How to Stick to a Budget while Still Spending Money on What You Love

…Even if you’re totally new to budgeting or just terrible at sticking to a budget.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

“I just need to know HOW to stick to a budget!”

That might have been the rallying cry in your head as you decided to find help online.

You’ve created a budget (or are thinking about it) but you want to be sure you can ACTUALLY stick to it. There’s no sense trying to budget if you don’t think you’ll be able to follow through.

Here’s the secret: you don’t need to cut all your spending to create a budget and save enough money for your future. In fact, you shouldn’t even try to do that.

A restrictive budget is a recipe for disaster.

But still, if you want financial freedom and time freedom in the future, you need to figure out how to stick to a budget while still getting to spend money on what you love. Yes, it’s important to get your budgeting, saving, and investing organized if you’re looking to grow and manage your wealth successfully.

But you shouldn’t have to sacrifice everything you enjoy doing just to meet your financial goals.

So what to do?

That’s what I’m going to cover in today’s post.

Remember, your budget doesn’t have to be complicated.

Yes, you do need to see where you spend your money and decide if that’s the right allocation.

But it’s also key to understand that creating a budget isn’t just about not spending, and it’s also not just for people who spend more than they earn.

Budgeting is about allocating your money towards the things you love. Budgeting is for people who are wealthy but afraid to spend money. And budgeting is for people who are spending beyond their means.

Everyone should have a budget because a smart budget helps create financial freedom.

So let’s get into this!

(And remember, your budget doesn’t need to be perfect. Pick some tactics below, and get started.)

There are two categories of people who need a budget:

- The first category is people who need to control their expenses because they go into debt each month and can’t get ahead.

- The second and often overlooked category is people who have more than enough money to live to 100 years old and never run out, yet they feel paralyzed when it comes to spending. Using a financial plan and following a budget, they can choose to spend according to their means and enjoy financial freedom.

Table of Contents

- Why It’s Important to Stick to a Budget

- Is It EVEN Possible to Stick to a Budget?

- Strict Budgeting vs. Relaxed Budgeting

- 17 Tips and Strategies for Sticking to a Budget

- Simple Steps to Creating a Budget Plan and Start Saving Money

- One Bank Account vs. Multiple Bank Accounts

- Why Consistency in Budgeting Is Important

- Common Questions about How to Stick to a Budget

Why It’s Important to Stick to a Budget

If you have an exciting financial goal you want to achieve, sticking to a budget is critical.

If you don’t, time goes by, yet you aren’t any closer to your target.

Think of Your Budget as a Guide

You can think of your budget as a guide. OK, so imagine you booked a fabulous trip to Europe; you want to visit so many beautiful places within your time frame.

Before you leave, you write out a list of all the sights you want to see and a detailed itinerary to act as your guide.

Now you’re in Europe.

If you lose your itinerary, how likely will you be to see all the sights?

But if you refer to your itinerary, maybe changing a few things as you go, will you manage to see most of the things you wanted?

Most likely, yes!

Budgeting Works

This is a lighthearted way of saying stick to a budget because it works.

But this metaphor also reminds us of the importance of setting a key intention, making a plan, and taking the necessary steps to achieve it. Your budget needs to take into account your living expenses, debts, and financial goals. It’s an important step in creating the life of your dreams.

Quick Videos: Try Out Values-Based Budgeting!

Find out what value-based budgeting is and why it feels so much better than traditional budgeting. You need to feel good about your budget; values-based budgeting will help you with this.

What is values-based budgeting?

How can I start values-based budgeting?

Is It EVEN Possible to Stick to a Budget?

Of course, it’s possible to stick to a budget! However, setting a realistic goal right from the start is paramount to your success.

If your budget means you don’t have any wiggle room and are depriving yourself of everything you love most, you’re going to run into problems. The likelihood that you stick to a budget that’s unpleasant or not aligned with your values is low.

Think of budgeting as an elastic band. When it’s relaxed, you’re not thinking about what you’re spending or saving.

When we budget, we stretch the elastic out of our comfort zone. But we don’t pull it so hard that it snaps. So, to start, make reasonable and positive changes. To do this, you have to identify your needs and wants and what brings you joy.

