Releasing Financial Blocks

Let’s talk about how to remove financial blockages with ease.

We all have limiting beliefs and money blocks that keep us from enjoying what we have and growing our wealth. Later in this post, you’ll discover how I overcame my biggest financial blockage and 10 tips to help you improve your money mindset.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

Quick Overview of Removing Financial Blockages

To remove financial blockages, you can start by writing down all your beliefs about money.

Then review the list and ask yourself if each money belief is 100% true. Identify which beliefs about money are blocking you. Then, write a positive affirmation that counters each money block.

When you hear yourself repeating the old subconscious beliefs about money, pause. Take a moment to remind yourself that this belief isn’t true, and then repeat your new positive affirmation.

Removing the first big money blockage can be the hardest, but you can do it. Keep reading to find out what my big money block was and how I overcame it.

My Biggest Money Block and How I Removed It

My biggest money block was thinking I was bad or selfish for wanting more success and, therefore, money.

I remember being in a serious relationship and living with a boyfriend. When you live with someone, you gain insight into your and their relationship with money. He constantly complained that I worked so much — insinuating that “Life is about more than work. It’s for living and enjoying the moment, and don’t I have enough?”

Looking back on this time, I realize I felt superficial or selfish for wanting to work and get ahead.

I thought that I should just be content with what I had. I even thought that I must be “money hungry.”

I don’t know whether he really believed I was selfish. But at the time, I did believe it. I was repeating in my head that I was wrong and questioning my values. These negative thoughts that “trying to get ahead means you aren’t zen, that you’re superficial, and money won’t buy you happiness” were my money block.

I began to question my reasoning for wanting to get ahead.

I tried to “slack off” and do less because this should result in me being more peaceful and, therefore, happy. The problem was the more I tried to change, the more unhappy I became.

I enjoyed being a contributor and having a purpose. I loved learning, building, and creating something of value. It made me feel peaceful. This realization made me realize my money beliefs were blocking me from happiness.

The change I needed to make was not to work less but to uncover what made me feel bad. So, I decided to face my money blocks head-on by writing out all my money beliefs.

Then, I got curious about these beliefs. What if these beliefs weren’t 100% true?

For example, if I worked harder, was I really selfish and unhappy? Or could I look at it differently?

I knew I felt good being a contributor and learning, and this created happiness.

So, next to the negative money block, I wrote out a positive affirmation.

Every time the old programming came up that I was selfish, I could pause and acknowledge that this was my old belief and wasn’t true. I could acknowledge that you can work hard and be happy.

Of course, you need balance, but you don’t need to live in fear and judgment if you choose to do an extra project. You get to decide if it is rewarding for you.

I found working through this initial money block the most difficult because I wasn’t sure I believed I could change.

Now, years later, I can recognize when a new money block is holding me back, and I can quickly acknowledge and move it out of my path.

Run Your Own Race and Ignore Societal Messaging

In our society, the message that wanting more and creating or having wealth is bad and selfish is everywhere.

It is much easier to sit back, play small, and not pursue your dreams because then you avoid the risk of judgment from others and, most importantly, from yourself.

I continually remind myself that while I can’t control what others believe, I can control my internal beliefs about money.

I can release these financial blocks and be aware of my relationship with money.

This story is from over a decade ago, but each time I take a financial leap, I hit another money block. The work is ongoing. But it gets easier to recognize new money blocks. And the rewards of being free to pursue whatever you want, even if the result is more money, are priceless!

Even the Ultra-Wealthy Struggle with Financial Blockages

Many people struggle with mental and emotional barriers that slow down their financial success.

Even the ultra-wealthy have money blocks and financial blockages that prevent them from making the best possible decisions about their wealth and enjoying a state of abundance.

I recommend you read this post in full as I’ll explore practical steps to identify and overcome these blocks, leaving you with a clear understanding of common money blocks and effective strategies to release them. By understanding and addressing these blocks, you can change your mindset and adopt positive habits that ensure long-term financial well-being.

What Is a Financial Blockage or Block?

