Let’s Talk About How To Become Rich

Written By Tiffany Woodfield, Financial Coach, TEP, CRPC®, CIM®

What are the main steps to becoming rich?

While everyone has heard a get-rich-quick strategy at some time or another, many wonder what the main steps to becoming rich actually are.

From my exposure as a wealth manager, I have experience helping others build and protect their wealth. I’ve also been on my own journey of building wealth and becoming rich. But remember, before we embark on this “getting rich” journey, becoming rich is an inside and an outside job.

You need soft skills just as much as you need hard skills if you want to build wealth and then keep the wealth that you’ve built. Keep reading to learn the four steps to becoming rich, and what I’ve learned about the psychology of money through being a financial professional.

Table of Contents

- But how can one get rich and stay rich?

- Luck, Failure, Fear, and Focus

- How to Stay Rich

- Remember to Consider Outside Forces

- What does being rich actually mean?

- Is money management a vital part of becoming rich?

- What kind of team should you have in place as you grow your wealth?

- Is investing an important part of becoming rich?

- The Power of Compounding

- Some Common Investment Options Everyone Should Know and Understand

- Getting Started with Investing to Grow Your Wealth

- What are the main ways in which people become rich?

- Don’t Be Limited by the Hours in the Day

- What mindset shifts are required to become rich?

- What limiting beliefs must be removed to become rich?

- Why do many people get stuck financially and not make remarkable improvements?

- It Takes Money to Earn Money… Or Does It?

The Four Main Steps to Becoming Rich

These are the steps to building wealth and becoming rich that I’ve seen work time and again:

1. Be accountable for your spending

This means actually looking at your finances to understand where you spend your hard-earned money.

You can see where you may have leaks in your bucket, otherwise known as unnecessary spending. Once you know where you spend your money, you can start to spend it intentionally. Learning to budget based on your values can be an important part of this process.

2. Live below your means

Sounds simple, right? This means either earning more or spending less.

However, most people find that the more they make, the more they spend, and often they do this without realizing what they spend on. They get bigger cars and bigger houses, and have lavish holidays, thus often increasing their debt and, therefore, not becoming any richer. So, if you earn more, ensure you know your spending and that it is below your means.

I know we live in a very “now” society where we want instant gratification, and the idea of waiting and saving up for a large purchase seems “old-fashioned.” In addition, credit has become so easy that debt is becoming just a part of life. So, it is more important than ever to be aware of this pressure and choose your path, knowing that if you live below your means, you can save and build your wealth.

3. Set SMART financial goals

So you have looked at what you spend, determined the leaks, and know you want to live below your means.

Now you need to set SMART goals. These are Specific, Measurable, Achievable, Realistic, and set to a Time frame. This is where it is helpful to detail short-, medium-, and long-term goals. Once you have written out your goals, the first step in keeping you accountable is starting a budget to track your spending as you work towards your goals.

4. Invest wisely

To accumulate wealth, you need to earn money and invest wisely.

You want to spend and save intentionally, so you invest according to your goals. You aren’t alone if you don’t have much knowledge or experience in this area. I would recommend you start by researching to build your knowledge foundation. This will help you feel less overwhelmed and provide more comfort by knowing the right questions to ask when you do seek professional advice. Many valuable and free tools are available online to help you embark on this financial journey.

Quick Videos: Try Out Values-Based Budgeting!

Find out what value-based budgeting is and why it feels so much better than traditional budgeting. You need to feel good about your budget; values-based budgeting will help you with this.

What is values-based budgeting?

How can I start values-based budgeting?

Getting Rich Isn’t a Miracle

Most people think they need a miracle to get rich, like winning the lottery or getting a huge inheritance.

While this happens, it is not something we control.

When exploring how to get rich, you can learn from these billionaires who grew up poor and created their success:

Oprah – first African American TV correspondent at age 19.

Kenny Troutt – started Excel; paid for his tuition by bartending.

Howard Schultz – founder of Starbucks; admits he grew up on the other side of the tracks.

Do Won Chang – founder of Forever 21; worked three jobs to stay afloat.

Ralph Lauren – founder of Ralph Lauren; dropped out of college.

These people knew they wanted to achieve what others said was impossible.

They grew up with obstacles and could easily have said success is for “other people.” They all have in common their vision, determination, perseverance, and grit.

You need to get uncomfortable.