Don’t Be Too Restrictive

If coffee at Starbucks is a luxury you value, don’t cut it. But you may be okay cutting down spending at the beauty counter because there’s a bonus you don’t need.

Most people fail at budgeting because they become too restrictive.

You don’t want the elastic to break. But you do want it to stretch. To do that, you need to be able to choose what you’re spending money on. You need to get a little uncomfortable because this is where long-term change happens.

Whether you need to spend less or you should allow yourself to spend more, try to be conscious of your spending and allow your budget to be based on reality, not fear.

Strict Budgeting vs. Relaxed Budgeting

The minute you hear the word strict, you might go back to when you were a kid sitting at your little desk with that teacher who terrified you.

The teacher didn’t motivate you to do your best work because you were always a little afraid and only completed what was necessary to avoid getting in trouble.

That is what traditional strict budgeting is like, and it makes us feel like we are getting in trouble or have done something wrong every time we spend. Instead, I want you to think of what I like to call “relaxed budgeting.” This is when you create flexibility in the budget.

For example, your planned budget has an amount you can spend each month.

But within that, you create a buffer of a set amount. Then if something unexpected comes up and you want to spend on it, you determine how much it’s worth. And you ask yourself, “Does the buffer cover this?”.

If you don’t use a buffer in one month, add it to the next month so you have a larger buffer. This is why it’s important to “check in” on your spending. You need to reevaluate if you’ve overspent your budget every month for three months. Ask yourself if your goal and timeline were unrealistic.

You don’t want to feel deprived, but you do want to feel empowered to make conscious choices that help you achieve your goals.

Simple Budgeting Example:

Let’s say your goal was to save for a trip in six months.

When you look at your spending, you might ask yourself these questions:

- Is it logical to save this much money in 6 months?

- Can I push out the timeline to 8 months or a year?

- When I look at my spending over the past 3 months, was it on things that brought me joy?

- Do I regret any purchases?

- Are there any leaks in my budgeting bucket?

Leaks are areas where you didn’t realize you were spending so much and don’t actually value the services or products that you’re spending money on.

This exercise is often eye-opening and can highlight why you’re spending, where you are, and the intention behind creating a budget. It also helps you recognize habits that may otherwise go unnoticed.

17 Tips and Strategies for Sticking to a Budget

1 – Keep Track of Your Spending

One of the easiest ways to be successful at staying on a budget is to keep track of your spending. It’s effective because tracking makes you accountable for every dollar spent. Ideally, you’ll want to write down your spending just before you spend money. You can use an app on your phone or a simple notebook.

2 – Define Your (Achievable) Budgeting Goals

Set SMART goals. SMART is an acronym for specific, measurable, attainable, realistic and timely. This is useful for budgeting because, ultimately, we all want to see success, and if you don’t set a realistic and measurable goal, you’ll end up feeling bad and are more likely to say “budgeting” didn’t work for you.

3 – Start With Your Current Needs

The important thing is to clearly separate a need from a want. Needs are things you really cannot survive without—like food, essential clothing and shelter. Wants are things like eating out, travelling, or entertaining.

Always start your budget with your current needs because then you have a baseline of expenses that likely won’t change. You can add in the wants you value and leave out the ones that aren’t that important.

4 – Save Money for an Emergency Fund

If you don’t have money saved in an emergency fund, don’t feel bad. You aren’t alone. However, this doesn’t mean it isn’t important. Life and unexpected events happen, and you need to keep a cushion with enough money to cover 3-6 months of expenses or more.

Decide on how much you want to save, and then add that to your plan. How much can you set aside each month for your emergency fund? ( + )

5 – Avoid the “Set It and Forget It” Mentality

I say to avoid the mentality of “set it and forget it” because when you start budgeting, you need to continually check in and ensure you are on track. You can’t just set a budget and think, “Great, I am on track and have a budget.” The most important step after creating the budget is evaluating if it’s accurate, realistic and whether you are staying on track. Think of the budget as your “accountability partner.”

6 – Try Different Budgeting Approaches to Find What Works

When it comes to budgeting, there’s no “one right way” to do it. What works for a friend might not work for you. So try different approaches until you find what works best. For example, there are a variety of different apps, such as Mint, YNAB, GoodBudget, and EveryDollar, to name a few. They often have free and premium versions to try. See if one of these apps works for you. Or try an analogue method of budgeting.

