Money Blocks May Be Holding You Back

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

A money block is any conscious or subconscious belief that holds you back from having the financial success you desire.

While it may be easy to lift a physical block if it is in front of you, a money block is a more significant challenge. It takes commitment to change your internal programming.

Are money blocks holding you back from achieving your next big financial goal?

If so, keep reading to find out how they develop and what you can do to release them once and for all!

Summary of Key Points:

- Even if you are wealthy, you still can have money blocks.

- A money block is a subconscious belief that is holding you back from financial freedom.

- Be brave and choose to make a change.

- Real change happens when we get uncomfortable.

- A positive mindset is essential.

- You cannot avoid your finances.

- Money affects all aspects of your life.

Table of Contents

- How do money blocks develop?

- What are money blocks?

- How do you know if you have money blocks?

- How do you break through money blocks?

- 7 Steps to Help You Overcome Big Money Blocks

- Identify the Top Money Blocks Holding You Back from Financial Abundance and Joy

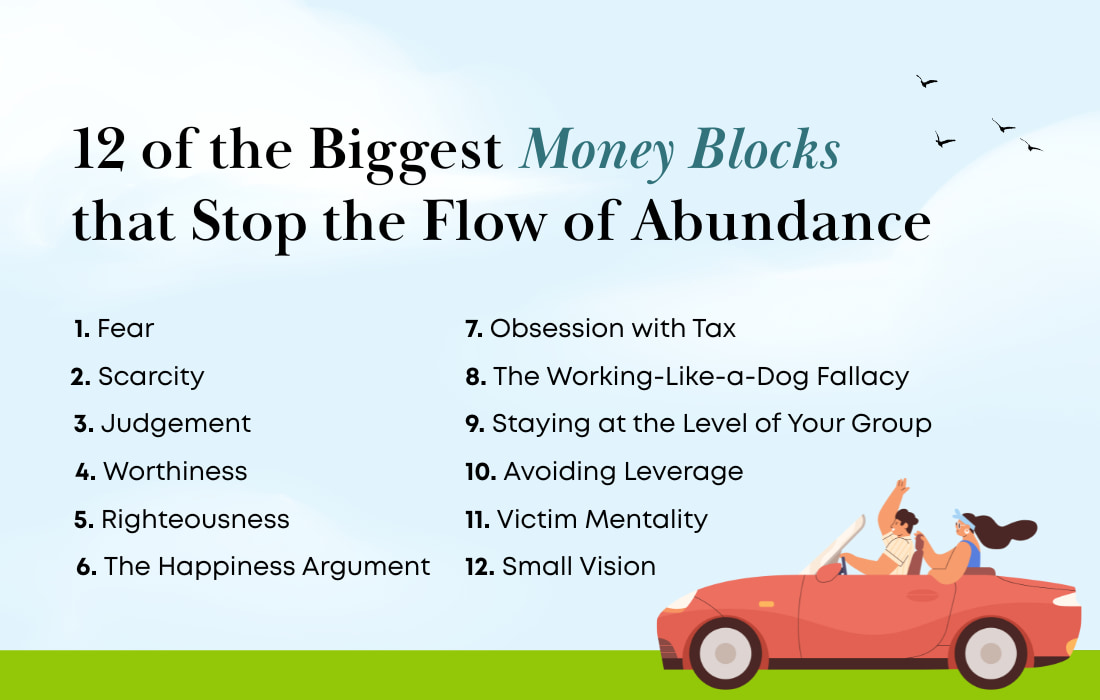

- 12 of the Biggest Money Blocks that Stop the Flow of Abundance

- Step-by-Step SMART Process to Releasing Common Money Blocks

- The Danger of Subconscious Money Blocks

- The Importance of a Positive Money Mindset

- Common Money Mistakes that Arise from Money Blocks

- What happens if you don’t clear money blocks?

- Common Questions about Money Blocks

- You Are Your Problem and Your Solution

How do money blocks develop?

Money blocks usually develop when you are young and impressionable.

They are things you learn and subconsciously take for granted. You believe them to be an absolute truth.

