What Happens to the Bank Account of Someone Who Dies Intestate?

What happens to bank accounts when someone dies without a will in Canada?

Generally, if someone dies without a will in Canada, their bank account will be frozen until their estate is settled. The distribution of their assets, including funds in their bank account, will follow the provincial or territorial laws.

Usually, this means that the deceased’s assets will be distributed to their closest relatives, such as their spouse or children, depending on the legal framework where they resided. If there are no immediate family members, the estate may eventually go to the provincial government.

Keep in mind that this article is general in nature, and it’s important to consult a legal expert for guidance specific to your situation.

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

What Does It Mean to Die Intestate?

Dying intestate means a person has passed away without a valid will.

When this happens, provincial laws decide how the person’s assets are distributed. This can delay the process and may not reflect the deceased’s wishes.

A 2023 survey indicates that 50% of Canadians don’t have a last will and testament in place, while 13% say that their will is not up to date. Most worrying is the number of Canadians in their 30s and 40s who don’t have a will. As of 2023, 69% of Canadians ages 35-44 did not have a last will and testament in place.

While prevention is ideal, sometimes a person does die intestate, and their family needs to deal with the consequences. We’ll cover the steps you need to take if you’re in this situation.

What Happens to Bank Accounts When There’s No Will?

When you die without a will in Canada, your bank accounts are typically frozen.

This means that no one can access the funds until the probate process is complete and an executor is appointed.

In addition, the courts, rather than you, determine how your assets will be distributed according to intestacy laws. Once these legal steps are cleared, the executor or administrator is authorized to manage the estate and can access the bank accounts to distribute the funds as stipulated by law.

The process can take time, often weeks or months, during which beneficiaries may not have immediate access to the deceased’s funds.

Now let’s break this down in more detail.

1. Joint Bank Accounts vs. Sole Accounts

If you have a joint bank account rather than sole accounts, the surviving account holder(s) can usually continue using the funds without interference from the probate process.

However, sole accounts are frozen until probate is completed, meaning that access to those funds is restricted until the estate is settled. This distinction is crucial to consider when doing your estate planning. Managing financial obligations, such as funeral expenses following the death of an account holder, may not be easy if you don’t have access to account funds.

2. What Happens If the Deceased Was Married?

If the deceased was married, their bank accounts are generally distributed according to provincial intestacy laws, which typically prioritize the surviving spouse.

In some provinces, the spouse may receive the entire estate, depending on the presence of surviving children and other relatives. However, each province varies, and a common law partner may not have the same rights as a spouse for distribution according to intestate rules. Make sure you check the laws in your province or territory.

3. What Happens If the Deceased Had Children?

If the deceased had children, the estate assets, including bank accounts, are usually split between the surviving spouse and the children according to provincial laws. If the deceased person doesn’t have a spouse but has more than one child, they would generally inherit the estate equally.

4. What Happens If the Deceased Had No Spouse or Children?

If the deceased had no spouse or children, the assets, including bank accounts, would be distributed to other relatives according to intestacy laws, which may include parents, siblings, and more distant relatives. The specific distribution hierarchy varies by province but generally aims to keep the assets within the family.

5. What Happens If the Deceased Had No Family at All?

If the deceased had no family, their intestate estate, including bank accounts, would ultimately escheat to the provincial government. This means that any assets would become the property of the state, as there are no legal heirs to inherit the deceased’s estate.

What Happens to Joint Bank Accounts When One Person Dies?

In Canada, when one person dies and there is a joint bank account, the surviving account holder usually automatically keeps access to the funds without the need for probate.

These joint accounts are considered to have a right of survivorship. This means the surviving joint account holder becomes the sole owner of the account upon the other account holder’s death.

Keep in mind, it is still important to inform the bank of the death and have the account re-registered in their name only.

How to Access Funds Without a Will

If someone close to you ends up dying intestate and without an estate plan, the first step is to contact the bank where the deceased held accounts to inform them of the situation.

Gather necessary documents, such as the death certificate and any proof of your relationship to the deceased. Next, you may need to apply for a certificate of appointment of an administrator, which allows you or another family member to manage the estate.

Once you have the necessary legal authority, you can gain access to the funds and begin the process of distributing the assets according to provincial intestacy laws. It’s also wise to consult with a lawyer or estate professional to navigate the process effectively and ensure compliance with local regulations.