7 – Pick Budgeting Categories that Make Sense for You

When making a budget, create categories that make sense to you. Some examples include having a food budget, an entertainment budget and a clothing budget. With different categories, you can quickly see where most of your money goes. It also can be useful for understanding your spending habits.

8 – Try Gradual Adjustments Instead of Overly Restrictive Budgets

Nobody wants to eat just lettuce and grapefruit for a week. Well, it’s the same with budgeting. Most people don’t want to go months without darkening the doors of a single restaurant.

We’ve all heard of “fad diets” that don’t work. The reason they don’t work is that they’re too restrictive. The best way to be successful is to be reasonable with what you can and cannot go without and slowly adjust so you are more conscious of your spending.

Remember, you want to feel motivated and stay on track for the long haul. “Little wins” can result in large gains over time, while being overly restrictive may cause you to go on a spending spree. So create a budget that’s sustainable.

9 – Be Honest in Tracking Your Expenses

One of the biggest mistakes I see is people “fudging the numbers” when they track their expenses. This creates two problems. First, you’re lying to yourself, and your subconscious knows, so you still feel guilty. Second, you’re taking away your chance of being successful at budgeting.

It’s crucial to be honest and write down the true number, no matter how big.

Trust me, it will only improve from here, and this initial step is making you mindful of your spending habits.

Be compassionate with yourself; you will be amazed that being attentive and pausing before you spend creates results.

10 – Regularly Monitor Your Budget

Regularly monitor your budget so you can celebrate your successes and continue to learn your spending habits. Remember to take baby steps; you want to learn what you spend on and why.

11 – Be Aware of Fixed and Variable Costs

The reason I emphasize being aware of fixed and variable costs is that your fixed costs are less likely to change over the short term, whereas you have more control over your variable costs.

12 – Plan for Seasonal Expenses

When you create a budget, make sure to plan for seasonal expenses such as Christmas, birthdays and any other major holidays.

13 – Know Bill Payment Dates to Avoid Surprises

Know your bill payment due dates and avoid surprises by adding them to your calendar on your phone or in your agenda. Alternatively, pay all bills on a set monthly date to avoid missing a payment.

If you want to further simplify your life, keep just one credit card because then you have only one credit card due date to remember.

Pay credit cards on time because the interest charged is among the highest.

14 – Spend Money on What You Love

What we view as expensive is very personal. I may find dinners out expensive because I don’t see the value, but nice jewelry isn’t expensive because I really enjoy it. So be aware of what brings YOU joy and spend money on what YOU love.

This is a key point because so many people spend what they think they should because of friends or influencers.

Be true to yourself and choose what to spend on consciously. It will bring you joy rather than regret.

15 – For Bigger Budgets, Focus on Key Categories Rather than Getting Granular

When looking at bigger budgets, the small details won’t have as much impact, so focus on key categories because it will make decisions easier. If you get too granular, you will be stalling the process of moving forward on your commitment.

16 – Set Up a Savings Account and a Checking Account

A savings and checking account are both necessary. Having both is a logical step that will help you categorize your spending. Your checking account is where your paycheque comes into and is for routine expenses. Your savings account is used to set aside money for a large purchase or to build an emergency fund.

17 – Budget for Health Insurance

In the US, health insurance is a major expense that needs to be planned for so you don’t end up going into debt due to health complications. Think of health care in three categories:

i) Fixed premium, which is what you pay for your insurance.

ii) Regular costs, which are things like your prescription or your co-pay at your annual check-up.

iii)Unexpected costs, which would be things like an emergency or urgent care.

You will want to have a budget for health insurance so you don’t run into problems down the road.

Simple Steps to Creating a Budget Plan and Start Saving Money

1. The first step is to calculate how much income you take home each month. Some examples are salary, investment income, rental income, royalties and pensions.

2. List your monthly expenses. Separate fixed expenses such as rent, mortgage, insurance, and utilities from variable expenses such as extra clothing, travel, entertainment, and charitable gifts.

Reflect on which variable expenses are filling your cup and which don’t bring you joy. When we review our expenses, we often find surprises and things we spend on that aren’t in alignment with our values and, therefore, would be easy to change.

