A Step-by-Step Guide to Building Generational Wealth

Written By Tiffany Woodfield, Financial Advisor, TEP®, CRPC®, CIM®

Many high-achievers are working toward building generational wealth, but the path to securing financial stability for future generations can seem daunting.

In this blog, I’ll share my views on how to do so and 16 different ways to build and preserve generational wealth.

I’ll cover the key components of building wealth, including smart investing, financial education, and estate planning while offering advice on overcoming common challenges and maximizing opportunities.

By the end, you’ll have a clear roadmap to ensure your hard-earned wealth supports your family for future generations.

Why Building Generational Wealth Is Important

Creating generational wealth is important because it sets the next generation up to succeed by creating financial assets and a solid foundation from which to start.

It’s challenging to think abundantly and to be confident in creating wealth.

You may question the value of generational wealth when you notice that many beneficiaries fail to strive and create success and meaning in their lives.

It’s important to remember that generational wealth is just one element that can create a solid financial foundation. Equally and arguably more important is having the right mindset when working to create success and maximize generational wealth.

So, when working towards leaving a legacy, focus on the mindset piece of the puzzle.

Table of Contents

- What Is Generational Wealth?

- Generational Wealth vs. Doing the Work

- What Are Common Wealth-Building Challenges?

- 16 Ways to Build a Legacy of Generational Wealth

- Common Questions about How to Build Generational Wealth

What Is Generational Wealth?

Generational wealth refers to financial assets, investments, and resources that are passed down from one generation to the next.

This wealth can include things like real estate, stocks, businesses, cash, and even life insurance policies. Beyond just money, generational wealth also includes the transfer of financial knowledge, values, and skills that help future generations manage and grow these assets.

In simpler terms, generational wealth is about leaving behind more than just money—it’s about creating a lasting financial legacy that supports your family for years to come.

Generational Wealth vs. Doing the Work

I have a quick anecdote that will illustrate two different approaches to generational wealth.

I’ve changed the names of the characters for privacy. However, these characters are based on my two friends, Jeff and Dirk.

These two friends grew up in the same area. Dirk seems to have the world by its tail. He’s confident, intelligent, and comes from a very successful family. He hasn’t had to work for anything because it has always been easy.

Dirk plans to take each day as it comes, coast, and eventually take over the family business.

Jeff, on the other hand, came from a middle-class family and had to work hard at school, come home to help on the farm, and put himself through university.

Jeff never took anything for granted, and nothing came easily.

However, his parents communicated the importance of education and goals. They wanted more for their son. They regularly spoke about finances and always told him he could be and do anything.

Fast-forward 25 years, and Jeff’s work ethic, financial literacy, and understanding of what was important to him set him up for maximizing generational wealth. Jeff has surpassed Dirk in wealth and has abundant time and freedom.

Dirk had more financial resources to start, but he didn’t have a clear vision or understanding of the family business. While he hasn’t lost his wealth and is still comfortable, he questions what is missing.

Dirk doesn’t feel entirely satisfied with his life despite having all his needs taken care of.

I use this example because financial resources are only part of the equation.

You also need clear goals, financial education, and a purpose for why you’re doing what you’re doing. It’s essential to continue to build and work towards a worthwhile goal, even if it isn’t out of necessity to pay your bills.

True generational wealth transfers wealth in three forms: money, mindset, and knowledge.

What Are Common Wealth-Building Challenges?

When building generational wealth, there is no shortage of challenges.

Some of the most common wealth-building challenges include falling into the working-harder trap, not addressing the money mindset piece, and playing small. Let’s break each one down!

1) Thinking, “If I work harder, I will have more wealth,” is a common trap.

Instead, you must consider how to use your time and work smarter, not just harder. Society has many distractions, so it’s not surprising many people are frazzled and can’t concentrate.

You must create boundaries and strategies to help prioritize the truly important tasks and identify which things drain you. It may feel like you worked a really “hard” day, but reflect on how much of your time was productive and how many things were distractions.

2) Another common challenge is not addressing your money mindset and limiting beliefs.

When you have limiting beliefs about money, you are holding yourself back. We must be proactive, acknowledge our money mindset, and change it to reflect where we want to go.

3) Playing small is an extremely common trap that will affect your ability to grow wealth.

Being afraid of what others would think if you wanted more in your life can hold you back. We must remind ourselves that wanting what we want doesn’t take anything from anyone else.

So, keeping these three common traps in mind, let’s talk about how you can build a legacy of generational wealth. These sixteen strategies will all help you on your path to long-term financial abundance.

