Estate Planning Is for Anyone with Assets

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

Are you one of those people who considers estate planning to be some obscure thing people only need to do if they are ultra-wealthy?

Do you say to yourself, “My situation is simple. I don’t need an “estate plan.”

You may also think, “My family will know what I want, so I don’t need to do anything.”

If this is you, you aren’t alone; many of us think of estate planning as something other people need to do. We think it’s for billionaires or people with hundreds of millions in their investment accounts. But, the truth is that estate planning is for anyone who wants to pass their assets to their loved ones in an efficient and effective manner.

This article will help you understand why estate planning is more relevant than you might think.

To show you why estate planning isn’t just for the ultra-wealthy, I will share the top myths about estate planning. See if you relate. By the end, you should see that estate planning is for everyone.

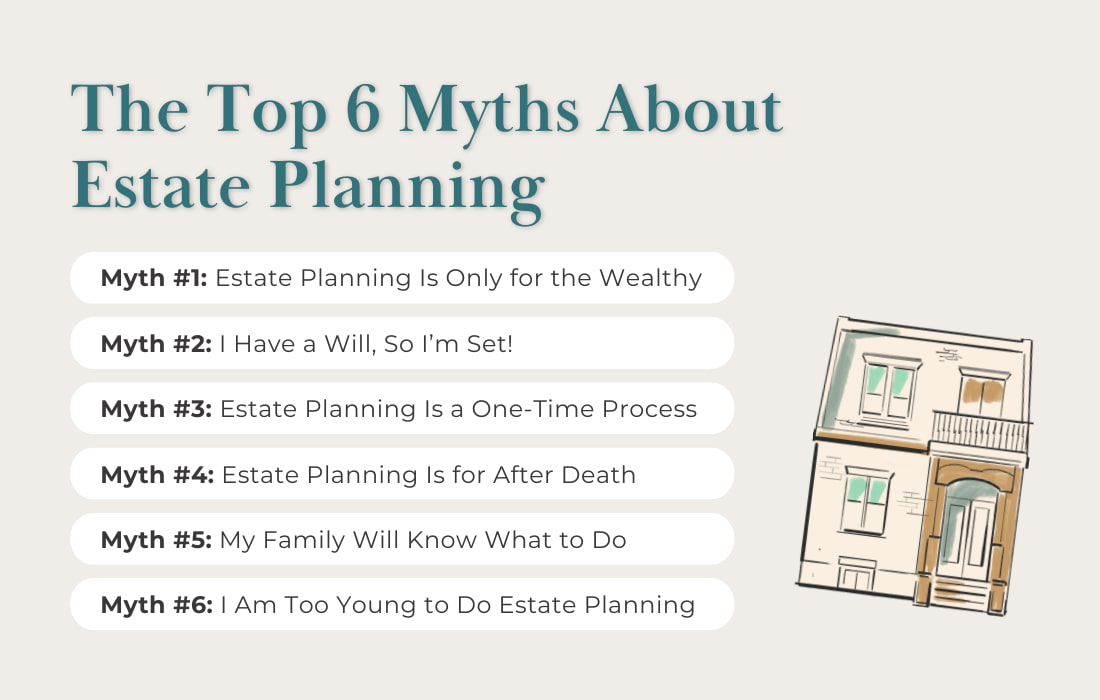

The Top 6 Myths About Estate Planning

Myth #1: Estate Planning Is Only for the Wealthy

While it is true that more wealthy people do estate planning, it is important to understand that everyone can benefit from planning and being proactive rather than reactive regarding estate planning, which includes what to do if you become incapacitated, even for a short time.

Myth #2: I Have a Will, So I’m Set!

Having a will is a step in the right direction, but it is only one part of the process.

Estate planning involves reviewing your entire picture, including considering who would act as a healthcare representative and who would make financial decisions on your behalf. Remember, a will only comes into effect after your death, and there are so many more stages in your life that you need to plan for.

Myth #3: Estate Planning is a One-Time Process

You need to review an estate plan every 3-5 years or sooner if you have had a major life event such as marriage, divorce, relocation, or a new addition to the family.

This is important because your life changes, and so do the rules and regulations. You want to ensure your current estate plan reflects that.

Myth #4: Estate Planning Is for After Death

Estate planning includes what happens after death, and it also includes strategies for when you are still alive.

For example, naming who will act if you become incapacitated. There are so many estate planning opportunities that can save you money and reduce the headache and stress that comes if there isn’t a clear document detailing your wishes.

Myth #5: My Family Will Know What to Do

Many people are surprised to learn that once you are a legal adult, your parents don’t automatically have the authorization to make decisions for you.

Also, people have this misperception that if something happens, your spouse can manage your affairs. The problem is unless you legally have given authority, their hands can be tied. In addition, different states and provinces have various rules on how your estate will be distributed if you die intestate, and it may not be how you intended.

Myth #6: I Am Too Young to Do Estate Planning

While creating an estate plan is more relevant at certain stages in life, we also know that life happens, and even when we are young and healthy, things don’t always go the way we expect.

Common Questions About Estate Planning

Can estate planning save my family time and money?

Estate planning can save your family time and money because you are proactive rather than reactive.

Estate planning involves creating a clear plan for what you wish to happen if you can no longer make those decisions alone. You can utilize planning strategies that can save you taxes and probate fees, not to mention all the potential conflicts and confusion on what you would want if it isn’t already in a plan.

Which important papers should be in my estate plan?

Your estate plan should include several important documents to ensure your wishes are carried out and provide peace of mind.

- A will outlines how your assets should be distributed, and it names an executor to manage your estate and guardians for any minor children.

- A Power of Attorney grants someone the authority to make financial decisions on your behalf if you become incapacitated.

- Documents detailing all your up-to-date beneficiary designations and ensuring that they reflect your wishes, as these designations often override your will.

- A list of assets and liabilities by keeping an updated inventory helps your executor understand your estate better and manage it efficiently.

- A trust deed, if necessary, can help manage your assets during your lifetime and after your death, providing privacy and potentially avoiding probate.

- A healthcare proxy, also known as a medical power of attorney, designates someone to make healthcare decisions for you if you cannot communicate your wishes.

- A living will outlines your preferences for medical treatment and end-of-life care, guiding healthcare providers and family members in making decisions.

How Can I Get Started?

Getting started with estate planning begins with taking a few simple steps:

- Assess Your Situation:

Take stock of your assets, liabilities, and family needs. Identify who should make financial and healthcare decisions if you’re unable to. - Gather Essential Documents:

Collect financial account details, beneficiary designations, and existing legal documents like wills or trusts. Find out when to use a trust for estate planning and see if it makes sense for you. - Consult Professionals:

Work with a financial advisor, estate attorney, and tax professional to check off all the estate planning boxes. - Create a Plan:

Develop a tailored estate plan that addresses your goals and is aligned with local laws. Review it every 3-5 years or after major life changes.

Final Thoughts

Estate planning is not just for the ultra-wealthy—it’s for anyone who wants to ensure their wishes are honoured, and their loved ones are protected.

It’s more than having a will; it’s a comprehensive strategy that addresses your finances, health, and family dynamics. Proactive planning can save time, money, and stress while avoiding conflicts.

By including key documents like a will, power of attorney, healthcare proxy, and living will, you’re creating clarity and security for the future. Life is unpredictable, and having an up-to-date estate plan ensures you’re prepared for whatever comes your way. Don’t leave it to chance.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 At What Age Should I Consider Estate Planning?

💎 What to Bring to an Estate Planning Appointment

💎 What Is Estate Planning in Canada?

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.