3. Set realistic goals. These goals should be long-term and short-term. You might be saving for retirement in the long term while saving to fund an upcoming holiday in the short term.

4. Create a plan. Now that you know what is coming in and going out, you need to create a plan for achieving your financial goals. You want your plan to be practical and achievable so you feel motivated to follow it.

5. Pay yourself first. This means when you get your paycheque before you pay bills and usual expenses, put aside money into a savings account to be used as an “emergency” fund. It’s no surprise that if you do it after you have paid your usual expenses, you’ll find it hard to find this extra money.

6. Track your progress. After each month, comparing your expenses and income is crucial. You likely will need to make modifications, especially when you first get started, and keep in mind a budget is only a guideline, and things can change. Your objective is to be flexible and accountable.

One Bank Account vs. Multiple Bank Accounts

Using different bank accounts is a strategy that helps you organize your money.

For example, have a checking account for everyday expenses, a savings account for future expenses such as home repairs or a holiday, and a separate checking account if you are running for business. These are the basics, and you may also want another checking account for fixed costs such as rent or a mortgage and an additional savings account if you are saving for a particular goal.

Remember that a checking account typically doesn’t earn interest, while a savings account does. The ideal number of bank accounts is personal to your situation, and consider what helps you manage your finances and track spending.

Why Consistency in Budgeting Is Important

Consistency in budgeting is important because it lets you know you are staying on track rather than waiting for a problem to arise. It also aligns with your wealth plan and when you are working towards a larger goal.

Common Questions about How to Stick to a Budget

How should I calculate my budget?

