Trusts and Estate Planning in the US and Canada

Wondering when to use a trust for estate planning?

You’re not alone. Estate planning is a complex topic. The answer will depend on where you live and what your goals are.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

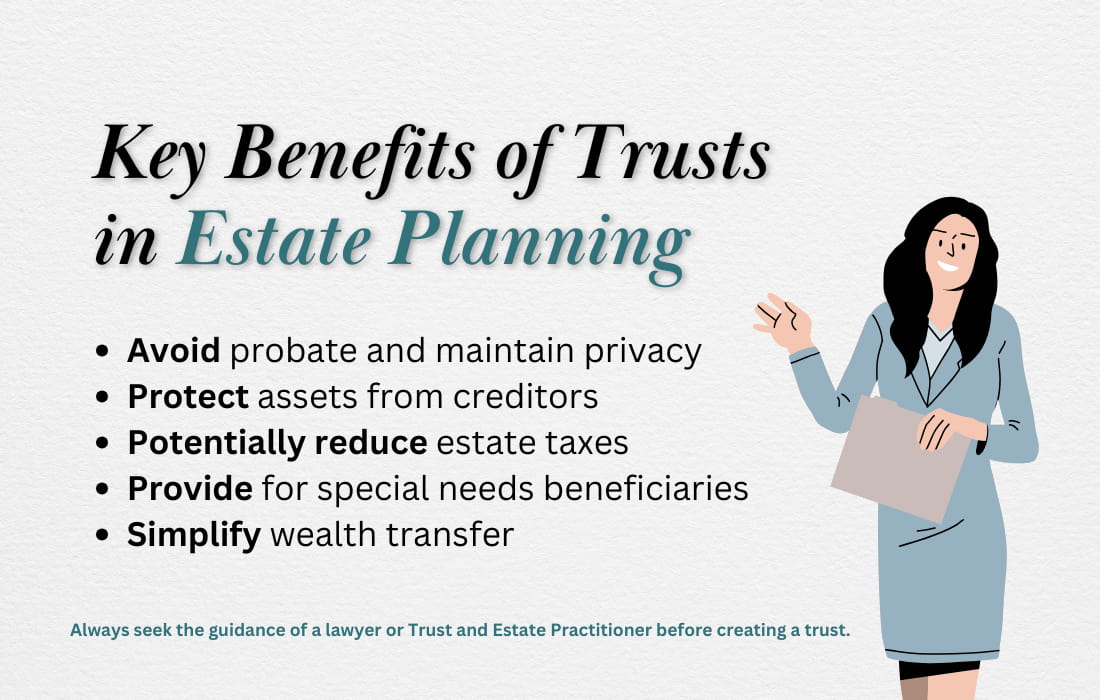

In the US and Canada, the most common reasons people use a trust for estate planning are:

- To avoid probate, which can be lengthy and costly.

- To have control over how their assets are distributed.

- To increase asset protection from creditors or lawsuits.

- To reduce estate taxes, such as with irrevocable trusts that remove assets from the taxable estate in the US. Certain types of trusts in Canada, such as family and alter ego trusts, help with tax planning.

- To help plan for incapacity so their financial affairs are still managed accordingly.

- Maintaining privacy is important because wills become public records, and trusts generally remain private.

Overall, trusts are versatile tools for individuals who want to manage their estate planning efficiently and according to their specific wishes.

What exactly is a trust?

A trust is a legal arrangement where one person (the trustee) holds and manages assets or property to benefit another person or group (the beneficiaries).

It allows the person who created the trust to have control and protection over the assets during their lifetime and after death.

How does a trust work in estate planning?

In estate planning, a trust is often used to avoid the lengthy and costly probate process, allowing beneficiaries to receive their inheritance sooner.

A trust offers a greater level of privacy compared to a will. It can also provide tax benefits, assist with planning for minors or beneficiaries with special needs, and allow the grantor to maintain control over the distribution of assets.

A grantor is the person or entity that creates the trust and transfers assets to it. Grantors are also called settlors or trustors.

You’ve probably noticed that estate planning is full of jargon, but don’t let that get in the way of figuring out the right move for you. I’d recommend reading a few articles about estate planning and then seeking the advice of an estate planning advisor or a financial advisor who can help you with estate planning.

When should I consider using a revocable trust versus an irrevocable trust?

Most people consider a revocable trust when they want flexibility and control over their assets during their lifetime.

This type of trust allows the grantor to modify or revoke the trust at any time, making it suitable for anyone anticipating changes in their financial situation or estate planning needs.

In the US, many people use a revocable trust to put their home, investable assets, bank accounts, business interests and personal property.

Revocable trusts are less commonly used in Canada because of a lack of legal recognition, limited tax savings, and the cost of setup and maintenance.

An irrevocable trust is appropriate for anyone seeking to protect their assets from creditors, minimize estate taxes, or provide for beneficiaries after death. The difference is that the grantor cannot modify or change the trust once established.

How can a trust help reduce estate taxes?

A trust can help reduce estate taxes because the assets held in an irrevocable trust do not form part of the deceased estate, reducing estate taxes.

In addition, the trust will not have to go through the expensive, time-consuming probate process. Moreover, trusts help facilitate gifting strategies before death, thus reducing your estate and the amount the government can tax.

Taxation upon death can eat up a large portion of one’s estate, reducing your loved one’s inheritance while lining the government’s pockets. For this reason, tax planning is an important part of estate planning.

What are the benefits of using a trust to protect assets from creditors?

When the grantor puts assets into an irrevocable trust, he no longer owns or controls them.

These assets are now in the trust’s name, limiting creditors’ access to them. However, if a trust is created to defraud creditors, the court might deem it invalid.

Does a trust simplify the transfer of wealth to beneficiaries?

