your body. When you say, “I choose.” You feel empowered and in control of your destiny. It is the decision of feeling like a victim versus the hero of your own story.

Sticking to a budget as absolutely possible with the right mindset.

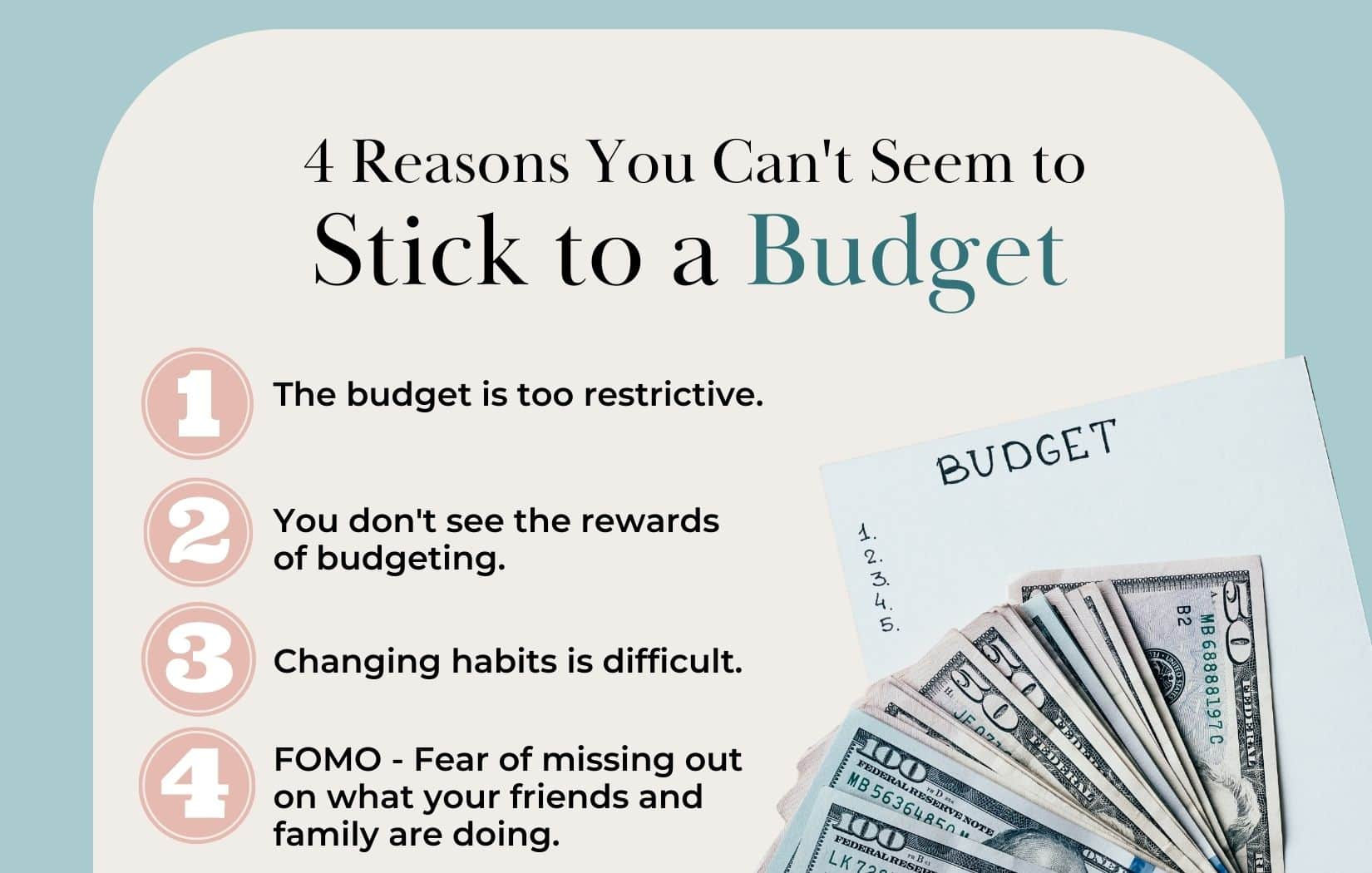

Why can’t I stick to a budget?

There are a few main reasons why you can’t stick to a budget:

- The budget is too restrictive

- You don’t see the rewards of budgeting

- Changing habits is difficult

- FOMO – Fear of missing out on what your friends and family are doing

This first reason is a more straightforward fix as it is logical, so you need to evaluate your budget and make sure it is realistic.

The other reasons are often more difficult to shift because they are based on your subconscious beliefs.

The practical tools, such as a budget tracker, won’t work to unlock your subconscious roadblocks. You are using the wrong key, so the door will never open.

You need to use a different key.

To work on your subconscious roadblocks, you need to look within to understand your beliefs around money that are holding you back. Manifesting and working on limiting beliefs can be helpful. I wrote an article about how to manifest anything, so check that out. In addition, I recommend reading the article I wrote about how to be rich. While the title might feel confronting, it’s full of information and mindset shifts that will help.

Why does budgeting give me anxiety?

The word budgeting often gives people anxiety because they instantly feel like they are doing something wrong and need to change.

A budget is like looking in the mirror at your finances: you are making yourself accountable and facing your fear. To counter this, remind yourself that you haven’t done anything wrong, and it is normal to feel this way.

You reduce your anxiety by acknowledging you aren’t in trouble, bad, or frivolous. And by using positive affirmations such as “I am getting control of my finances,” you reduce your anxiety.

Quick Video: 5 Basic Elements of a Budget that Everyone Needs to Know

These five elements of a budget are critical to consider when you’re creating a financial plan that helps you build towards a work-optional lifestyle and financial freedom.

Related Articles on Budgeting

💎 How to Stick to a Budget (Even If You’re New to Budgeting)

💎 Budgeting 101: How to Create and Follow a Simple Budget

💎 Three Essential Money Management Rules for Growing Your Wealth

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.