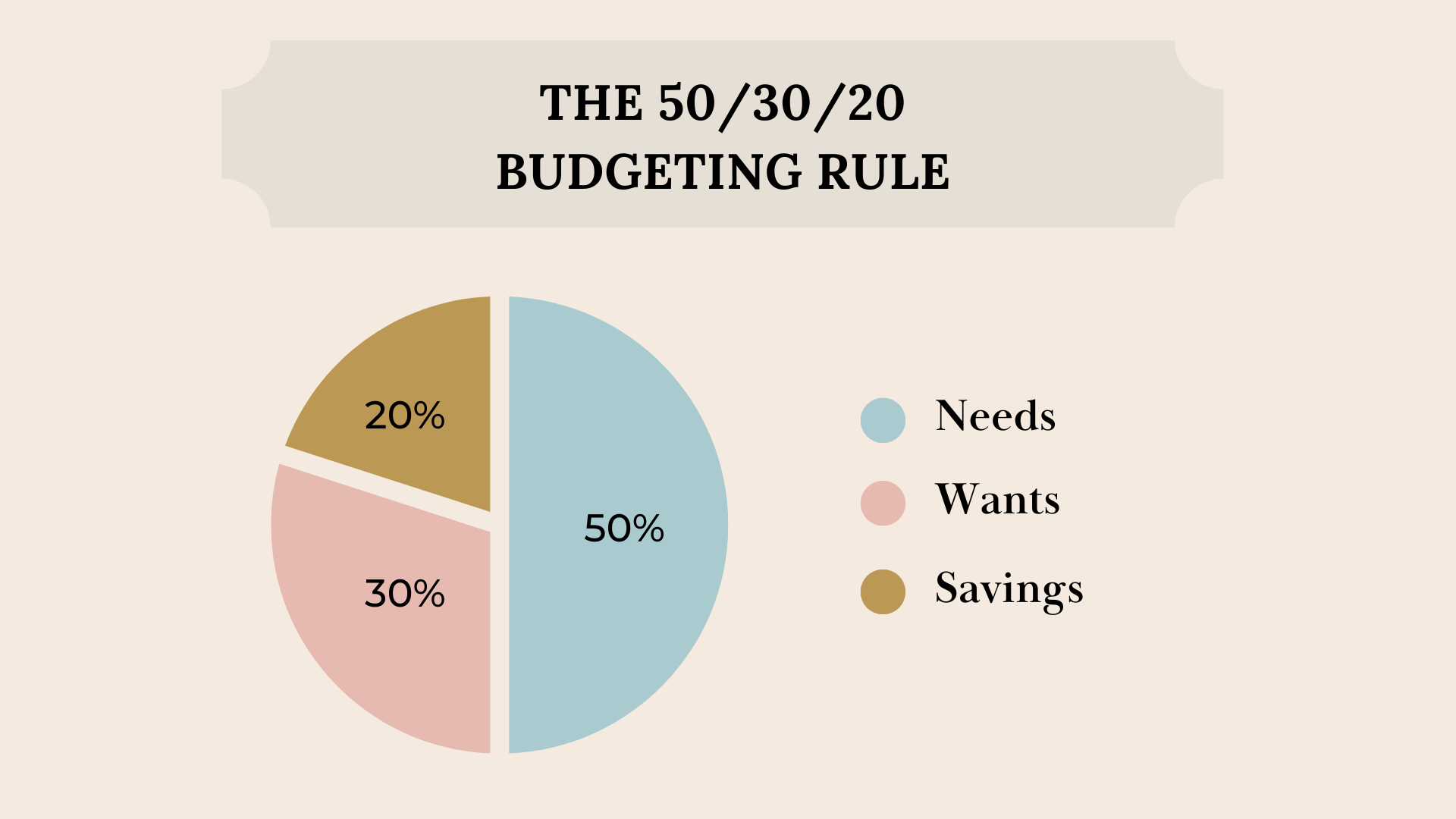

One of the simplest ways to calculate a budget is to put your money into three buckets.

- The first bucket has 50% of your take-home pay to cover your needs for rent, food and minimum payments on credit cards.

- The second bucket has 30% of your take-home pay and is for wants such as entertainment and extra luxuries.

- The final bucket has 20% of your take-home pay and is for savings and debt repayment.

Remember, you will also need to create some flexibility with this plan.

How should I put together a budget?

- Determine the net income you bring home each month.

- Look at your current spending and separate it into your fixed expenses, such as a mortgage, and flexible expenses, such as entertainment.

- Write down your short and long-term goals. Make sure they are pragmatic.

- Make a plan to achieve your goals. Create spending limits for yourself, consider needs versus wants, and dig deep, asking yourself what things you spend on that bring you joy.

- Reevaluate every month. You want to be accountable, so you may need to adjust your spending, particularly for wants. Use positive affirmations like I am choosing to save money rather than I can’t afford to go out. You want to feel in control and like you are making a win/win decision.

Should I have a monthly budget or a weekly budget?

When creating a budget, it’s often easier to organize a monthly budget because many expenses, such as utilities, insurance, debt repayment and rent, come out monthly. Then when you look at your total of money coming in and going out, your should separate it into weekly totals.

This is important if you are running very close to the line of not being able to cover your costs. You don’t have as much room for error by following a weekly budget.

Should I have a full grocery shopping budget?

With the inflation rate close to its peak, you can appreciate that your grocery bill has increased dramatically. The problem is that wages haven’t grown at the same speed, and if you don’t create a grocery budget, you may run into trouble when you have to pay for utilities or your mortgage. Creating a grocery budget is also a great exercise to do with kids because it helps them to appreciate the cost of food and they are less likely to be wasteful.

What kind of bank accounts should I use for organizing my money?

A good rule of thumb is to have two savings accounts, one for your cushion or emergency savings and the second for saving for a particular goal. I also suggest two checking accounts to keep it simple; One for everyday expenses and the other for fixed costs such as mortgage, food and utilities.

This makes it easy to quickly see the totals and where you are at in your spending. Of course, this is personal; you may need more if you also run a business. If you are working, having a retirement savings account and an investment account is important. One of the most common mistakes I see is if people are in their peak earning years and aren’t actively trying to save money for the future.

What is the key to managing my money effectively?

The first step to managing money effectively is tracking your monthly income and expenses to understand where your money goes. You then need to dive deeper and separate costs into expenses necessary for daily living, such as food, clothing, and transportation. Then look at variable or discretionary expenses, where you can decide if and how much you will spend on these items.

When setting a budget, it’s the discretionary expenses that you have more control over reducing. Your goal should be to feel empowered to make intelligent decisions so you can save money for larger purposes and feel fulfilled rather than guilty when you are spending.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles on Budgeting

💎 Budgeting 101: How to Create and Follow a Simple Budget

💎 Budgeting with the 50:30:20 Rule

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.