How much of my income should I allocate to fun money?

Budgeting doesn’t have to be dull.

One of the best parts of budgeting is allocating fun money, which is money you spend on “wants” rather than necessities. But if you’re starting to budget, you may wonder how much to budget for fun money.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

When planning how much money to set aside for fun activities, it’s all about finding the right balance that lets you enjoy life while still taking care of your needs and savings.

Fun money is about spending on things that make you happy but aren’t essential, like a fun trip, a great night out, or clothes that make you feel amazing.

Having a fun money budget is important because it keeps you from feeling too restricted.

If your budget makes you feel like you can’t have fun, you might get fed up and stop following it altogether. This could lead to spending too much on things you don’t need just to make yourself feel better. Setting aside a little for fun helps you stick to your budget because you don’t feel missing out.

It can be helpful to budget 30% of your income for spending on fun.

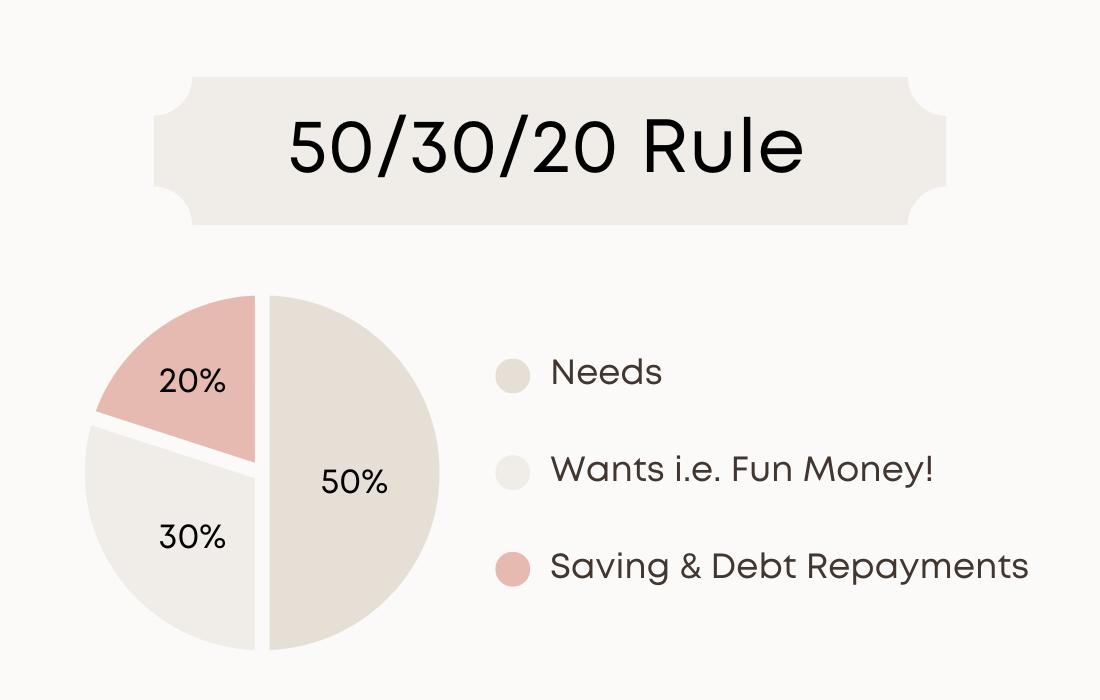

Following the 50/30/20 rule, 50% of your income will be spent on needs, 30% on wants, and 20% on savings. This money management strategy allows you to enjoy some of your money now while saving for later.

To make the most of your fun money, spend on things that matter to you.

Sometimes, we buy stuff because we think we should, not because we truly want it. Be smart with your choices. If you love fashion, sell old clothes before buying new ones. If you love hosting, try a potluck instead of a big dinner. When you think about what makes you happy, your fun money can go a long way.

What is fun money?

Fun money is money for things that are wants and not needs.

Fun money is not for practical expenses like heating your home. Instead, it is meant to bring joy to you and your family. Setting it aside as a separate budget line can help you be consistent with your budgeting and avoid overspending.

Examples of fun money are that great trip you want to take, a night out in the town, or clothes that make your heart sing!

Why is fun money important in a budget?

Fun money is essential in a budget because it helps you stay on track and enjoy the journey towards financial freedom.

When a budget is too restrictive, it can feel like it is too much of a struggle, and you’re at risk of giving up on the whole concept of budgeting. This can cause financial problems because you’re more likely to overspend and impulse shop to make yourself feel better.

Planning for some little extras will make you feel in control and more motivated to continue budgeting.

In addition, when a budget is too restrictive, your money mindset can be set to scarcity, and you start to feel like you don’t deserve to have money or spend it on yourself. You can get tripped up and allow your money blocks to stand in your way, preventing you from earning, saving, and spending with enjoyment and ease.

How can I balance saving with spending on fun activities?

To balance saving with spending, allocate a percentage of your budget for fun activities.

A popular budgeting technique is the 50/30/20 rule, which states that 50% of your monthly take-home income goes to needs, 30% to wants, and 20% to savings and debt repayment. This means 30% of your monthly income goes towards “fun money.”

Being intentional and allocating this money in advance reduces the potential guilty feeling when you spend on something you may view as “frivolous.”

Always avoid judging yourself, and remember that what is expensive to someone else isn’t necessarily expensive to you. We all value different things, and different things bring us joy. This is okay and natural. With the 50/30/20 rule, you can feel confident with your budget, pay for necessities, save a percentage for the future, and allocate a percentage towards wants.

Should fun money be a part of every budget?

Fun money should be part of every budget because, without it, people are much more likely to overspend to compensate for feelings of suppression.

Think of a restrictive diet where you’re extremely limited with your daily caloric intake intact. All the foods you enjoy and look forward to eating are “off limits.” You end up feeling bad and wrong for wanting these items, and suddenly, the chocolate cake seems way more enticing.

It’s all you can think about.

If, instead, you were on a diet where you were allowed a little piece of cake each day, you’re less likely to overindulge and more likely to follow the diet successfully.

Any change is difficult, whether it is to save money for the future or to get healthier. To help make it easier, you must acknowledge that change is difficult, be kind when speaking to yourself, and ensure you still have fun.

Ultimately, it will be worth it.

But you need to be consistent, and this can only happen if the path forward is realistic and achievable.

What are some creative ways to maximize my fun money?

To maximize your fun money, ensure you spend on what you love and value.

We often fall prey to spending on things we “think” we should enjoy or value. Instead, we should maximize or double down on what we love.

For example, if you love clothes and bags, consider consigning something you no longer use before purchasing something new. This will allow you to have extra money for a future purchase.

If entertaining is a favourite pastime, consider having a potluck or serving appetizers instead of dinner.

It is incredible how much further your money goes when you become intentional about only spending on things you love.

Quick Videos: Try Out Values-Based Budgeting!

Find out what value-based budgeting is and why it feels so much better than traditional budgeting. You need to feel good about your budget; values-based budgeting will help you with this.

What is values-based budgeting?

How can I start values-based budgeting?

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 Budgeting 101: How to Create and Follow a Simple Budget

💎 How To Become Good at Saving Money

💎 How To Become Rich by Saving Money

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.