You will likely fail along the way, and it will be hard. People will challenge you and tell you that you can’t do it.

Yet you need to keep going and use every opportunity and failure as a chance to learn and get better.

Luck, Failure, Fear, and Focus

At this point, you may think that there was luck involved and that outside forces helped these people, and I agree.

The external forces are always there, and luck and failure are part of the journey. You need to focus on what you can control: your individual efforts and how you respond to risks and failures.

So, when the right opportunity comes at the right time, that is, luck, you are ready.

When fear makes you stay in your safety zone and not take the next step forward, remember you can control how you view things, and even if you fall, you will get back up again.

Failing is part of life and how we grow.

Even when you learned to walk, you would first crawl, then get up and fall, and eventually, you walked and even ran. The expectation was that you would fall and learn to walk, so there was no other option.

What if you could view the next step toward your dreams like when you were learning to walk? Like there is no other option? You NEED to move forward.

Do you believe in the saying that life is 10% what happens to you and 90% how you react to it?

The ways people got rich are all different, but what is consistent is their attitude and mindset. They used their soft and hard skills to work together and create something.

How to Stay Rich

The skills and attitudes needed to get rich are different from the skills and attitudes needed to stay rich.

While getting rich, you need to take measured risks and be opportunistic. To stay rich, you need to remain humble and focus on having the ability to stick around for the long haul. This means not thinking you are beyond reality, and remembering what you have made can be taken away.

You understand that your past success doesn’t guarantee future success, and you must be mindful.

Now I don’t mean you need to be paranoid, and once you consider yourself rich, you need to live in fear and hide money under your mattress. What I do mean is you need to appreciate that life is unpredictable, and you will want to be able to weather the storm, to build a safety net even when you are wealthy to run your business and still think about how this will look in the next 5, 10, 20 years.

While we cannot predict many of life’s bumps; thus, as long as we can ride through the storm and stay invested, we can survive.

It is much the same as the markets. If you put all your eggs into a high-risk basket and the market drops significantly, you sell out because you need cash flow, a loss is crystallizing. Instead, if you built in a buffer or set aside money for a rainy day, you could continue on your path.

Remember to Consider Outside Forces

I have found a percentage of people get high from this newfound success and think they are invincible and that luck is always in their favour.

Remember, there are always outside forces, and you need to stay humble while you continue on your path. Even when you are wealthy and your business is successful, you still need a plan and you also need a margin of error.

Look at Amazon.

It went through serious market downturns, survived the dot-com bubble, and is now the biggest eCommerce site. All this materialized from the start-up idea of an online bookstore. While I cannot predict the future, we can learn that this company was able to adapt and survive unpredictable environments.

Also, if you were an investor and could stay invested, you would have shared in their success.

The moral is: it isn’t about getting rich quickly. It is about having the skills to get rich and stay rich and having a survival plan to weather the storm and be patient.

What does being rich actually mean?

Often, we need to consider the question of what “being rich actually means” because it is somewhat subjective and can be different depending on your situation.

I once worked with a client who was in her 80s and had more money than she would ever need. She was a widow, and her kids were independent with successful careers and family lives. She constantly worried she would run out of money and be a burden to her family, so much so she couldn’t enjoy her life.

It didn’t matter how many financial plans she had done with various scenarios.

She didn’t feel rich even though she would be considered wealthy by many people’s standards. I had wished for her to be free to spend on the things she loved and not to worry constantly. Unfortunately, her anxiety kept her alone and at home.

I brought up this story because being rich is about more than a dollar figure, even when we are talking strictly in the financial sense.

Being rich is only partially about money and is more influenced by a mindset of abundance and wealth.

If you look up different descriptions of being rich, some say it is when you have 1 million dollars or a paid-off home and 1 million dollars in investments. What I say to this is it depends. Rich is having enough money so that you have the freedom to live the life you want and to choose how to spend your money. It relates to happiness, and studies have shown that the happiest people feel they are in control of their lives.

So one person may have 1 million dollars and be rich, and another may have 10 million dollars and not be rich.

This is because it is about much more than an amount. It is about your mindset, your relationship with money, and how you view your life and success. To be truly rich is when you have reached a level of success and self-actualization where you feel you have made a difference and had an impact.

Sometimes money blocks can leave you feeling “poor” even though you’re wealthy. Other times, money blocks keep you down and prevent you from earning and living up to your potential.