A financial blockage is just what it sounds like; it blocks your path to financial freedom.

Although the definition is simple, understanding your financial blockages is much more complex because they aren’t always logical. And they’re often subconscious.

For example, an illogical financial block could be that you won’t let yourself find a job that helps you earn enough money to get out of debt and get ahead. An emotional financial block could be that you don’t think you deserve more money or opportunities.

Why Do We Have Financial Blocks?

The most common reason we have financial blocks is a deep-rooted fear.

People worry about what family or friends will think if they have more money.

- How will I be judged if I am successful?

- What are the negative consequences of creating wealth?

Often, your financial blocks stem from your childhood and the beliefs you acquired from your parents, caregivers, or society.

How Do You Know If You Have Financial Blocks?

To understand if you have financial blocks, you need to be honest with yourself and ask some difficult questions.

If you’re serious about understanding if you have financial blocks, you need to set aside some time and honestly ask yourself a few questions. Grab a pen and paper and start journalling through these questions right now! (Or bookmark this blog for later, and go through this journalling process sometime this week.)

By going through these questions, you’ll gain a better picture of how you actually think about money. This is invaluable information as you work to overcome your financial blockages.

Background Programming

- What is your earliest memory of money?

- What values or lessons did you learn about money?

- How does your family view money?

- When you think about money, do you feel like a victim and like money has a hold over you? Or do you appreciate that money always flows and you can create wealth and give it away?

Current Situation

- Do you judge people with money?

- Are you comfortable with people who have wealth?

- Are you able to meet your financial commitments?

- Do the people around you have good money beliefs? Are they positive when speaking about money or negative?

- Do you feel guilty about pursuing goals where financial success may be a part of it?

- Can you give away money, or are you afraid of losing it?

Future Expectations

- How do you feel about your financial future?

10 Ways to Remove Financial Blocks with Ease

Are money blocks holding you back?

These 10 steps can help you remove your biggest money blocks and achieve financial success. Clearing money blocks is important. But it’s an ongoing process.

You won’t clear every single money block you have in one sitting. And you don’t need to eradicate every single money block to start improving your financial success.

Embrace the process, and start taking small, consistent steps today.

1. Set a Financial Goal

You need to create a clear purpose and reason why you want to remove your financial blocks.

This is your motivation for making a change, so ensure it’s what feels most important to you. Some examples to get your thinking are:

- To be able to pay off credit card debt so I feel financially free

- To be able to purchase a home,

- To create security for me and/or my family

- To go on a trip to Europe

- To feel independent so I don’t need to rely on anyone else

- To be able to go back to school

There are many different goals, and you may find it helpful to create a long-term goal as well as a mid-term goal, so you know you are staying on track. Remember, having financial freedom means you have choices in life. And that is more empowering than anything else.

2. Acknowledge you have Financial Blocks

To create any change, you must know your starting point.

In this case, your starting point is understanding your financial blocks. It’s like lifting the hood of your car to find out what isn’t working and why you aren’t moving forward. So, I suggest writing down all the negative beliefs you have about money in a dedicated journal.

Think of anything that doesn’t align with your financial goals.

Next, put a star beside anything that really stands out to you and choose a couple to work on changing by considering if you could view a different way and if these negative thoughts are 100% true. On a daily basis, revisit the list of identified key blocks and consider examples of where this isn’t accurate.

3. Release Your Grudges

You need to release any grudges because this takes up energy and keeps you thinking like a victim rather than creating the life you want.

For example, let’s say you often think to yourself, “Well, my dad was terrible with money, and I never had any hope of success.” Instead, accept that although your early experience with money didn’t support you in the past, now, you can choose to learn new ways to create success different from the past.

This early experience has made you stronger, and you can identify what you want to do differently.

An example of a grudge we can all relate to:

I have a friend who was in a marriage that ended. And now, every time you see him, you can hear him complaining about his financial situation. He says things like, “I got taken for everything, and if I had never gotten married, I wouldn’t be in this financial mess!”

