What to Do When You Feel Stuck in a Lack Mentality

Are you stuck in a mindset of never feeling like you have enough money?

Getting stuck in this way of thinking can happen whether you have $1 in the bank or $1M. But improving your money mindset can provide a sense of control and confidence in creating your financial future and help you eliminate that “nagging feeling” of never having enough.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

How do I get rid of my negative money mindset?

You’ve already taken the first important step to eliminating your negative money mindset: acknowledging that your money mindset is negative. Now, you need to take action and reprogram your mind to think positively about money.

Below is a short version of the process. But I recommend downloading the meditation and guide to money mindset and manifesting.

Steps to Get Started:

- Get a notebook dedicated to working on your money mindset.

- Write down all your negative beliefs about money. Such as “money is evil” or “ I will never have enough money.”

- Work on each belief separately (one at a time) and ask yourself these questions:

What if I am wrong?

Is it 100% true that money is evil?

Can you think of any examples where money is good? - Write down positive examples that contradict each belief.

- Practice during your daily routine. Every time a negative money thought comes into your head, such as “money is evil,” pause. Be curious whether it is accurate, and repeat the positive example you identified earlier.

- Repeat this process with all of the negative beliefs you have identified. Do it over a long period. It is easiest to focus on one belief at a time. Start with overcoming just one limiting belief and then tackle the others.

Positive Money Mindset Cultivation Tip

It’s important to keep yourself on track.

To keep yourself accountable for your progress, write down each negative money belief at the top of a page, and underneath, put the percentage you believe to be accurate along with the date. Keep checking in on your progress to see how your money mindset has started to shift, and you may even be able to identify more positive examples of things that contradict the limiting belief.

Why do I never feel like I have enough?

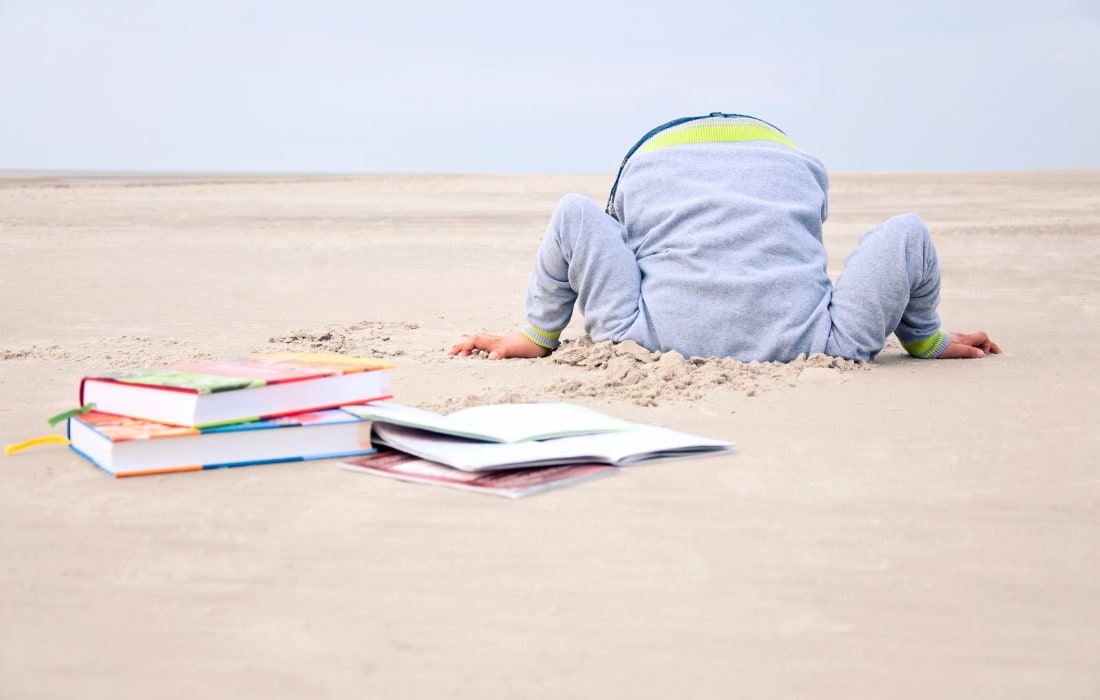

We learn most of our values as a child.

We learn from significant influences such as our parents, community, and society. This feeling of never having enough is likely traced back to when you were growing up and didn’t have enough, and it now acts as a compass for how you perceive the world.

What is a toxic money mindset?

A toxic money mindset is an attitude towards money that is a roadblock to your financial success.

If you believe things like, “I am not good with money; I will never have enough money; I don’t deserve money; Rich people are bad,” you likely have a toxic relationship with money.

How do I stop overthinking about money?

Often, we undervalue what is going on in our minds and want it just to end.

Your mind is trying to tell you something. Instead of trying to stop the thoughts, listen to why your mind is overthinking about money and notice when you started obsessing over money. Then, you will find the root cause of your distress and can look for solutions to help you move forward.

What are realistic financial goals, and how do I set them?

A realistic financial goal is achievable and linked to a predetermined time frame.

To set realistic goals, you must look deeply at how much money you bring each month from all sources and what goes out. Then, determine if you can spend less or earn more to achieve your financial goal.

Quick Video: 3 Steps to Manifest Money (Or Anything Else)

You can use these three simple steps to manifest money or anything else! Make sure you click the subscribe button if you’re YouTube user so you get more of these videos in your feed.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 How to Change Your Mindset on Making Money

💎 How Your Money Mindset Affects You and How To Change It

💎 How To Get Your Mind in the Mindset of Saving Money

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.