Chasing Money Won’t Make You Rich

An example of an extreme case where someone should have felt “rich” because they had hundreds of millions of dollars is Bernie Madoff.

Before Madoff started his Ponzi scheme, he ran a legitimate, highly successful business where he made more than most people would dream of. He was by all outside accounts “rich” and had built a considerable fortune. However, he risked everything to get more money and status.

It is an excellent reflection on being careful of what you are chasing.

The money didn’t fill his cup; the status wasn’t filling his cup. He continued to want more and more and was continually comparing himself to others.

While this is an extreme case, and many have concluded Madoff was a sociopath, it is interesting to learn from. I also find it fascinating that, in an interview with Barbara Walters, he said it was nice to live in passive contemplation rather than fear because in prison he is no longer in control.

Is money management a vital part of becoming rich?

Money management is one of the essential parts of becoming rich because it considers everything about managing your finances, from setting financial goals to budgeting to saving and investing.

It is only possible to understand how to move forward by knowing where your money goes and how much is coming in.

Money management creates a solid foundation and understanding of your finances to make changes effectively.

What kind of team should you have in place as you grow your wealth?

When you start growing your wealth, consider investing strategies, minimizing taxes, and effectively transferring your wealth.

Building a team that has experience in dealing with clients in situations like yours and can be your guide is important.

Some of the key players and their roles are:

Tax Advisor – understands the laws and regulations to advise on tax minimization strategies.

Estate Lawyer – a licensed professional who can offer advice and draft legal documents such as wills and trusts; can also help organize the legal documents to transfer assets to your beneficiaries.

Portfolio Manager/Financial Advisor – understands the financial tools available to invest your money according to your risk profile and goals.

Certified Financial Planner (CFP) – has the knowledge and expertise to create a financial plan and help keep you on track.

Accountant – can help individuals or businesses beyond just preparing tax returns.

Is investing an important part of becoming rich?

Investing is an important part of becoming rich because if you just put the money you saved in the bank, you will lose purchasing power because of inflation.

This means the cost of goods, such as food and clothing, will continue to increase, and the money you put under your mattress will be able to purchase less in future years.

Many people invest their money to counter inflation and have their money work for them.

The first step when you consider investing is to determine your time frame for when you will need the money.

Often it is best to have a diversified portfolio which includes some cash, some fixed income as well as company stocks. Your expected return will vary depending on your time frame and the risk you are willing and able to take. It is best to speak to someone about your particular situation if you don’t have experience in this area.

When thinking of investing, there aren’t many people who haven’t heard the name Warren Buffet. Many believe he is the best investor and must get the biggest returns.

Actually, what Warren Buffett is great at is utilizing compounding and staying in the market.

Warren Buffett has been in the market for a long time. He started investing when he was only ten years old, and when he reached the age of thirty, he had accumulated a net worth of 1 million dollars.

This would be close to 10 million dollars today.

So arguably, Buffett may be the richest investor of all time, but if you look at his annual returns, he isn’t the best investor of all time. Other investors may have gotten bigger returns in a given year, but Warren’s secret is that he stays invested and has been in the markets for a long time, which has compounded his wealth.

He has been known to say, “Buy quality companies and hold them.”

When everyone jumps out of the market and panics, he stays the course and looks at the long term, allowing compounding to work for him over the years.

The Power of Compounding

Now let’s discuss the impact of compounding.

This is when earnings from an asset are reinvested to generate more earnings over time. For example, if you purchased a stock and the dividends or capital gains are reinvested, these provide more earnings over time. This exponential growth is more than most people can get their heads around when you look at the numbers.

So as a simple example, if you invested $1,000 and earned 6% interest in a year and reinvested the earnings the next year, your base is $1,060. If you earned 6% again, it is now $1,123.60.

Let’s think of more significant numbers; assume it was $100,000 making 6% in a year. The following year you are reinvesting $106,000, and if you earn 6% again, it is now $112,360 as a base.

So, by utilizing compounding, you will be able to earn money more quickly.

What does this compounding effect mean for you?

From this example, you can understand that investing is an important part of becoming rich.

