These Key Rules of Money Management Are Critical

When it comes to managing your finances, knowing the right rules of money management can make all the difference.

If you want clear and actionable guidelines to take control of your financial future and feel more abundant, you’re in the right place! I’m going to cover 12 simple rules of money management that I’ve learned the hard way.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

My Money Story

Although I’m now a portfolio manager and financial advisor, I wasn’t born being “good” with money.

Becoming good with money started in University. I can still remember opening up my Visa bill and seeing what I owed. The number felt huge. And, realistically, I didn’t have the money to pay the bill. As I calculated the monthly interest rates, I felt panic set in. I was going to have to pay 18% interest because of careless spending!

That moment sparked a deep commitment to managing my finances properly.

I created a budget, scrutinized my income, and searched for non-essential expenses that I could cut. Honestly, it was daunting to sacrifice some of my wants, especially when I compared myself to my friends who seemed to have more financial freedom. But I found motivation in the feeling of empowerment that I got from controlling my money for the first time.

Money Management Advice for My Kids

If you just want some quick advice, I’ve got you covered.

I have two twin boys who are in their tween years. This is what I will tell my boys when they are older, and it’s what I would tell anyone who is starting out on their money management journey:

- Establish automatic savings, where a portion of your income goes into a separate account that earns passive income

- Putting aside money in your 20s means time is on your side because it allows your money to compound over the years, leading to significant growth.

- Remember, your savings and investing accounts should be viewed as long-term investments in your future, not money for immediate expenses.

Now, if you’ve got those basics covered, keep reading for more actionable tips!

12 Simple Rules of Money Management

1. Understand Your Income

Understanding your income starts with knowing how much money you earn monthly from your job or other sources, such as investments.

You should also know how taxes and deductions reduce your take-home pay, so you can budget accurately.

For example, if you earn $100K a year, how much do you receive in your pocket each month? This creates a clear picture to build your financial situation.

2. Don’t Spend More Than You Make

While it may seem obvious not to spend more than you make, it is increasingly difficult to avoid spending, given credit cards, societal pressure, and social media.

You’ll need to make a conscious effort to live within your means, which helps you avoid debt and financial stress. Remember, when you overspend, it spirals, and you can end up spending more on debt repayments than you imagined possible. Remember that saving money is a way of taking care of yourself.

3. Get Your Budget in Order and Track Your Expenses

It is so vital to be proactive and set a budget so you can understand how much money comes in and out each month.

There are many excellent budgeting tools, so choose one that is suitable for you.

