Pros and Cons of Continuing to Save in Retirement

“Should I keep saving money when I retire?”

First, you’ll want to ensure you don’t have to save during retirement. Ideally, it should be a choice and not a need.

Written By Tiffany Woodfield, Financial Advisor, TEP®, CRPC®, CIM®

But the truth is that it can be difficult to switch your mindset from saving to spending.

I’ve worked with many clients who have enough money to live the life they want during retirement but are so driven by the fear of running out that they can’t spend and enjoy their money.

Next, you need to balance the good and the bad when saving in retirement. Is your desire to save money practical? Do you need to save more money? Or are you making decisions rooted in fear?

It can be helpful to work on your money mindset if you’re struggling with fear around retirement and having “enough.”

Is Your Desire to Save Money Practical or Fear-Based?

Let me use a story to show you how the fear of spending (and an obsession with saving) can take the joy out of your retirement.

Rose was a widow. She was in her 70s with successful adult children. She had more than enough money to live comfortably for the rest of her life. In fact, she had three times as much money as she would ever need. But she couldn’t get herself to spend any money.

Rose had grown up poor and had lived her entire life frugally.

As a result, she was more comfortable with continuing to save in retirement rather than spending and enjoying herself.

Her kids openly encouraged Rose to go on trips or to spend on a cab or a nice dinner, but she couldn’t bring herself to do it. Now, you might think, “What’s the harm in saving, especially if it makes her happy?” But the problem was she wasn’t happy; instead, she felt trapped and lonely.

She didn’t have the mindset, tools or confidence to allow herself the freedom to do what she loved.

She wanted to take trips but wouldn’t let herself do it. Her frugality was no longer logical based on her financial situation and age.

I encourage my clients and friends to understand their money mindset and learn how to use practical financial planning tools.

Mastering your mindset is the only way to truly feel empowered to make smart decisions around money.

*Name has been changed.

Is it necessary to continue saving after retirement?

Fear of running out of money doesn’t go away after retirement.

If you have saved and invested sufficiently, it may not be necessary to continue saving after retirement. But you will want to have a clear understanding of your financial picture before you actually retire.

Look at your current lifestyle and how much it costs. Then, look at what income sources you’ll have in retirement and how long your money needs to last.

A simple rule of thumb is that your savings should be ten times your gross salary if you wish to retire between the ages of 65-67.

However, everyone’s situation is different. It’s important to seek professional advice if you think you might not have enough to retire or you’re simply not sure.

How much money should I have in savings when I retire?

How much you should have in savings when you retire will vary depending on your lifestyle, your current income, and what age you plan on retiring.

Because we’re all living longer these days, if you retire at age 65, then you should plan to have enough money for at least 30 years of retirement.

Below is a breakdown of an accepted rule of how much to save by certain milestones.

It’s commonly recommended that you need to save the following:

- 1 times your salary by age 30

- 3 times your salary by age 40

- 6 times your salary by age 50

- 8 times your salary by age 60

- 10 times your salary by age 67

This financial planning rule of thumb means that if you retire at age 67, you will need to save 10 times your current salary.

This financial planning rule uses your gross pre-tax salary as the basis for calculating how much you need to save.

This means that when you are assessing whether you have saved one times your salary by age 30, you should be looking at your gross salary. Your gross salary refers to the amount you earn before any taxes or deductions are taken out.

This rule takes into account the potential growth of your investments and the sustainable withdrawal rate during retirement. A common guideline is the 4% rule, which suggests you can withdraw 4% of your retirement savings annually without running out of money for at least 30 years.

Therefore, having saved 10 times your salary by retirement would allow for this 4% withdrawal rate to provide around 40% of your pre-retirement salary per year.

When combined with government retirement income such as Social Security in the US or Old Age Security in Canada and any other income sources, this should help you achieve a solid income replacement ratio.

If you’re not on track with your saving and investing goals, you can increase how much you save, reduce your spending, or potentially push back your retirement age.

How can I manage my expenses to allow for savings in retirement?