Yes, he might be in a poor financial situation, but it has been several years since the divorce, and he hasn’t done anything to change it. By holding onto this grudge, he is “frozen” in time as a victim and is not taking action to get where he wants to go.

We need to let go of grudges so that we can take positive action and not get frozen into an unhelpful view of ourselves as victims.

4. Counselling/Therapy

If you are struggling with how to get started and don’t know your financial roadblocks, a counsellor or therapist can help.

Make sure they specialize in financial coaching or helping others create an abundance mindset. They can act as a guide, provide valuable tools, and hold you accountable for making changes.

Several coaches use a popular technique called tapping, which uses acupuncture points on your body while focusing on a particular emotion or issue.

Evidence shows that it can connect the body and mind, creating change sooner.

Remember, everyone is different, so it is important to do what works best for you and try different options if the first doesn’t “feel right.”

5. Practice Gratitude

Practicing gratitude is an effective and easy way to shift your money mindset and remove financial blockages.

Create a routine where you practice gratitude daily. It’s best to practice it at the same time each day. For example, every night, you could write in a journal three things you are grateful for. By keeping a visual reminder, such as your journal on your bedside table, it is more likely that you will remember.

If you aren’t convinced this “gratitude practice” works, test it the next time you feel frustrated, down, or upset.

Go to the bathroom and say three things you are grateful for. It is helpful to already have three things you know you are always grateful for because when you are upset, it can be difficult to think clearly. Some examples that many people can be grateful for are:

I am grateful for:

- The roof over my head

- The clothes I am wearing

- My sense of smell, sight, sound or taste

- My health

- The last meal I had

- Nature and the trees or water

- Someone you care about or who has been there for you, even if in the past

6. Get Intimate with Your Finances

It may be easier to stick your head in the sand or to avoid opening yet another bill.

But without understanding your current financial situation, you will not be able to make changes. You need to develop a close and positive relationship with your finances. This means looking at how much money comes in and goes out each month.

Delve into what costs are fixed, such as a mortgage or rent, and which are variable, such as entertainment.

Be curious about things you spend money on that feel worth it versus other things that don’t feel worth it.

7. Create a Budget

Once you have created the foundation of understanding your money flow and financial situation, it’s time to create a budget.

Look at your goals and see how you can achieve them and stay on track. That means earning more or spending less. Consider what you’re spending on and whether you value it or if it is an impulse buy.

There are many reasons we spend money; make sure that your spending aligns with your values and goals. In the short term, it may mean “missing out” on a few comforts you are used to, such as subscriptions, eating out, or the latest fad.

You may start to work a second job to get ahead. Sometimes, you need to give things up to get ahead, and this is why it is so essential to keep your purpose clear in your mind.

A Word of Encouragement:

If you just read the word budget and cringed, remember a budget doesn’t mean you’re bad for spending. If you think of a budget as a bad word, call it a tracker because this is what it is.

It’s just a tracker that will move you along the right path to reach your goal!

8. Meditate

Meditation is one of the best tools available to help you focus and learn more about your subconscious thought patterns, which leads to discovering your financial blocks.

Many people mistakenly think meditation only works when sitting on a mat. However, once you start a regular meditation practice, it impacts your daily life by providing perspective and insight into how you interact with your environment. Because you have listened to what is going on in your mind during meditation, you start to listen even when you aren’t sitting on your mat.

For example, you will begin to notice your internal dialogue and judgments when you encounter different people and situations. You may start to wonder if this view supports your goals or is, in fact, a roadblock.

A common misconception about meditation is that it isn’t working.

Have you ever tried meditating and felt your mind racing the entire time? You might think, “Frigg, this isn’t working. I am not zen. My mind is racing! And I am only stressing about what I need to do. I must be doing it wrong.”

This experience is common and one I used to have daily when I first started.

I remember being more stressed after my meditation because I had “wasted” precious time.

But I want you to know that this exact experience is meditation working.

Meditation isn’t about arriving at some destination.

Rather, meditation is a process of observing your thoughts, continually returning to inner awareness, and focusing on your breath. This allows you to observe what is going on in your mind and helps you notice all the thoughts you have throughout the day.