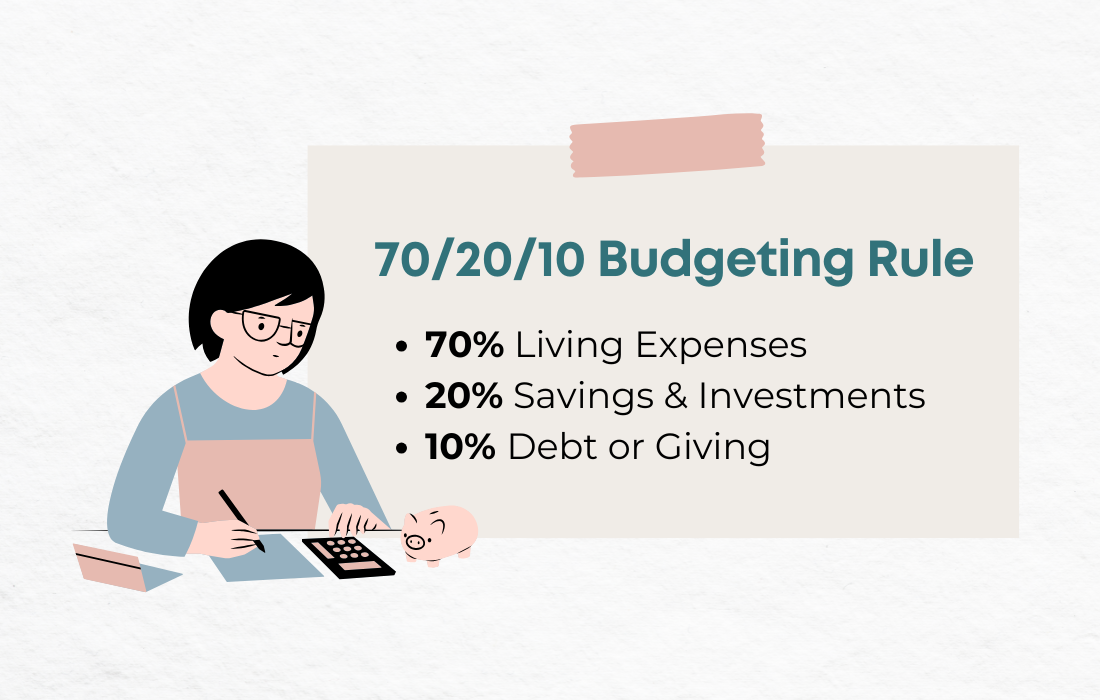

70/20/10 Budgeting Rule

The 70/20/10 budgeting rule is a simple way to manage your money by dividing your income into three categories: 70% for living expenses, 20% for savings and investments, and 10% for debt repayment or charitable giving.

You can get overwhelmed when trying to budget, and categorizing your priorities ensures your basic needs are met without overspending. It also encourages you to build an emergency fund, promotes responsible debt management, and gives back to the community.

This budgeting rule may be best for those with a higher cost of living relative to their income.

- 70% living expenses

- 20% saving and investing

- 10% debt or charitable giving

The 50/30/20 Budget Rule

The 50/30/20 budget rule divides your income into three categories:

- 50% for needs, such as rent, groceries, and utilities

- 30% for wants such as entertainment and eating out

- 20% for savings and debt repayment

Following this method, you can prepare for emergencies and future goals, while also tackling any debt you may have.

These rules allow you to enjoy life while building a strong financial foundation.

4. Research Before Making Big Purchases

Researching before making big purchases means taking the time to gather information about the product or service you’re considering.

Doing your homework ensures you’re getting the best quality for your money and avoiding buyer’s remorse later on. Being informed can save money and help you make smarter decisions.

5. Plan for Retirement

I often say I wish they taught kids in school how to manage their money and the importance of planning for retirement.

You want to think ahead about how you will support yourself financially when you stop working. All too often, people spend what they earn and don’t put enough value on saving for retirement. There are several easy ways to set up saving automatically, such as investing in retirement plans or having a set amount come off each pay cheque to save and allow it to grow over time.

6. Automate Your Savings

I’m a big believer in the benefits of automating your savings because it makes saving money easy and less stressful. (And who doesn’t love that!?)

For example, let’s say your teenage son has a part-time job and earns $200 a week. You could advise him to set up a bank account to automatically transfer $20 into a savings account right after he gets paid. This way, he won’t even notice the money is gone. Over time, he’ll build a nice savings cushion without thinking about it.

Quick sidebar: You know all those subscriptions you don’t realize you pay for each month?

These companies’ business models are successful because they automatically get paid. Imagine if Netflix had to contact you each month to confirm whether you would like to sign up for the following month. How much money would they lose out on? The same is true for your savings plan. You lose out when it isn’t automatic.

7. Invest Wisely and Don’t Try to Time the Market!

Investing wisely means putting your money into stable companies with a good track record, rather than gambling by trying to time the market.

Remember, when timing the market, you need to be right twice—once when you buy and again when you sell, which can be risky. Since even most professionals don’t beat the market, who is to say that you’re going to have such luck?

Instead, focus on investing for the long term with a focus on high-quality businesses that are likely to grow over time. This approach reduces the stress of constantly watching the market and makes it easier to stay invested.

A simple example:

Imagine two brothers, Jake and Alex, who had $100,000 to invest. Jake loved the thrill of gambling with his money, so he decided to invest in a single trendy stock he thought would skyrocket overnight.

Alex took a more thoughtful approach, investing his money in well-established companies. He left his money in the market no matter what was happening. And he kept investing more each month.

Jake kept pulling his money out “strategically” to reinvest it into new hot stocks. He was always trying to beat the market or get in on the latest hot stock tip.

Over the next 10 years, Jake ended up losing most of his initial investment because, well, timing the market is hard! Meanwhile, Alex’s stable investments gradually grew. In the end, Alex doubled his money and learned the value of patience and careful planning.

8. Understand Taxes

Understanding taxes is crucial because they impact all aspects of money management, from your income and investments to estate planning.

For many people of all income ranges, the tax bill is the largest expense of the year. So, it pays to be aware of your taxes and reduce them when possible.

Examples:

- Taxes reduce the amount of money you take home from your job, so you must account for them when budgeting.