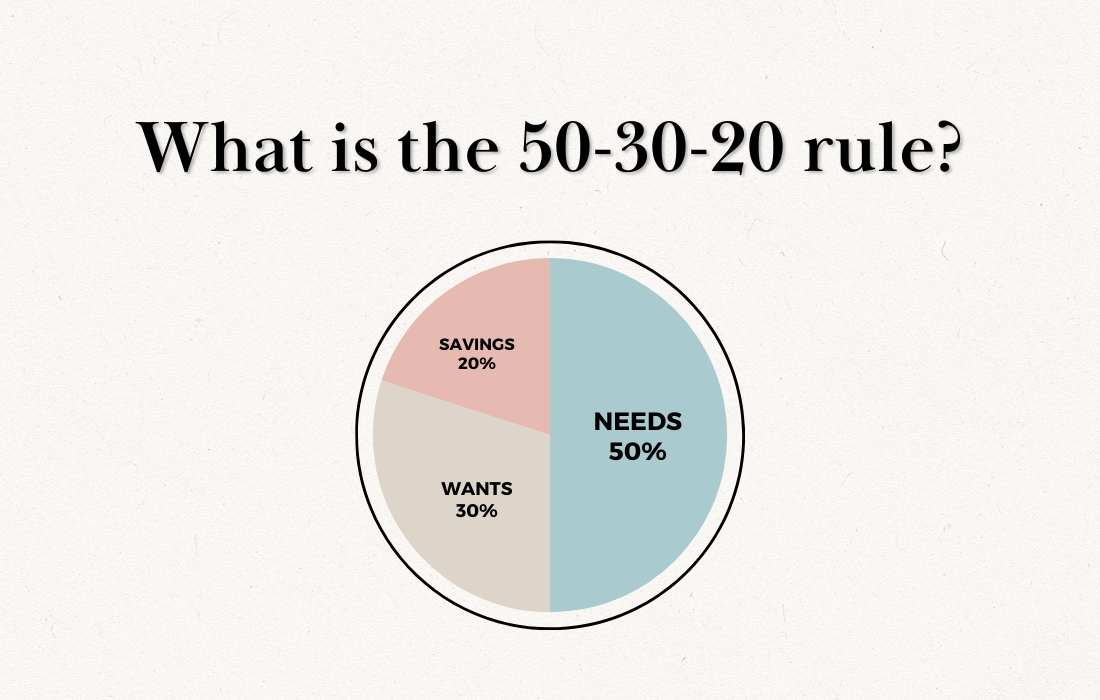

One of my favourite budgeting tools is the simple rule of 50/30/20.

So 50% of your income should go to needs, 30% to wants and 20% to savings and debt repayment.

Should I invest my retirement savings for additional income?

Whenever you are considering any investment, you need to examine your time frame.

For example, investing in a risky stock when you need the money in two years is dangerous. Instead, if you are in retirement and your savings aren’t earning anything, you may want to consider investing in dividend-paying stocks or interest-bearing securities.

You should speak with your financial advisor or financial planner about any big money moves you plan on making during retirement.

How do healthcare costs impact saving during retirement?

Healthcare costs can significantly impact savings during retirement, particularly if you live in the United States. Even when you qualify for Medicare, the average cost of healthcare is still approximately $5000 per year.

What are the tax implications of saving and withdrawing from savings in retirement?

As a financial advisor, I tell my clients that taxation is one of the biggest risks to their savings.

To prevent being taxed excessively, you need to understand the rules. For example, if you take money out of your IRA before the age of 59.5, you may face a 10% penalty.

Getting professional advice on where to draw money from first and which investments are taxed favourably to create an income stream is essential. Speak to your financial planner, accountant or financial advisor to ensure that you’re making withdrawals during retirement in a tax-efficient manner.

How can I ensure my savings last throughout retirement?

The easiest way to make sure your savings last throughout retirement is to know how much you can spend monthly during retirement so as not to run out of money.

Then, create a budget so you know where your money goes each month. Finally, make sure you stick to your budget!

If you haven’t retired yet, then speak with a financial planner or advisor to find out if you’re set for retirement or not.

Final Thoughts

Remember, you want to balance the fear of running out of money with living and enjoying yourself.

There’s no sense in being so frugal that you don’t enjoy your retirement. You’ve worked hard, and you should be able to enjoy your time with family and friends doing the things that you love!

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 How To Become Good at Saving Money

💎 Money Management Rules: 50 30 20, 7-Day Rule, and 20/10 Rule

💎 How To Get Your Mind in the Mindset of Saving Money

About the Author

TIFFANY WOODFIELD is a senior financial advisor, estate-planning expert, and dual-licensed portfolio manager based in Kelowna, British Columbia. She is the co-founder of SWAN Wealth Management, where she helps Canadian and cross-border families build lasting wealth, reduce tax risk, and create meaningful legacies.

As a TEP (Trust and Estate Practitioner) and associate portfolio manager, Tiffany works closely with successful professionals, business owners, and internationally mobile families who want to enjoy a more flexible, work-optional lifestyle. She combines deep technical expertise in wealth management with a strong focus on mindset, personal development, and purposeful decision-making.

Tiffany has been a contributor to Bloomberg TV and has been featured in major national and international publications, including The Globe and Mail and Barron’s, for her insights on retirement planning, cross-border wealth issues, and estate planning.

Professional designations:

- TEP® – Trust and Estate Practitioner

- CRPC® – Chartered Retirement Planning Counselor

- CIM® – Chartered Investment Manager