It’s not a straightforward yes or no answer, as each individual’s circumstances vary and should be carefully considered.

However, I can say with complete confidence that effective estate planning simplifies the transfer of wealth to beneficiaries. By proactively seeking advice and creating a well-thought-out estate plan, you can identify strategies to protect your loved ones and your legacy.

Can a trust help with special needs planning for a family member?

Yes, a special needs trust in the US and a qualified disability trust in Canada allow families to put money aside in a trust to support a person with disabilities without impacting their eligibility for government benefits.

The beneficiary can still receive income from the trust for daily living expenses, medical expenses, and other needs. These trusts provide significant relief and peace of mind that their loved ones will be cared for now and in the future.

What is the process of setting up a trust?

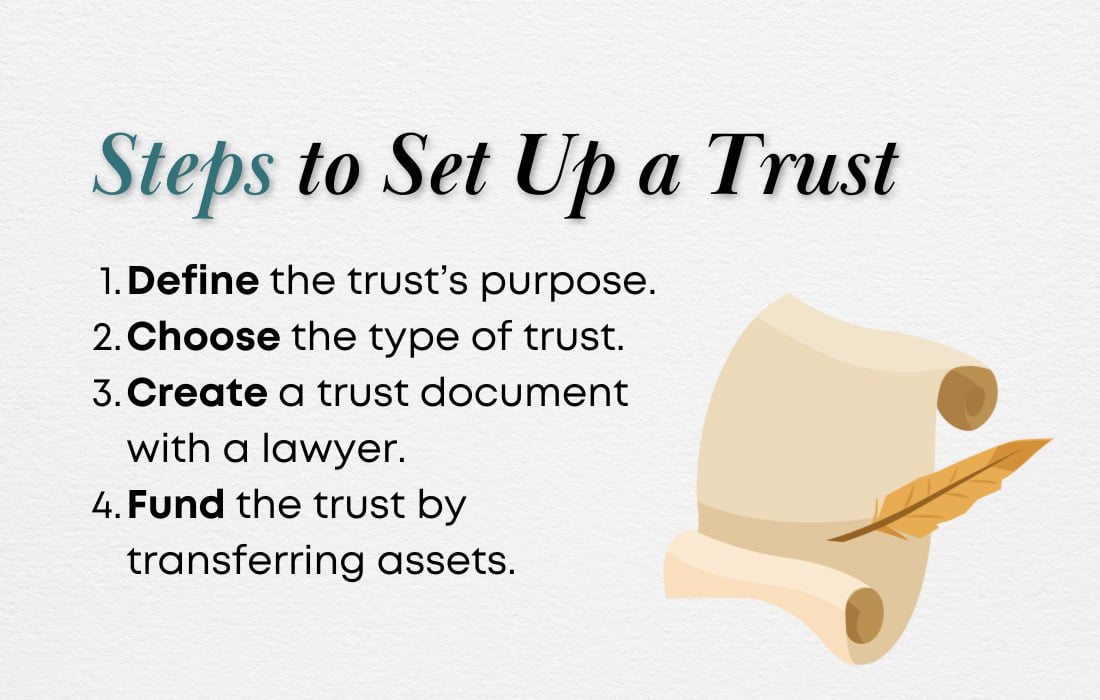

- First, determine the trust’s purpose. Is it for estate planning, asset protection, special needs, or another purpose?

- Determine the type of trust, such as revocable or irrevocable, living or testamentary trust, charitable or assets protection trust, special needs or family trust.

- Create a trust document with an estate planning attorney. Outline who will be the trustee(s) and beneficiaries and what your wishes are for managing and distributing the assets.

- Fund the trust. This is where you move assets into the trust, and they will now be property of the trust and managed by the trustee according to your wishes.

Do I need a lawyer to set up a trust?

It isn’t legally required to have a lawyer to set up a trust.

However, I highly recommend you use one because the cost and risk of your mistakes are much greater than the cost of advice. Trusts are complex legal documents that must be appropriately structured to comply with the relevant laws and effectively carry out your intentions.

Final Thoughts

Using a trust for estate planning in Canada or the US can be a game changer when it comes to protecting your legacy and simplifying the transition of wealth.

However, trusts are not a one-size-fits-all solution, and their effectiveness depends on your unique circumstances and goals. That’s why working with a financial advisor and estate planning attorney is critical. These experts can guide you through the complexities of tax laws, asset protection, and family dynamics to craft a strategy that reflects your values and priorities.

By taking the time to plan thoughtfully and seek professional advice, you can protect your loved ones, preserve your wealth, and ensure your wishes are carried out seamlessly. Estate planning is not just about wealth transfer—it’s about peace of mind for you and your family.

Finally, remember that everyone needs to do estate planning. It’s not just for billionaires. If you plan on leaving an inheritance to your loved ones, it’s important to make sure that it won’t be taxed excessively and that your wishes will be followed.

Summary of Key Points

- Avoid Probate: Trusts streamline inheritance by bypassing the lengthy and costly probate process.

- Control Asset Distribution: Ensure assets are distributed according to your wishes, including provisions for minors or special needs beneficiaries.

- Tax Efficiency: Reduce estate taxes with strategies like irrevocable trusts in the US and family trusts in Canada.

- Protect Assets: Safeguard wealth from creditors and lawsuits through proper trust structuring.

- Plan for Incapacity: Trusts ensure financial affairs are managed if you become unable to handle them personally.

- Seek Professional Advice: The cost of working with a professional is worth it over the long term. You don’t want to make costly mistakes that create a mess for your loved ones.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 What to Bring to an Estate Planning Appointment

💎 What Is Estate Planning in Canada?

💎 Why Is Generational Wealth Important?

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.