- Taxes can diminish your overall investment returns. You should consider which investments and accounts are taxed favorably and understand the tax impact when you sell assets.

- When it comes to estate planning, understanding how taxes affect inheritance and gifts is essential to ensure your loved ones receive the maximum benefits.

By considering the impact of taxes on your financial decisions, you can create strategies that help you keep more of your money.

9. Financial Goal Setting and Maintaining Consistency

Financial goal setting is important because it gives you a clear direction for your money and helps you stay focused on your goals.

Let’s look at an example to illustrate:

Jessie and Dan are married with two kids. They’ve been dreaming of going on a vacation to Hawaii. But when they looked at the cost, they realized it was unaffordable.

Instead of giving up, they set a financial goal to save $5,000 for the trip over the next year, which felt much more achievable once they broke it down. They created a savings calendar, marking each month with how much money they needed to save—about $416 per month—to stay on track.

By seeing their progress on the calendar, the whole family could celebrate milestones, like reaching the halfway mark. This motivated them to stick to their budget.

In the end, they not only reached their savings goal but also enjoyed the vacation of their dreams!

10. Get Out of Consumer Debt

Getting out of consumer debt is crucial because it frees up your money for savings and investments instead of just paying interest on loans.

When you’re in debt, especially from credit cards and personal loans, the interest can add up quickly, making it hard to achieve your financial goals. Reducing or eliminating debt relieves stress and is an essential step toward building a secure financial future.

11. Create an Emergency Fund

An emergency fund is like a safety net when life throws surprises your way, such as job loss or medical emergencies.

It can also help you avoid going into debt or derailing your budget. Ideally, your emergency fund should cover three to six months’ worth of living expenses.

12. Maintain or Improve Your Credit Score

Maintaining or improving your credit score is vital because it affects your ability to borrow money and the interest rates you’ll pay on loans and credit cards.

A higher credit score opens the door to better loan terms, saving you a lot of money over time. You can improve your credit score by paying bills on time, keeping your credit card balances low, and avoiding opening too many accounts at once.

BONUS: Separate Your Emotions from Finances

Many people underestimate the emotional side of their financial decisions, which can significantly impact their financial well-being.

While strategies like budgeting and automatic saving are crucial, if you haven’t addressed your emotional relationship with money, those tools may not lead you to financial freedom. It’s like having the parking brake on while you’re trying to drive towards your ideal financial goals.

Emotions create our behaviours, both consciously and subconsciously, influencing everything from spending habits to saving tendencies.

To reflect on your beliefs about money, ask yourself these questions:

- Do you see yourself as deserving of success?

- What are your views on money? Is money good or evil?

- What about people with money? Do you believe they are selfish or good?

- Do you believe you are good with money?

- Do you have any limiting beliefs about money? What are they?

Understanding your emotions about success and money can help you develop a healthier financial mindset and make better decisions.

Common Questions

What is financial planning?

Financial planning is the process of setting goals for your financial future and creating a comprehensive strategy to achieve those goals. It includes managing income, expenses, savings, and investments.

How can I figure out if I’m spending money irresponsibly?

To determine if you’re spending money irresponsibly, you first need to define what responsible spending looks like for you. It isn’t about being “perfect,” but it typically includes prioritizing essential needs before indulging in wants or luxuries. It involves budgeting, saving a portion of your income, and making thoughtful decisions that align with your financial goals.

Evaluating your spending habits against these criteria can help you identify areas where you may be overspending or making impulsive purchases.