16 Ways to Build a Legacy of Generational Wealth

1. Set Your Financial Goals

To create generational wealth, you must define short-term and long-term financial goals. Clear objectives help guide your decisions and measure progress toward building generational wealth.

2. Build a Strong Financial Foundation

Establishing a solid financial base through budgeting, saving, and financial education is crucial. This means getting a clear picture of how much money comes in each month and where it goes. This is your starting point, from which you can prioritize paying down debt, saving, and investing for your future.

3. Manage and Eliminate Debt

Once you understand your current financial situation, you must eliminate existing debts, avoid accumulating debt, and leverage opportunities without compromising your financial health.

4. Have an Emergency Fund

It’s essential to have a financial safety net to protect against unforeseen expenses. An emergency fund usually covers around 3-6 months of expenses saved in a separate account.

5. Invest in Education

Investing in education is investing in yourself and is crucial for personal growth and long-term financial success.

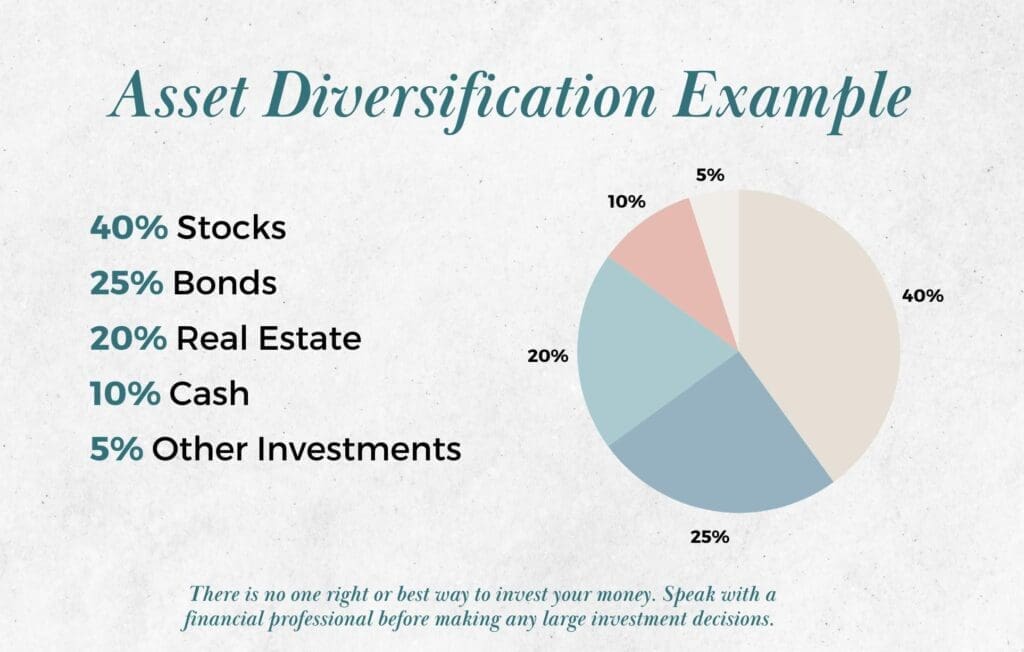

6. Diversify Your Investments

Whether you’re a seasoned investor or just starting out, investing in various financial instruments, including stocks, bonds, GICs, and other assets, is beneficial for creating a balanced and resilient wealth-building strategy. It’s also important to understand the tax implications of your investment choices.

As your assets grow, it’s wise to work with a professional financial advisor or wealth management team to build a diversified investment portfolio.

7. Focus on Long-Term Investing

Too often, investors focus on the short term and underestimate the importance of long-term investment strategies and how they contribute to wealth growth. A short-term mindset often leads to emotional buying and selling, which can be very costly.

A long-term perspective is more stable and follows your financial goals to ensure lasting wealth.

8. Maximize Your Tax Benefits

I often remind clients that a one-year return may fluctuate by a few percentage points, but a major tax hit can cost you more than 40%.

A hefty tax hit can set you back significantly. Understanding ways to take advantage of tax benefits is essential to enhance wealth-building efforts.

9. Consider Homeownership as a Wealth Builder

Homeownership has significant emotional and financial benefits for building generational wealth and financial security.

The financial benefits include the appreciation of a valuable asset, forced savings, and a way to build credit to borrow against. The emotional benefits are a sense of pride, security for your family, comfort, and confidence in your future.

10. Consider Investing in Real Estate

You can invest in real estate beyond your primary residence.