When we are young, we are like sponges and don’t have any filters. This makes it great for learning, but not all learning is good. The negative messages we pick up when we’re young can create feelings of being undeserving. We may grow a “lack mentality” around money.

Let’s say your parents always said things like “Money doesn’t grow on trees” or “Do you think we are made of money?”

This may create a scarcity mentality and could create a money block.

Where you grow up, your community and the values around you impact your beliefs about money.

Everyone has a relationship with money, but most people haven’t spent any time cultivating a good relationship with money.

However, if you want to start manifesting more money and abundance in your life, then you need to get rid of your most harmful money blocks.

What are money blocks?

Money blocks are deeply ingrained subconscious beliefs about money that create psychological barriers to financial success.

These negative patterns operate below conscious awareness, making it challenging to implement behavioral changes. Overcoming money blocks requires reprogramming these subconscious beliefs to align with conscious financial goals.

How do you know if you have money blocks?

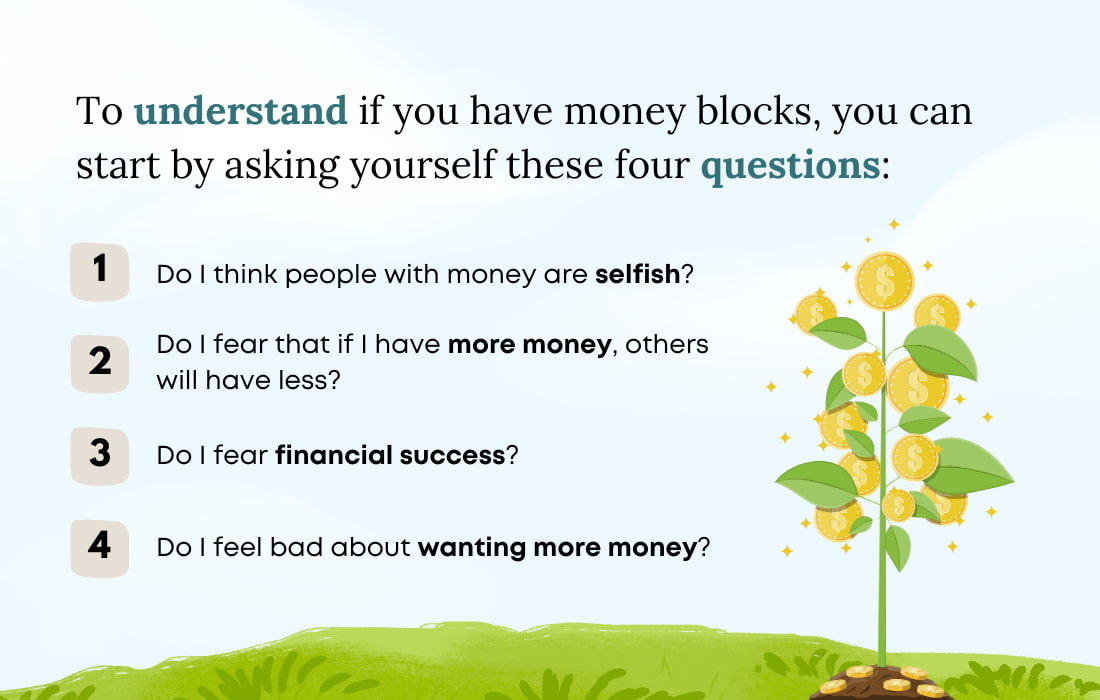

To understand if you have money blocks, you can start by asking yourself these four questions:

- Do I think people with money are selfish?

- Do I fear that if I have more money, others will have less?

- Do I fear financial success?

- Do I feel bad about wanting more money?

These questions get you thinking about some of the “holes” in your relationship with money.

A more direct question I like to use is asking people if they can say, “I love money.”

The look of utter shock on their faces is worth a thousand words. It is like I said, “I love blood.”

It is a speedy and straightforward way to measure if you have money blocks because if you cannot say, “I love money,” then you have money blocks.

In fact, how loud you can say it speaks to how firmly you believe you can achieve financial success. Many respond, “Well, I like what money allows me to do or buy, but not money.”