Keep with the practice; you will have great “quiet moments” in between the constant chatter, and the insights will come and be worth it.

9. Visualize Your Financial Goals

Have a visual reminder of your financial goals and have it in a location you will see every day.

This creates the motivation to keep going because you know the end result. For example, if your goal is to travel to Africa, then have a picture that represents this to you, and keep it where you see it.

I have had people put the picture on the back of their clear phone case, so it is always visual. Use what works best for you. But the more you see it, the quicker your results can come because you are motivated and looking for opportunities to achieve your goal.

10. Continually Track and Review Your Progress

It is important to track your progress by setting a regular schedule.

For example, you could review your progress on the first Monday of each month. This would hold you accountable and allow you to celebrate your successes. It is also equally important to identify when you went off track and where you went wrong to prevent your progress from stagnating too much.

It isn’t about feeling bad but acknowledging that you made a mistake so you can improve. Just know that this is part of the learning.

Remember to track not just your financial milestones, such as paying down debt, but also emotional milestones, such as recognizing money blocks and taking action to change these thought patterns.

Always remind yourself that it is one step at a time, and it gets easier.

3 Most Common Financial Blocks

The three most common financial blocks that I’ve seen in my work as a financial advisor and coach are

1) Fear of Financial Success: A fear that having more wealth or money will negatively impact you. For example, you might think to yourself, “But what would my family or friends think if I made a lot of money?”

2) Scarcity Mentality: A chronic fear that you will never have enough and that money is to be held tightly because it may disappear. This is a “lack mentality” and creates a need to continually save.

Even if you have more than enough money to enjoy your life, you can’t enjoy it because you are terrified of running out. This mindset keeps you from enjoying life because you are frozen with fear.

3) Negative thoughts about Money: If you hold negative beliefs about money, then you are repelling more money and abundance from coming into your life.

For example, if you think rich people are bad, then you will never make decisions that will create more wealth because of this negative belief that if you were rich, you would be bad.

Money Blocks Q & A

Do affirmations help with financial blocks?

Yes, by practicing money affirmations, you are retraining your subconscious mind with abundance and letting go of limiting beliefs.

How important is mindset in overcoming financial blocks?

Your mindset drives all your decisions and, therefore, actions.

Not addressing your money mindset so it aligns with your goals is like having the parking brake on while trying to drive to your destination.

What have you done to stay motivated while working on your financial blocks?

To stay motivated, I focus on what I have achieved so far, especially when I have large impact goals that have a longer time frame.

To do this, I look at a time frame, such as 3-6 months, and write down everything I have already achieved. I write down things like how often I meditated, practiced gratitude, or worked on visualizations.

Then, I look at the logical numbers. Have I saved more? How have I made progress?

We often forget all the “little wins.” But little wins are part of bigger successes. And the little wins are what keep you motivated.

What is a positive money mindset?

A positive money mindset is where you think abundantly about money and the ability to create more.

You love how money supports your life, and you love giving to others, knowing there is always more. You have a positive attitude about your ability to create success and admire those who have money.

You have worked on your past beliefs that may not have served you, such as that money is bad or people with money are bad.

Remember, it isn’t money that makes someone bad. It is an individual’s values and decisions. There are just as many crooks who don’t have money. They just have an easier time hiding.

Does my bank account balance reflect my financial blockages?

Yes, often, your bank account balance reflects your financial blockages, especially if you are at the stage where you have had opportunities to create financial security.

How do I know if I have “enough money?”

Having “enough money” is subjective because it is different for everyone and depends on where you live, your age, and your lifestyle.

As a simple rule of thumb, start looking at how much you earn and how much your expenses are. Then, are you saving or going into debt each month?

If you are looking at retirement or a “work optional” lifestyle, you can use the 4% rule, which means you will need 4% of your savings for each year in retirement.

Consider that we often live for 30 years or more in retirement.

Another strategy is to consider that you will need 70% of your working income to spend each year on retirement. But before making drastic decisions like quitting work, I recommend having a trained professional create a financial plan for you.