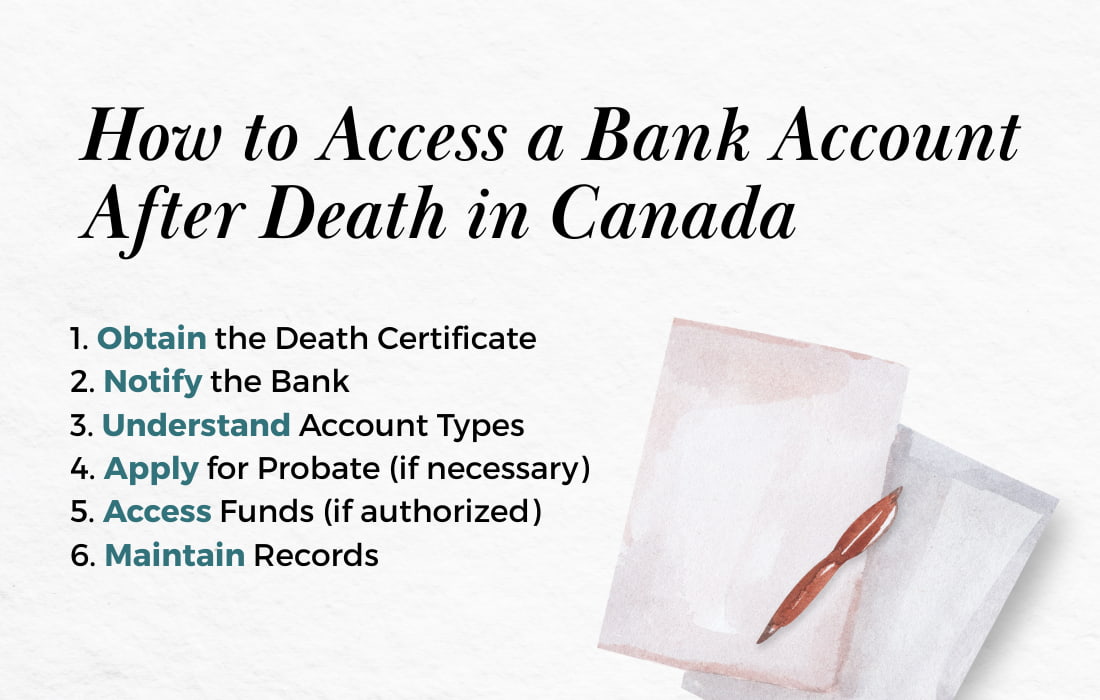

How to Access a Bank Account After Death in Canada

If you find yourself in the unfortunate situation as a family member or appointed administrator where you are trying to access a bank account after the death of a loved one, following these steps can help:

1. Obtain the Death Certificate: You need an official death certificate before dealing with the financial institution.

2. Notify the Bank: Next, you can contact the bank where the deceased held accounts to inform them of the death. You will need to provide the death certificate and any required identification or documentation proving your relationship to the deceased.

3. Understand Account Types: It is important to understand whether the account is a joint account or a sole account. Joint accounts usually remain accessible to the surviving account holder, while sole accounts will be frozen until probate is granted.

4. Apply for Probate (if necessary): If you need to access a sole account, you or another family member must apply for a certificate of appointment of an administrator through the probate court. This process is not simple and can be time-consuming, so I recommend getting started right away.

5. Access Funds (if authorized): Once you have the required authority (either through probate or as a surviving joint account holder), you can access the funds to cover estate debts, funeral expenses, or other obligations.

6. Maintain Records: It is essential to keep thorough records of all transactions related to the estate. These will be essential for future accounting, distribution to beneficiaries, and to help avoid conflicts. You may want to consult with a lawyer regarding your specific situation.

Who Becomes the Executor If There Is No Will?

If someone dies intestate without a will, the court must appoint an administrator to manage the estate.

To become an administrator, family members or close friends would need to apply. If multiple people are eligible and willing, they will need to decide who they want to have be an administrator. Or, if they cannot agree, they will need to go through a formal process through the courts to determine who will be able to act as an administrator. Usually, the court will favour a spouse, adult child, or sibling to take on this role.

The problem is that this takes time, costs money, and can create conflicts.

While all of this is going on, people are likely dealing with the emotional turmoil of a loss and the financial burden of managing the estate when they don’t have access to additional funds or know the wishes of the deceased.

Once an administrator has been given the responsibility to handle the estate, the real work begins. They will need to pay debts, manage the estate assets, and distribute what remains according to the provincial intestate laws.

This is a complex process, and consulting a lawyer can be very helpful in avoiding mistakes.

Why Dying Without a Will Is Difficult on Your Spouse

Dying without a will can create significant challenges for a surviving spouse because provincial laws govern the distribution of assets.

While many assume that everything will automatically transfer to their spouse, the reality is that a portion of the estate may go to any children, including minors, which can complicate access to funds for the surviving spouse.

This can lead to financial difficulties during a time of emotional stress, as the surviving spouse may need to navigate legal requirements to claim their rightful share.

For example, if the family home is solely in the deceased spouse’s name, the surviving spouse may be unable to access or sell the property without first going through the probate process to establish legal authority over the estate.

This can result in delays and potential financial strain, particularly if the home needs maintenance or if other living arrangements must be made while waiting for the estate to settle.

Tips for Avoiding Issues with Bank Accounts After You Die

There are ways to structure your bank accounts to help you avoid issues after you die.

1. Name a Beneficiary (Where Allowed)

- Many banks let you add a “Payable on Death” (POD) beneficiary.

- This lets the money pass directly to your chosen person without probate.