My point is that in our society, money is a dirty word.

But money is just a “currency of exchange,” much like chickens may have been many years ago.

So, would you be comfortable with saying, “I love chickens?”

I bet there is no recoil or body tension when you say that you love chickens!

My goal is for you to be able to say, “I love money,” and be proud of it. Yes, pursuing money for evil is bad, but it’s not the money that’s bad. It is the pursuit of it at all costs.

What if you had an abundance of money and could then have a positive impact on the world? You could do good things and be able to give back. This is financial freedom, and it all starts with addressing your money blocks.

How do you break through money blocks?

To make any change in your life, you first need to want to change. Second, you need to embrace being uncomfortable.

You must be committed to being brave, vulnerable, and pursuing your dreams. You have to accept that what holds us back is often the fear of the unknown.

It is much easier to stay the same even if it isn’t what you want. Whether you remain in a bad relationship, stay in a job you don’t like, or always feel that you are broke, these are all things you can overcome.

To break through money blocks, YOU must choose to change and be comfortable being out of your comfort zone.

7 Steps to Help You Overcome Big Money Blocks

Step 1: Accept and take responsibility for where you currently are.

Blaming others for where we are is giving away our internal strength and power to make positive changes. You may not have had the same opportunities as someone else, or you may have had more opportunities than the next person. The only thing you can control is you and your choices. So, decide now to change your money blocks.

Step 2: Identify why you want to change your relationship with money.

This is where you visualize the life you want and why you want more financial freedom. This is your opportunity to motivate yourself. You need to come back to visualization when the going gets tough. Visualizing reminds you that working through challenges is worth it.

Step 3: Get prepared to be uncomfortable.

If you want to make a positive change in your life, you need to accept it will make you uncomfortable. Do not take this as a reason to stop trying and take the easy way out. If you really get scared, return to your WHY and remind yourself this is a journey towards your dreams.

Step 4: Identify your money blocks.

You need to reflect and look deep within to uncover your money blocks. Think of these money blocks as rocks in the middle of your path. They are sitting between you and where you want to be. I have outlined common money blocks and how to overcome them later in this article.

Step 5: Challenge your money blocks.

Break down each of your money blocks one at a time.

What are your blocks, where did they come from, and are they true?

Step 6: Stay on track and measure your success.

We need tools to stay on track whenever we start a new journey. Just as you’d use a compass and a map if you were going backcountry trekking, you need a way to ensure you’re on track with your money goals.

Set SMART goals to keep you on track when identifying your money blocks. Specific, Measurable, Achievable, Realistic and Timely goals are critical. Below, I detailed a process for implementing a SMART plan for tackling these. It only takes a few minutes a day, and you will see the results.

Step 7: Stay committed to your goal.

Remind yourself that, though this change is uncomfortable, it will be worth it. (I promise!!)

Identify the Top Money Blocks Holding You Back from Financial Abundance and Joy

Before breaking through your money blocks, you need to identify them.

Below are the 12 most common money blocks I’ve seen as a financial advisor. Whether you have $100 in your bank account or $10,000,000, you might be dealing with one or more of these money blocks.

Everyone has a money mindset and work to do on their money mindset.

Nobody gets through life without accumulating a few limiting beliefs around money, happiness, and success. But regardless of your background and current circumstances, you CAN release your money blocks and experience more wealth, joy, and abundance.

Whether you’re already experiencing financial success but not enjoying it or are feeling stuck in a situation with less money than you’d like, you must identify the top money blocks holding you back.

Then, go through the process below to release your money blocks.

12 of the Biggest Money Blocks that Stop the Flow of Abundance

Money Block 1: Fear, Then Knowledge

Thought: “I don’t understand money, investments, finances.”

At first, you may think this isn’t a money block; this is just a lack of understanding. But WHY do you have a lack of knowledge? Because, most likely, you’re afraid and therefore you can’t learn. When it comes to money, people often say they don’t understand investments or finances because they are afraid of them. But they can begin to understand how these tools work once they deal with the money block of fear.