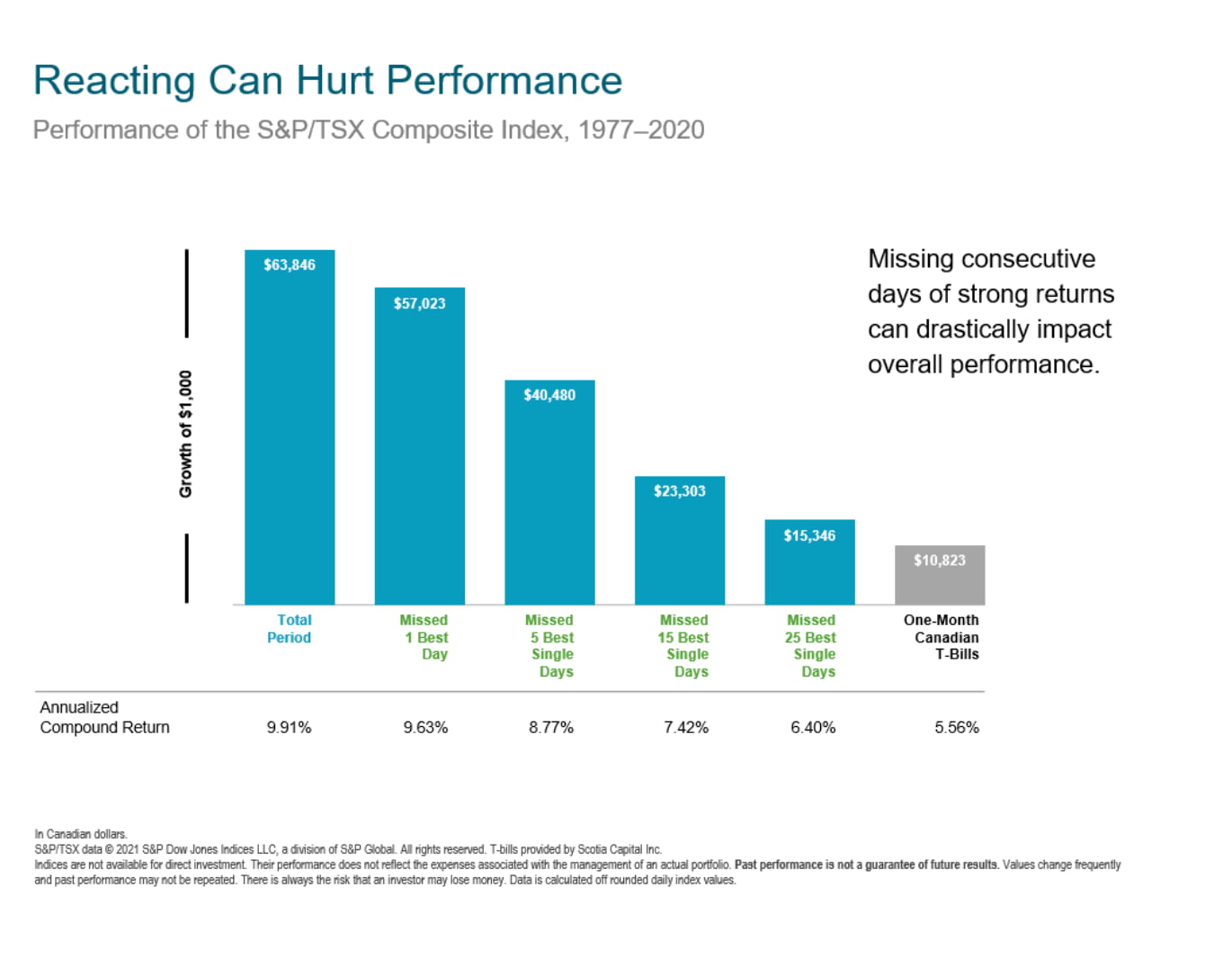

It is also important to invest wisely and be consistent. Choose quality companies that have a proven track record. Try not to time the market because you have to be right twice: when you buy and when you sell. This is unlikely.

Look to invest long-term, be consistent, disciplined and stay invested.

This will allow your money to compound, which means exponential growth.

And keep in mind, good investing doesn’t mean earning the highest returns because often, with higher returns come higher downsides and fluctuations, and this is where people sell out. Investing is about staying the course.

See the chart below on what can happen when you try to time the market and miss the best days.

Some Common Investment Options Everyone Should Know and Understand

Bonds

Where you, as the investor, loan the government or corporation money and receive interest in return.

Certificate of Deposit (CDs)

A savings tool that provides a set interest rate for a period of time. The most common maturities are three months, six months, one year, two years, three years, or five years. If you take the money out early, you will likely face penalties.