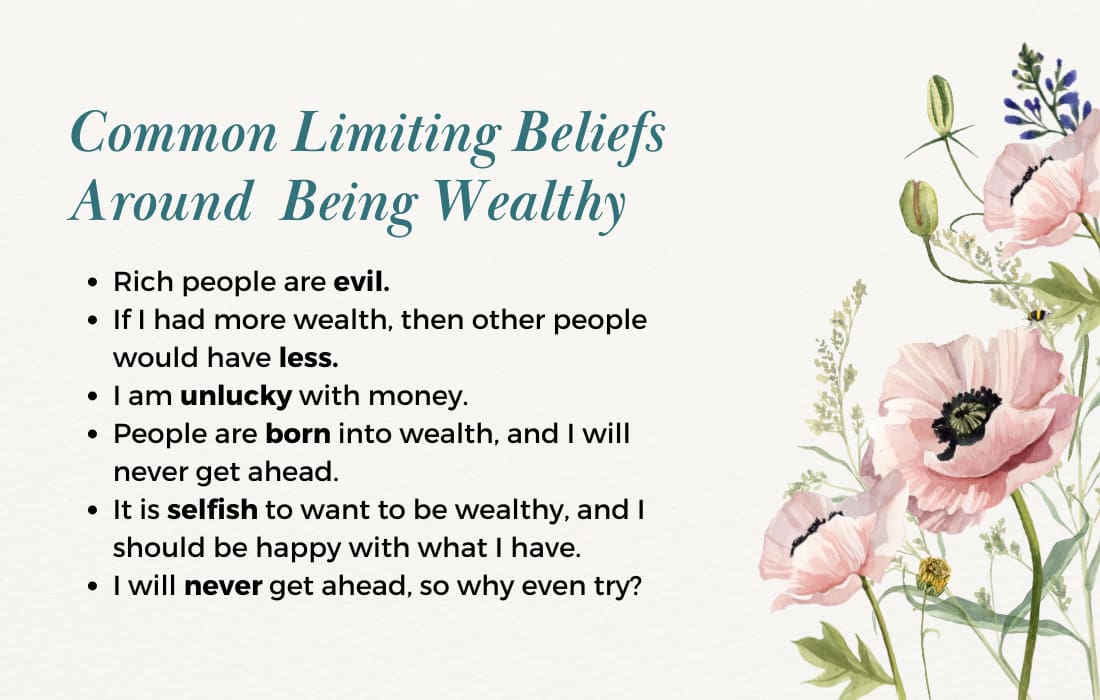

What are the most common limiting beliefs around wealth and being rich?

The most common limiting beliefs around wealth are:

- Rich people are evil.

- If I had more wealth, then other people would have less.

- I am unlucky with money.

- People are born into wealth, and I will never get ahead.

- It is selfish to want to be wealthy, and I should be happy with what I have.

- I will never get ahead, so why even try?

What are some common negative money beliefs?

One common money block is that money is bad, and the people who want money are also bad. This might be the most common money block. Here are a few more negative beliefs that often block people:

- Money is scarce.

- I am bad with money.

- Money is bad, and if I have more, I will be bad.

- Money doesn’t buy happiness.

- What would my family or friends think if I wanted to pursue more money!? They might think badly of me!

Do you hold any of these beliefs about money? Go through the process to release these blocks, and you’ll be on the path to financial freedom!

Final Thoughts

Remember that there’s only one you.

Your life matters, and playing small is not the path to happiness. Instead, being yourself and going after what you want allows you to be a contributor. The world needs your gifts and talents. Being a contributor helps everyone, not just you.

Everyone makes money mistakes. However, the path to financial abundance and financial freedom is through small, consistent steps. You may have one money block or 100 money blocks. It doesn’t matter.

As long as you continue to question negative beliefs and replace them with helpful beliefs, you will continue to make progress.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 12 Big Money Blocks Even the Rich Have and How to Reverse Them

💎 What Are Limiting Beliefs About Money?

💎 How to Remove Limiting Beliefs about Money

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.