Cash-flow-positive real estate, such as rental properties, can generate ongoing income and may appreciate in value over time.

However, vacation properties, while providing personal enjoyment, may not always generate consistent income and can incur higher maintenance and management costs. It’s essential to evaluate both the financial and lifestyle impacts when considering real estate investments.

The advantages of investing in real estate to build and preserve wealth include:

- Potential for stable cash flow

- Opportunities for passive income

- Tax benefits, such as depreciation and mortgage interest deductions

- Diversification from stock market volatility

- The ability to leverage investments (e.g., using mortgages to acquire additional properties)

11. Build and Protect Your Assets

To build and protect your assets, the first step is understanding your current financial health.

Think of it as a financial check-up. Once you have a clear picture of your financial situation, you can create a comprehensive financial plan that includes budgeting, saving, and debt management strategies.

By tracking where your money goes each month, you can prioritize paying down debt and focus on acquiring valuable assets, such as a home and investments. Your financial plan should also outline your long-term goals and help you stay on track, ensuring that you can continue to grow and protect your assets over time.

12. Have an Estate Plan

It’s essential to have a comprehensive estate plan to ensure the smooth transfer of wealth.

Many people mistakenly assume that only “wealthy families” need an estate plan, and this couldn’t be further from the truth.

Everyone needs an estate plan unless they want the government to make the decisions on their behalf, which will cost their estate money and leave their loved ones exposed.

13. Consider Life Insurance for Wealth Protection

Before I worked in the wealth services industry, I thought insurance was overused and often just “a sales tactic.”

Now, I appreciate its value and necessity as an integral part of wealth protection.

There are three main reasons someone might choose to purchase life insurance:

- Create an Estate: If you have debt and young children, life insurance proceeds can provide financial support for your family if something happens to you.

- Equalize an Estate: If you have a business or asset that may be difficult to divide, life insurance can create liquidity in your estate. This prevents the need to sell assets and helps distribute the estate equally among family members.

- Preserve an Estate: When assets have significantly increased in value, resulting in large capital gains, life insurance can help cover the tax liability. This ensures that you can transfer more of your wealth to your beneficiaries.

14. Plan for Retirement or Work-Optional

Effective retirement planning ensures financial stability in your later years and contributes to generational wealth.

Use retirement accounts, benefits, and strategic planning to secure a comfortable future. If you don’t have a plan for your work-optional future, start planning today.

15. Teach and Share Financial Wisdom with Your Family

Providing your family with financial education tools and resources is vital for maintaining generational wealth.

Early financial education on the financial tools available and the importance of a healthy money mindset helps to instill good money habits from a young age. I cannot stress enough the importance of having open conversations about money to instill good financial habits in the next generation and avoid many future disputes.

Make sure your vision and values are evident from the beginning.

16. Get Expert Financial Advice

Working with financial advisors can provide expert guidance tailored to your wealth-building goals.

Learn how to choose the right financial professionals to help you make informed decisions and optimize your financial strategies. I recommend making sure your advisors specialize in helping people in similar situations and that you feel comfortable asking questions without being made to feel “silly” or “uneducated.”

Your financial advisor needs to be the expert in you and your goals so they can be the quarterback for your financial future.

Common Questions about How to Build Generational Wealth

What is the best way to build wealth that can be passed down to future generations?

Building wealth that can be passed down to future generations can be achieved through various means, such as investing in real estate, financial markets, and creating businesses.

The key difference between those who build generational wealth and those who don’t is that wealth builders invest in themselves. They work to understand their emotional and logical beliefs about money, aligning their mindset with their wealth-building strategies.

They don’t just focus on accumulating money; they focus on their purpose and are driven by the desire to make a meaningful contribution to the future.

How can I start building generational wealth from scratch?

To start building generational wealth from scratch, do a deep dive into your current financial situation.

Uncover where all your money goes each month. Create and follow a detailed strategy to pay down debt, increase savings, and have clear financial goals. Be accountable for your results and ability to stay on track.

In addition, you need to learn the financial tools available to help you earn passive income. You need to learn to invest.

Equally important is to dedicate time to becoming aware of your emotional beliefs about money, wealth, and success. If you have limiting beliefs about money, which most of us do, this will impede your future success and limit your wealth-building efforts.

What is the secret to generational wealth?

The secret to generational wealth is you.

You are the foundation of the “house,” so building a solid financial foundation begins with your financial literacy. Wealth-building habits start with paying down debt, saving consistently, setting clear financial goals, and holding yourself accountable.