Money Block 2: Scarcity

Though: “I am working for money.”

This money block is an excellent example of the difference between people working to pay their bills and those working for fulfillment. Successful millionaires have a different mentality. They focus on doing what they love and investing time in getting good at it to impact others significantly. Work is about more than money; it is about making a contribution to the universe.

Money Block 3: Judgement

Thought: “People with money are selfish.”

This is a common negative message many of us learned growing up. We took this message to be 100% true. It holds us back because we don’t want to be selfish, so we do not pursue anything that could create more money in our lives.

Money Block 4: Worthiness

Thought: “I don’t deserve to be wealthy.”

This is a lack mentality that you aren’t smart enough, lucky enough, or deserving enough to be wealthy. It is based on a lack of self-esteem and makes it challenging to pursue abundance because you don’t think you are worthy.

Money Block 5: Righteousness

Thought: “Money is bad.”

This often develops because we hear our parents or someone of influence criticizing people with money. We then take on this money block and subconsciously do things to avoid making more money. We are lying to ourselves and sabotaging our ability to have financial freedom. We may feel righteous that we don’t “need” money.

Money Block 6: The Happiness Argument

Thought: “Money doesn’t buy you happiness.”

I commonly hear, “Money doesn’t buy you happiness.” While this is true, the opposite is also true, “Money doesn’t buy you unhappiness.” But there is real damage that comes from this phrase. It gives you an excuse not to pursue money, abundance, and success. It gives you an out and a reason to stay where you are and not try for more.

Money Block 7: Obsession with Tax

Thought: “I will get taxed more!”

When I discovered how common this money block is, I was initially surprised. You are often taxed more when you make more. However, I have clients that, even though they ended up with more money in their pocket, they still would get worried about paying more tax.

They would say, “But I will get taxed more!” And they would avoid taking the most logical action.

This is because they have a block around their tax bill. Logically, as long as you end up with more money in your pocket, it doesn’t matter that your tax bill is higher. But the fear of the significant tax bill is often greater than the increased money one can earn.

Money Block 8: The Working-Like-a-Dog Fallacy

Thought: “To have more money, I have to work harder, and then I will be stressed out.”

This is based on a fear that you can’t have it all. You might think that if you are working and building wealth, you cannot also have a balanced family life. This block highlights a lack mentality. You are making yourself choose wealth or family life. Instead, you must focus on shifting your mentality to how to have both.

Money Block 9: Staying at the Level of Your Group

Though: “My family and friends will resent me.”

The fear of being judged by family and friends is a common money block. Remember, when we are afraid of being judged for something, it is because we are judging ourselves.

You need to stop judging yourself and change your self-talk. Focus on how creating more wealth would be positive. Consider what others could learn from you if you successfully raised your level of abundance. Ask yourself if you’d be happy to see your friends and family with greater means.

Money Block 10: Avoiding Leverage

Thought: “I just need to work harder to be rich.”

While you need to put in the effort to make any change, it is essential to distinguish between just putting in more hours on the job and leveraging what you are doing. You need to determine what skills fill you up and have others do the work that drains you. If this isn’t possible at your current work stage, it is still important to understand it isn’t just working harder that makes someone rich; it is evaluating how you can leverage your skills and others’ skills.

⭐ Related Article: How to Be Rich

Money Block 11: Victim Mentality

Thought: “I have to have money to make money.”

If you catch yourself saying, “I have to have money to make money,” you are letting yourself off the hook from even attempting to make more money. This allows you to be the victim rather than in control of the financial success you can build.

Money Block 12: Small Vision

Thought: “I only want enough money to retire.”

The difference between people who want to create great wealth is they are thinking of the bigger picture. Instead of saying, “I only want enough money to retire,” which comes from a lack mentality, they say, “I want to build wealth to leave a legacy, to make a difference and to have an impact on the world.”

Step-by-Step SMART Process to Releasing Common Money Blocks

The first step in breaking through common money blocks is acknowledging that you have them.

Then, you should clarify what these are and take positive steps to improve your relationship with money. Remember, we need to be motivated to start, so I suggest you remind yourself that by changing your beliefs around money, you will allow more abundance to flow into your life.