Guaranteed Income Certificate (GIC)

Provides a guaranteed interest rate for a specific period, typically ranging from 6 months to 10 years.

Stock

Security sold on the stock market. When you own a stock, it represents partial ownership of the company.

Exchange-Traded Fund (ETF)

A bundle of assets that are grouped together and traded like a stock on an exchange. Often, they track a specific index, such as the S&P.

Mutual Fund

A managed fund that pools investors’ money to buy securities and follows a particular investment. It does not trade on an exchange and is usually purchased through brokerage firms or fund companies. Details of the individual mutual funds are in a prospectus.

Hedge Fund

A pooled investment that usually is more aggressive and uses derivatives and leverage to produce higher returns. These have a higher risk.

Getting Started with Investing to Grow Your Wealth

An easy way to start investing if you work for a company is to contribute to a company-sponsored retirement plan, such as a Group RRSP in Canada or a 401(k) in the US.

Often the employer will match up to a certain percentage to encourage saving for retirement.

A return can be as income or capital gain. Interest is earned from fixed income such as a bond and can give a return over time as income or capital gain, where you sell the asset you purchased for a profit.

What are the main ways in which people become rich?

As we all have the same amount of time in a day, you may wonder how some people get rich while others financially stay the same.

One of the biggest differentiators is that rich people earn passive income and active income, which are opposite to each other.

Passive income doesn’t require as much effort to obtain as active income, and it is something where you don’t have to be actively participating.

So, while active income would be your job that you have to go to every day, passive income is having your money work for you.

Examples of passive income are income from a rental property, dividends from company stocks, or another business in which you aren’t actively involved.

Don’t Be Limited by the Hours in the Day

When I was entering university, my dad told me that if you are only earning during the hours you work and don’t earn anything when you aren’t working, you will always be limited by the number of hours in the day.

This always stuck with me and made me curious to learn how to also earn passive income.

Recently, I worked with a client who was an entrepreneur and had done research to create a new technology that eventually was purchased by a larger company. She had to stay on for only 2 years and then would continue to earn royalties according to her agreement.

This is a case where she earned active income and then sold and now earns passive income.

The main way to get rich isn’t just working more; it is working smart and using your skills to earn, being intentional with your work, and continuing to learn.

Learn how to scale your business or work, so you have more time and can earn passive income.

What mindset shifts are required to become rich?

Bill Gates is one of the richest people in the world; looking at his mindset can help us understand what shifts may be required.

When Bill Gates was interviewed at Harvard, he explained how he originally thought he could be a professor of mathematics. He described himself as a nervous, antisocial introvert. He had to shift his mindset to get out of his comfort zone and expand.

He had to get more comfortable with taking a risk and launching Microsoft.

It is understood that he is brilliant and has the technical ability, and he needed a mindset shift and some luck. It is important to admit that there are forces we cannot control and beyond individual effort. These are luck and risk. So in order to take a chance, you need to accept these facts and change only the things you can control, which are your mindset and individual effort.

Some common mental shifts you may need to make are to go from:

- Life happens to me to I am in control of my destiny

- Money is bad to money is good and creates more control over my life

- Just surviving and security to abundance and growth

- Being comfortable with the status quo to stretching the boundaries and taking risks

- I’m not smart to I can learn anything

- I don’t have time to I will make time to do what it takes

- Success is all because of luck to I agree luck plays a role, and I can have control over my actions

- What if I fail to what if I succeed?

What limiting beliefs must be removed to become rich?

No matter how hard you try, if you believe deep down that being rich isn’t for you or is bad, you will not be rich.

Your subconscious will work to protect you from getting what you don’t want. This is why it is vital to address your limiting beliefs head-on.

I need you to go back to when you were little.

What were the lessons you learned about money?

Did you grow up with a scarcity mentality? Was there enough food and things to go around? What lessons or observations did you have about money? I would like you to write down your thoughts on these. Was there more than enough money to go around? Did you have anyone who had lots of money and did you judge them, or do so now?

Why do many people get stuck financially and not make remarkable improvements?

Many people get stuck financially and don’t make remarkable improvements because of their mindset. They hold on to limiting beliefs that hold them back. Couple this with the fact that it is much easier to keep the status quo rather than challenge yourself to look deep and change.