This also means staying curious about financial security, identifying any money-related mental blocks, and understanding how they affect your financial future. Once you’ve created a financial plan and eliminated debt, you can start making long-term investments in assets.

In addition, having an emergency fund is essential so you’re not forced to sell valuable assets at the wrong time.

Building generational wealth also means preparing your family for the future, which begins with financial education, open conversations about money, and learning about the available financial tools. Remember, money isn’t the goal; wealth is. And true wealth is the freedom of time.

What is the 3-generation rule of wealth?

The 3-generation rule of wealth suggests that the first generation earns the money, the second generation spends it, and by the third generation, the wealth is gone.

However, this outcome isn’t inevitable. The main reason this often happens is a lack of financial education and forward planning, which leads to mismanagement of wealth.

When the primary wealth creator passes, the second generation may have some financial knowledge and a succession team to help manage the assets.

But by the time the wealth reaches the third generation, the original vision and rules for how the money should be managed are often unclear. Additionally, planning may not have included a succession team for the third generation, which can lead to less structure and more freedom in spending, ultimately diminishing the wealth.

Is it possible to build generational wealth starting with limited financial resources?

Absolutely! Learn how to grow wealth and build your financial foundation.

Be strategic, follow your goals, save more than you spend, avoid debt, and invest for the long term. Surround yourself with people who have similar values and visions. Be courageous and follow your passion and purpose. Education is critical not only for the practical tools but also for your money mindset.

If you’re still a skeptic, just Google “successful people who started with nothing.”

Remember, it isn’t just about working harder; it’s also about working smarter and being disciplined in your vision and goals.

Does proper estate planning play a role in building generational wealth?

In 1789, Benjamin Franklin said, “Nothing is certain except death and taxes.”

This still holds true today. Death and taxes are related because passing away is a major taxable event, and without proper estate planning, more money will end up going to the government.

Also, without a proper estate plan, your wishes won’t be followed, and your estate will be divided according to a government formula. Imagine spending your life building a legacy, and in the end, you won’t be able to protect your assets and loved ones.

How does market volatility affect building generational wealth?

Market volatility can create opportunities to build generational wealth because when the market reacts to factors that affect the market as a whole, such as inflation, government policy, or technology changes, this can create a buying opportunity.

In such cases, the downturn isn’t about supply and demand for an individual stock or whether a company is a good investment.

For example, let’s say you purchased a quality stock for $100, and six months later, it had gone up to $150. However, some bad news affected the entire market, causing a bear market. Your stock is now worth $90. The opportunity is to purchase more of this stock as it’s “on sale.”

Unfortunately, many investors particularly if they are managing investments on their own panic and sell, incurring a loss. This is the problem with trying to “time the market” and missing the best days.

Click below to see a chart that shows you how missing the “best days” affects your investment outcomes:

What is personal finance?

Personal finance refers to all of the financial decisions for your family or household.

This includes budgeting, financial planning, insurance planning, saving and estate planning.

Final Thoughts

Building generational wealth requires more than just financial resources—it’s about fostering the right mindset, making smart investments, and preparing your family for the future.

Remember, wealth isn’t just about money; it’s also about knowledge, values, and a clear purpose. By setting financial goals, educating your family, and planning for the long term, you’re laying the foundation for a lasting legacy.

Take time to nurture both your financial literacy and your family’s understanding of wealth-building strategies. With persistence and the right approach, you can create lasting financial stability for generations.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 Why Is Generational Wealth Important?

💎 How To Become Rich by Saving Money

💎 Wealth Coach: What To Expect and When to Hire an Expert

About the Author

TIFFANY WOODFIELD is a senior financial advisor, estate-planning expert, and dual-licensed portfolio manager based in Kelowna, British Columbia. She is the co-founder of SWAN Wealth Management, where she helps Canadian and cross-border families build lasting wealth, reduce tax risk, and create meaningful legacies.

As a TEP (Trust and Estate Practitioner) and associate portfolio manager, Tiffany works closely with successful professionals, business owners, and internationally mobile families who want to enjoy a more flexible, work-optional lifestyle. She combines deep technical expertise in wealth management with a strong focus on mindset, personal development, and purposeful decision-making.

Tiffany has been a contributor to Bloomberg TV and has been featured in major national and international publications, including The Globe and Mail and Barron’s, for her insights on retirement planning, cross-border wealth issues, and estate planning.

Professional designations:

- TEP® – Trust and Estate Practitioner

- CRPC® – Chartered Retirement Planning Counselor

- CIM® – Chartered Investment Manager