Getting Rich or Staying Rich During a Recession

Understanding how to be rich in a recession means seeing it as a chance to buy things cheaper if you’ve saved up.

A recession means the economy isn’t doing well, which affects jobs and how much money people and businesses make. However, there’s no need to be worried. During a recession, smart moves include saving cash, buying gold and bonds, and investing in companies that pay dividends and make everyday items.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

To keep what you already have safe, mix up your investments and don’t panic-sell.

Also, cutting back on spending is important. This means figuring out what you need versus what you just want and saving money for emergencies.

In this post, I’ll cover the top five investments during a recession and how to protect yourself and your finances. As a financial professional, I know people get scared at the prospect of a recession. But it doesn’t have to keep you up at night.

If you don’t already have a great financial advisor or wealth management team, this will help you get through the next recession with much less worry.

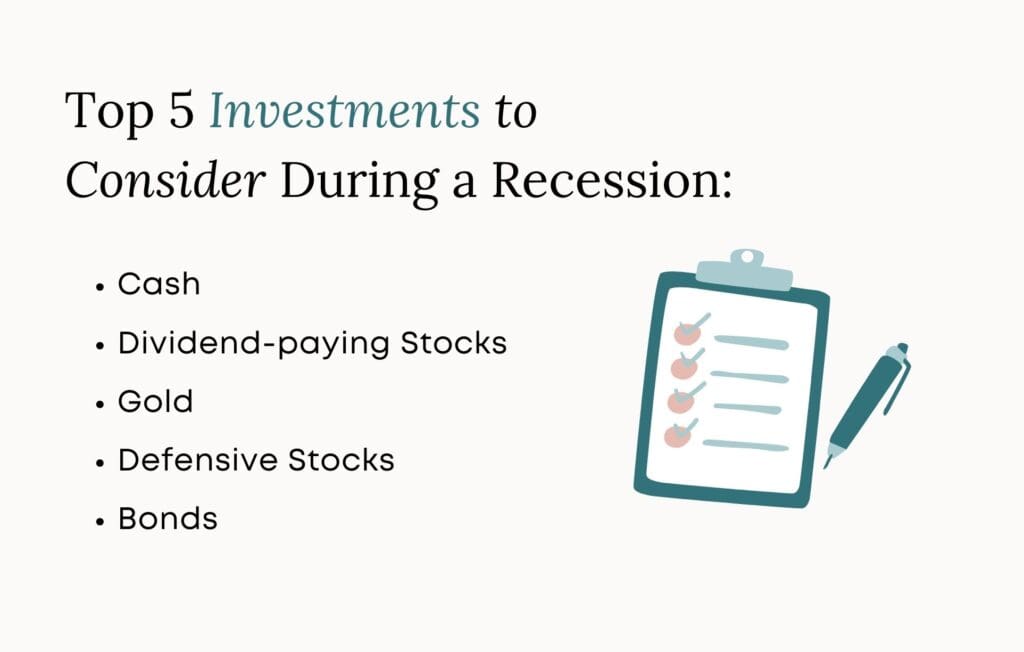

Top 5 Investments During a Recession

These five strategies are worth considering during a recession:

1 – Cash: Keeping cash on hand can have significant benefits. You are ready to take advantage of buying opportunities and aren’t forced to sell if a significant expense arises.

2 – Dividend-Paying Stocks: Investing in dividend-paying stocks is a wise decision. Although you may not see market growth, a steady dividend creates a cushion and helps you “get paid while you wait.”

3 – Gold: Buying gold is common during a recession because it is considered a “safe haven” during economic uncertainty and tends to hold its value. It is also an asset that tends to go up when other asset classes go down.

4 – Defensive Stocks: It’s smart to invest in defensive stocks, such as companies producing household items, food, utilities, or healthcare. Think of things people will still need to use and purchase despite a shrinking economy.

5 – Bonds: It can be beneficial to hold bonds that pay a secure interest rate because they tend to fluctuate less than the general market during a recession.

What is a recession, and how does it affect the economy?

A recession is two consecutive quarters where the GDP declines or the economy contracts over a few months.

A recession impacts everyone, including large and small businesses and the individual consumer. When the economy is in a recession, there usually are job losses, a reduction in company cash flow and profits, and a decline in consumer demand and spending.

A recession also causes a lot of uncertainty in the marketplace, making getting credit more difficult because lenders fear the borrowers will be unable to make payments.

Can you actually get rich during a recession?

Although a recession causes significant anxiety in most people, it also can represent an opportunity if you are in an excellent financial position and have cash on the side.

This is because you can find buying opportunities while everyone is panicking and cutting back. The caveat is that you still don’t know how long it will take for the market to recover, and you may be unable to “time the market” to get the absolute bottom price. So be prepared to stay the course, be level-headed, and only consider quality companies and not “get rich” schemes.

How do I protect my current assets in a recession?

To protect your assets during a recession, ensure your current portfolio is aligned with your risk profile.

A diversified portfolio with various assets, such as stocks, bonds, and quality companies, helps because it smoothes the effect of market fluctuations on your portfolio. Hence, it is easier for you to stay on course for the long term. Ensure you have a long-term plan that considers your ability to handle risk while keeping you on track to reach your goals. It sounds simple, but some of the biggest mistakes happen when people try to “time the market.”

Whatever you do, don’t panic and sell.

To weather a recession successfully, you will need money set aside for emergencies so you don’t “need” the money you have invested.

How can I reduce my personal or business expenses during tough economic times?

Whether you are in tough economic times or not, you need to understand where your money is going each month to reduce expenses.

Create a budget or spreadsheet that shows all the money coming in and going out each month. Separate fixed expenses from flexible expenses and determine the difference between your needs and wants. A need is something you cannot survive without, whereas a want is a “nice to have.”

You will want to understand your cash flow so you don’t have to pay off expensive debt or sell assets that may be down during a recession.

It is essential to create an emergency fund so you can be prepared. As a business owner, you will want to look at ways to reduce costs without limiting future growth.

Remember, a recession can last a few months to a few years.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 How To Become Good at Saving Money

💎 How To Become Rich by Saving Money

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.