A perfect example of this is when I moved to a new home in a location I had dreamed of being in. It was a dramatic improvement and represented a significant jump financially. It was almost like I had lifted my head out of the sand of playing small and was standing in my own power.

I was letting the universe know I had reached a certain level of success.

I should have been ecstatic because my dream came to fruition and I was actualizing my success. But the interesting thing is I was anxious, fearful, and definitely not ecstatic. I felt judged and the worst person judging me was myself.

I would apologize when someone came over and downplayed the house.

This went on for months; I was also getting run down and easily stressed.

After doing some internal work through meditation, I realized it was my subconscious freaking out. Change is hard at the best of times, and this was a major change, along with a significant jump in the direction of my dreams. So, it was a double whammy and caused all my fears to come to the surface. I felt guilty, like if I had more others had less, and that I wasn’t deserving.

Asking myself “Who did I think I was?” helped me.

All the old programming I had learned as a child was coming at me with full force. The universe was testing me to see if I really could handle this. It was a very good lesson for me because it forced me to acknowledge my limiting beliefs and fears and address them head-on. I now look back and I love my home and feel very grateful.

It is not to say those fears won’t come up again, but I will be ready.

Each time we stretch ourselves, it gets easier. This means we are growing and need to navigate new territory until our subconscious settles down.

The moral of this story is that you can have access to all the right education, tools, and opportunities to be financially successful, but if you don’t do the internal work, you will never be truly free and likely won’t hold on to your wealth.

It Takes Money to Earn Money… Or Does It?

Over the years of working with many high-net-worth individuals, I have learned that the saying, “It takes money to earn money,” doesn’t always hold true.

Most of my clients’ wealth is not from a large inheritance or winning the lottery but from their own success across a variety of backgrounds.

I see that people who created their own wealth usually have a sense of adventure, a thirst for knowledge, and a passion for life. This is balanced with grit and willingness to go against the grain and do hard things and trust they are on the right path. Also, the individuals weren’t happy because of their status or the amount of money they had, they were happy because of a positive and abundant mentality.

My high-net-worth clients who either created or built something and had an impact were the happiest. Interestingly, most of these clients wouldn’t describe themselves as rich because someone else always had more and it isn’t a measuring stick. I also wouldn’t say that more money made them happy, but I wouldn’t say it made them less happy either. It was the control over their lives; part of this comes from money and also from doing internal work to be comfortable and truly free.

What have I noticed in the behaviour of people with a lack of mentality and less money?

These people tend to be more afraid and need security, whereas wealthier people are more comfortable with taking calculated risks and trusting that it will all come together. Remember that fear is more powerful than the positive potential result. So if you are fearful, you are less willing to take a chance, which is influenced most strongly by your personal experience.

Take, for example, two individuals who have identical amounts of wealth, education, and background and are of the same age, but one has a fear-based mentality while the other is a positive person.

Unsurprisingly, a positive person will have more wealth in the next 5 years. Such people are more willing to invest in the long term and less anxious about shifts in the market. They are confident in their goals. So although they both had similar options and opportunities, behaviour had a large impact.

Becoming Rich is About Money and Mindset

In conclusion, becoming rich is not just about the amount of money you have but also about having a mindset of abundance and wealth.

It is about having the skills to get rich and stay rich, having a survival plan to weather the storm and be patient, and understanding what being rich truly means to you.

Money management, investing wisely, and building a team to guide you are all important aspects of growing your wealth.

It takes more than just working harder to become rich; it takes a willingness to take risks, learn, and make mindset shifts to remove limiting beliefs.

Remember, good investing doesn’t mean earning the highest returns but rather staying the course and being consistent.

By utilizing compounding and staying invested, you can earn money more quickly and achieve exponential growth.

Summary of Key Points:

- Becoming rich is about having a mindset of abundance and wealth, having a survival plan, and understanding what being rich truly means to you.

- Money management, investing wisely, and building a team to guide you are all important aspects of growing your wealth.

- Good investing doesn’t mean earning the highest returns but rather staying the course and being consistent.

- Utilizing compounding interest and staying invested can help you achieve exponential growth.

- It takes a willingness to take risks, learn, and make mindset shifts to remove limiting beliefs to become rich.

Read More:

💎 Wealth Coaching: What It Is and When You Need One

💎 Everything You Need to Know about Expanding Your Money Mindset

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and entrepreneur based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.