Day 1: Write down all your money blocks

15 minutes

Start with a journal dedicated to this process and keep it somewhere you see it daily to act as a reminder. Set aside 15 minutes and begin writing down all the money blocks you believe you have.

These are things like fears, insecurities and any negative thoughts you have about money.

Once you have written a comprehensive list, choose the top 3 that seem most important or that you feel the most strongly about. Write these three on a separate page, and remember to put the date at the top.

Close your book and carry on about your day.

When you are doing this activity, you are awakening your subconscious. You may be thinking, “I just wrote these down, and what good does that do?” But you are still contemplating the ideas in your subconscious; there will be more time to work on this tomorrow.

Day 2: Confirm the top 3 money blocks and think of where you learned each money block.

20 minutes

Now, I want you to review your big list and see if you need to add anything else. If so, add them at the bottom. Now, before you look at the top three you chose yesterday, I want you to look at the entire list and put a star beside the top three. Next, compare if they are the same as the ones you chose yesterday. If so, great. These will be the three priorities to work on for the next few days.

If not, then narrow it down from the top six you identified to the three you feel the most strongly are holding you back.

Now, for each of these three, I want you to write 2 to 3 sentences sharing the earliest experience you remember having where you learned this belief.

Try to think of who said it and where you were. Write in enough detail to picture your younger self learning this. Repeat for all three.

Then, close the journal and go about your day. Remain curious about how often these “money blocks” creep into your thoughts or impact your decisions. For example, when you go out to pick up a coffee and judge someone, what is that telling you? Is it about your money beliefs?

Or maybe you go to the grocery store and see how costly groceries are and think to yourself, “I will never get ahead.”

Just continue to be curious, teaching yourself to be awake and see when these blocks present to you in everyday life.

Day 3: What % do you believe these top 3 blocks are true?

15 minutes

Yesterday, you identified your three most important blocks and when they came up for you. Now, I want you to consider if these are 100% true.

Write down each of the three money blocks on a clean page and what percentage you believe these to be true. It is okay if you think 80% or 90% because the one you ranked as being the truest, i.e. closest to 100%, is what you will focus on for the next week.

So choose it, write it down on the next page, and close the book.

This is the page where you will come tomorrow. For the rest of the day, you will be curious about how often this belief comes up and then think, Is it always true?

Day 4 – 7: Focusing on Money Block #1 and Being Curious

15 minutes daily

For days 4-7, each day, you will write the #1 limiting money block you have at the top of the page, along with the date. Then I want you to spend 15 minutes thinking about if you have ever experienced anything contrary to this belief and write it down.

So if your money block was “making money is bad,” then I want you to be curious if you have ever seen or experienced a situation where making money was good.

For the first day, you will flip to the page where you wrote this money block at the top, and underneath, you will write down anything contrary to this belief. Then, I want you to be unbiased, open and curious each day.

I want you to look for situations where, in this example, “making money is good.”

For these four days, each morning, you will write down the same money block and again write examples of where earning money is good.

If you seek inspiration, you can use social media or just pay attention to your daily interactions. The important thing is to find examples that you can picture that are contrary to your negative belief about money.

Day 8: Evaluation of your Number #1 Money Block

15 minutes

You have now tackled your most crucial money block for the past four days, and I want you to write what % you believe to be true. Then flip back to when you started and compare if you have moved the needle.

Remember, it takes time to change a habit, especially a subconscious one, so don’t be disappointed if it doesn’t change as much as you expected.

Choose to celebrate that you are awake, aware, and now you are in control. You have only been doing this for eight days; imagine the results after one month, six months or even a year.

Second Week:

Repeat days 4-7 for Money Block #2 and continue the same check-in.

Third Week:

Repeat days 4-7 for Money Block #3 and continue the same check-in.

Remember, to be successful, you need to want to change, be ready to be uncomfortable and be committed.

Tools such as this SMART process, where you only spend a few minutes each day, help because it makes you accountable, and you can see your results.