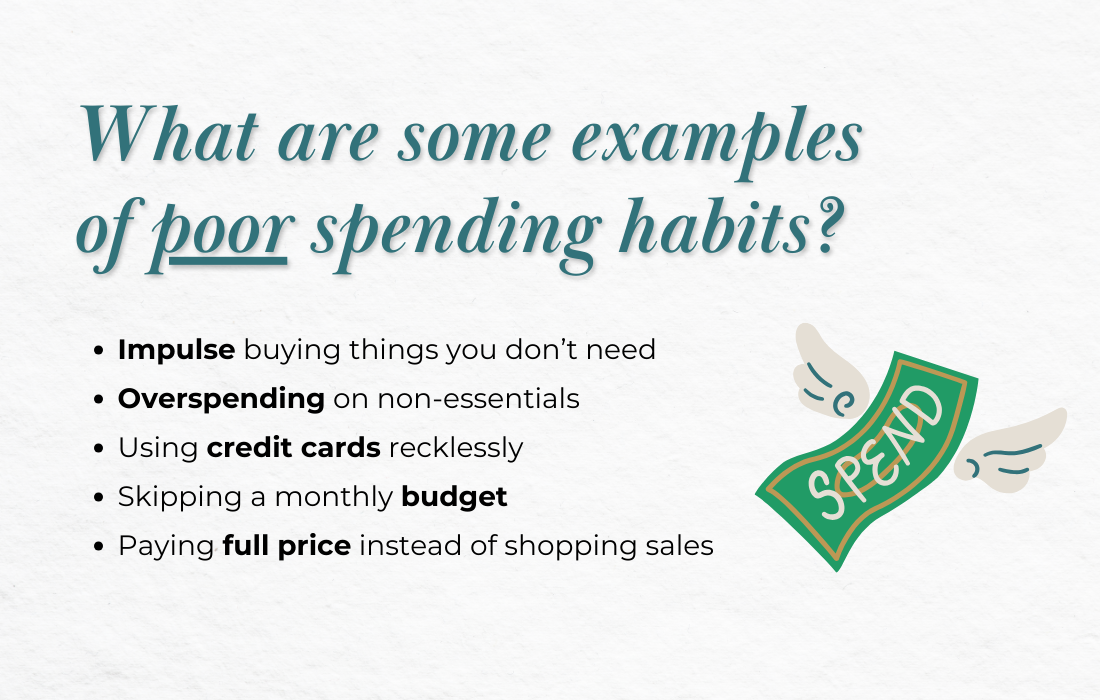

What are some examples of poor spending habits?

- Impulse Buying: Making unplanned purchases without considering whether the item is truly needed.

- Overspending on Wants: Consistently prioritizing non-essential items over saving for needs or future goals.

- Using Credit Cards Recklessly: Racking up credit card debt by purchasing items without the ability to pay them off in full, leading to high-interest payments.

- Not Budgeting: Failing to create or stick to a budget can result in overspending and a lack of awareness of where money is going.

- Ignoring Sales and Discounts: Purchasing items at full price when discounts or sales are available, which can lead to unnecessary spending.

How can I select smart and sustainable savings goals?

Start by setting specific, measurable, achievable, relevant, and time-bound (SMART) objectives that align with your financial priorities. Consider your short-term and long-term needs, such as building an emergency fund or saving for a major purchase.

Ensure your goals are realistic and based on your current income and expenses. Regularly reviewing and adjusting these goals will help keep you motivated and on track to achieve them.

Is it better to pay off debt or save money first?

I usually recommend prioritizing paying off high-interest debt first, as the interest can quickly accumulate and outweigh the benefits of saving.

However, it’s also important to have a small emergency fund in place to avoid accumulating more debt when unexpected expenses arise. Finding a balance between paying off debt and saving can lead to better overall financial health.

When should you pay more than the minimum payment on a debt?

You should pay more than the minimum payment on a debt whenever possible, particularly if it’s high-interest debt, like credit cards. Increasing your payments can help you pay off the debt faster, improving your overall financial health and credit score.

In addition, making larger payments can provide peace of mind and lessen the burden of debt more quickly.

What is the most important strategy to follow if you want to achieve financial freedom?

The most important strategy to achieve financial freedom is to create and stick to a well-defined budget that balances income, expenses, savings, and debt repayment. By consistently tracking your spending and prioritizing saving and investing, you can build a solid foundation for wealth over time. Additionally, you need to understand any of your limiting beliefs around money and success, which could be holding you back.

Final Thoughts

At the heart of smart money management is understanding how to make conscious decisions about how you spend money.

Whether it’s reviewing your checking account regularly or setting up automatic contributions to your savings accounts, the small habits you build today will shape your financial future.

These 12 rules aren’t just guidelines—they’re stepping stones toward a more empowered and intentional relationship with money. Remember, you don’t need to be perfect; you just need to be consistent and mindful as you grow. And if you’re having trouble getting there on your own, consider working with a wealth coach or a financial coach. Find someone who can help you overcome limiting beliefs around money and give you strategic advice.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Read More:

💎 Budgeting 101: How to Create and Follow a Simple Budget

💎 Money Management Rules: 50 30 20, 7-Day Rule, and 20/10 Rule

💎 How To Become Rich by Saving Money

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.