2. Use Joint Accounts Strategically

- Joint accounts with rights of survivorship can transfer automatically to the surviving account holder.

- Be careful—this overrides your will and gives the joint owner full control.

3. Keep Your Will Updated

- Make sure your will names who should receive your assets and aligns with your account setup.

- A will doesn’t override joint ownership or named beneficiaries, but it helps with individual accounts.

4. List All Accounts in One Document

- Create a secure list of your accounts, institutions, and login information for your executor or family.

- Without this, accounts can go unclaimed for years or default to the government.

5. Use a Trust for Large or Complex Estates

- A trust can avoid probate entirely, speed up access to funds, and add privacy.

- This is especially helpful if you have dependents, properties in multiple provinces, or blended family dynamics.

6. Talk to Your Bank

- Ask what options they offer for beneficiaries, joint accounts, or estate planning tools.

- Rules vary between institutions and provinces.

7. Minimize Probate Where Possible

- In Canada, probate fees (especially in Ontario and BC) can be significant.

- Use tools like joint ownership, named beneficiaries, or insurance-style structures to reduce what’s subject to probate.

Common Questions

What does it mean to die intestate?

Dying intestate means that a person has passed without a will. As a result, the government will decide how to distribute the person’s assets based on rules that vary by province. This process is time-consuming and leaves the deceased’s family exposed during a time of financial and emotional stress.

Are bank accounts frozen when someone dies in Canada?

Yes, when someone dies in Canada, their bank accounts are usually frozen until it is determined who is in charge of settling their estate. This means no one can take money out of those accounts until the legal process is completed.

What happens if no beneficiary is named on a bank account?

If no beneficiary is named on a bank account, the money in that account will become part of the deceased person’s estate. It will then be distributed according to the intestacy laws, meaning the government will decide who gets the money based on family relationships.

How are debts handled when someone dies without a will?

Unfortunately, there is no get-out-of-jail-free card, and when someone dies without a will, their debts must still be paid. The estate must settle any debts before any money or property is distributed to heirs. In cases where there isn’t enough money, some debts may go unpaid.

Can creditors access a deceased person’s bank account?

Creditors cannot directly access a deceased person’s bank account until the estate has been settled. They must wait for the estate to be managed by an executor or administrator, who will pay off debts with the assets from the estate.

What happens if your spouse or common-law partner dies without a will?

If your spouse or common-law partner dies without a will, the law will decide how their belongings and money are shared among family members rather than going automatically to you.

This can lead to confusion and delays in receiving what you might expect. It is also important to note that some provinces do not give the same legal rights to common-law partners. For example, in Ontario, the surviving common-law partner generally does not inherit any part of the estate if their partner dies intestate. Make sure to speak to a professional about your situation.

What does an estate trustee do?

An estate trustee, also known as an executor, is responsible for managing a deceased person’s estate. The estate trustee is legally responsible for ensuring debts are paid, the person’s belongings are taken care of accordingly, and what’s left is distributed to the rightful heirs.

What is the Succession Law Reform Act, and why does it matter?

The Succession Law Reform Act is a set of laws that help determine how a deceased person’s belongings are distributed if they die without a will. It matters because it provides clear rules for handling estates so that everything can be settled fairly and legally according to family relationships.

Summary of Key Points:

- When someone dies without a will in Canada, their financial affairs become part of the deceased person’s estate.

- The entire estate must go through a legal process called estate administration.

- The provincial or territorial government sets the rules for how the estate is handled and who inherits the assets.

- If there is no will, a court appoints someone to manage the estate, often called an estate administrator.

- The administrator may need to open an estate account to collect funds, pay off debts, and distribute what remains to heirs.

- Bank accounts may be frozen upon death if they are in the deceased’s sole name, delaying access until the estate is settled.

- Joint bank accounts with rights of survivorship typically pass directly to the surviving account holder and do not go through the estate.

- Without a will, the estate is distributed according to intestacy laws, which vary by province and prioritize spouses, children, and other relatives in a fixed order.

- Spouses may not automatically receive the entire estate, especially in blended families or where common-law status complicates inheritance.

- Accessing funds without a will usually requires court approval, such as a Certificate of Appointment of Estate Trustee Without a Will (Ontario) or similar in other provinces.

- Naming a beneficiary (where allowed) on an account can help avoid probate and speed up access to funds.

- Creating a will and keeping account documentation up to date helps avoid delays, disputes, and unexpected outcomes for loved ones.

Final Thoughts & Next Steps

The implications of dying without a will and the processes surrounding bank account access can help you understand steps to mitigate challenges.

To provide peace of mind, speak to your bank and legal professionals to get your estate in order. Setting up a will may have an initial cost, but the savings and headaches in the future are worthwhile.

Although none of us want to think of a time when we are no longer around, by being proactive and informed, you can ensure your financial affairs are handled smoothly and according to your wishes.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Read More:

💎 How to Build Generational Wealth Successfully

💎 Who Needs to Do Estate Planning?

💎 What Is Estate Planning in Canada?

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.