It is specific, realistic and set to a time frame. Once you have finished all three, compare them and how they have been reduced. If you started at believing “Money is bad” as 100% true, and now you only think it is 60%, that is progress! I also bet you find it much easier to see when this is holding you back.

I don’t recommend just forgetting these after you have done the initial work, but continue to focus on how they are impacting your life and only when you get closer to 0% do you choose to start working on a new set of money blocks.

The Danger of Subconscious Money Blocks

The most significant danger of subconscious money blocks is they control you whether you want them to or not. It is like you are on a bus that’s about to go off a cliff, and you are completely asleep at the wheel.

How can you ever create the life you want when you are sleeping?

The danger is that you are a victim of your subconscious thoughts.

Instead, by choosing to be brave, digging deep and becoming aware, you can address these money blocks and have financial freedom.

I encourage you to wake up and take the steering wheel.

The Importance of a Positive Money Mindset

If you want more money and to enjoy the money that you have, you need a positive money mindset.

This is because our perception determines our perspective on a situation. If you view money negatively, you will tell the universe that you don’t want more money. When you have a positive money mindset, you focus on the belief that you can achieve financial freedom and more abundance in your life.

Common Money Mistakes that Arise from Money Blocks

1 – Not Forgiving Yourself for Your Money Mistakes

You must let go of the guilt and shame around making a money mistake because this is holding you back. Instead, choose to forgive yourself and learn from your mistakes consciously. Life is full of mistakes; these are opportunities. You just need to shift how you view them.

2 – Avoiding Your Finances

Avoiding looking at bills or statements does not move you forward into abundance and instead keeps you in denial. Think of the game of hide and go seek. Do you remember when you were really little and didn’t hide but instead closed your eyes, hoping no one would find you?

This is what avoiding your finances is like. As much as closing your eyes makes you feel safe for a moment, the person can still easily find you. This is much the same as the statements are still there when you open your eyes, and they won’t disappear by avoiding them.

3 – Not Taking Responsibility for Your Financial Situation

To make any change in your life, you need to be empowered by choosing to take responsibility. When you are a victim, you shift the blame to someone else instead of doing your internal work. We cannot control anyone else’s reaction, but we can take responsibility today for our actions.

What happens if you don’t clear money blocks?

If you don’t clear your money blocks, you are not opening the door to financial freedom and abundance.

It is always about more than money. It is about being in control of your destiny and following your path. Remember, life is not a dress rehearsal. So get out there and take action. You are worth it!

Common Questions about Money Blocks

How can I remove beliefs that are keeping me stuck?

To remove beliefs that keep you stuck, you need to identify the most harmful negative thoughts holding you back. Secondly, you must commit to getting uncomfortable and making a positive change.

What is blocking my abundance?

The biggest thing blocking your abundance is you and your subconscious mind. The only way to break through this is to be brave and decide to change.

What is a mental block to making money?

A mental block to making money is any negative belief you learned growing up that allows you to blame outside circumstances for why you don’t have more money in your life.

What is a financial blockage?

A financial blockage is anything getting in the way of your achieving financial freedom. It is often linked to your subconscious thoughts because if you have negative beliefs about money, you will be “blocking” or “closing” the door to having more wealth.

You Are Your Problem and Your Solution

I am glad you took the time to read this and are embarking on this journey to financial freedom.

Money blocks are a pressing issue I am passionate about because they hold almost everyone back and keep things the same.

Remember, you are your problem, and you are your solution. I wish for you to be brave, tackle these money blocks head-on, and allow yourself to reach your dreams.

Acknowledging that it will be uncomfortable and that staying in your comfort zone is easier. But what is the cost if you never try?

There is only one you in this world; you are unique and have much to offer. So quiet your mind and dream of what you want to achieve and who you want to be.

Then, commit to making a change that will result in abundance and opportunity.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting your desires, and creating a fulfilling life.

Related Articles

💎 Financial Coaching: What It Is and Why to Work with a Coach

💎 Manifesting Money: Use the Subconscious Mind to Create Abundance

💎 Money Management Rules: 50 30 20, 7-Day Rule, and 20/10 Rule

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.