Getting Your Estate Planning Organized

Written By Tiffany Woodfield, Financial Coach, TEP®, CRPC®, CIM®

Getting your estate organized can feel overwhelming, and many people would like to put this off indefinitely.

However, being proactive means you can relax knowing that everything has been taken care of. When you’ve taken the proper steps to ensure your legacy is protected and your loved ones are considered, you don’t have to worry about the future anymore. In this post, I’ll cover what to bring to an estate planning appointment so that you have everything you need.

I hope to instill confidence in you as you prepare for your estate planning session! And don’t worry; it’s normal to feel a little overwhelmed or unsure about the next steps.

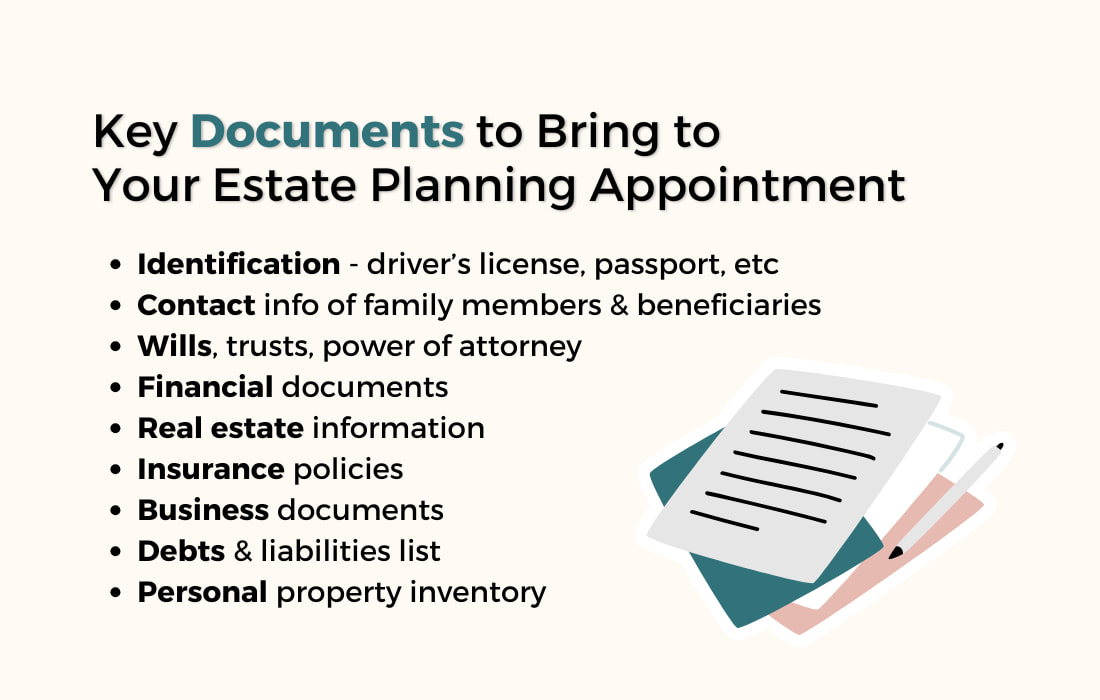

Bring These Key Documents to Your Estate Planning Appointment:

- Identification such as a driver’s license, passport

- Contact information of family members, beneficiaries, and guardians

- Existing Estate Documents such as wills, trusts, power of attorney, and health directives

- Financial documents such as investment accounts, bank statements, and information for other financial assets

- Real estate information for any properties you own

- Insurance Policies

- Business Documents such as partnership agreements, registration, and financial statements

- Debts and Liabilities, for example, current debts such as mortgages and loans

- Personal Property Inventory, i.e., a list of valuable personal property such as jewelry, art, and collectibles

What should I expect during the first estate planning meeting?

During your first estate planning meeting, your planner will ask about your goals and any concerns you have.

You’ll provide information about your family and any significant individuals. You’ll also give an overview of your assets and liabilities.

The estate planner will want to review any existing estate planning documents to evaluate if they are still adequate. Once your estate planner understands your wishes, they’ll explain various estate planning strategies.

You’ll also discuss the fees associated with creating your estate plan. At the end of the meeting, you’ll have an outline of the next steps, including any additional documents you need and when the follow-up meeting will occur.

📖 Related Read: What Questions Should I Ask at an Estate Planning Appointment?

How often should I update my estate plan?

It’s important to update your estate plan when you have any major life events, such as getting married, divorced, the birth of a child, or any significant financial changes. Otherwise, most financial professionals recommend updating your estate plan every 3-5 years.

Can I make changes to my estate plan later?

Yes, you can make changes to your estate plan at a later date.

Estate planning is not a one-time event; it should be regularly reviewed and updated to reflect changes in your life circumstances.

Depending on the type of estate planning documents you have, you may need to create new ones, amend existing ones, or revoke previous documents entirely. It’s wise to review your plan periodically and consult an estate planning professional.

Doing this will ensure your estate plan remains effective and aligned with your current wishes.

What is the difference between a will and a trust?

A will is a legal document that specifies how your assets will be distributed after your death and goes through probate, which can be time-consuming and public.

In contrast, a trust is a fiduciary arrangement that allows you to manage assets during your lifetime and can provide for beneficiaries both during and after your life while usually avoiding probate for quicker and private distribution.

Wills are usually simpler and less expensive to create, and trusts can be more complex and costly but offer enhanced control and flexibility.

How much does it cost to create an estate plan?

The cost of creating an estate plan can vary depending on the complexity of your situation, the type of estate planning documents you need, and the experience of the professional you hire.

On average, simple wills may cost between $300 and $1,000, while more comprehensive estate plans, including trusts, can cost anywhere from $1,500 to $5,000 or more.

Remember to consider these costs as an investment in ensuring your loved ones are protected, and your wishes are followed.

Do I need a lawyer to create an estate plan?

Many people think they can simply create an estate plan online.

Unfortunately, they don’t understand the risks and complexities they can inadvertently fall into. Consulting a professional means you get personalized advice.

You’ll be able to feel confident that your documents comply with the laws in your jurisdiction. You’ll also have assistance navigating potential family dynamics and complex issues such as taxation, which is a critical part of estate planning.

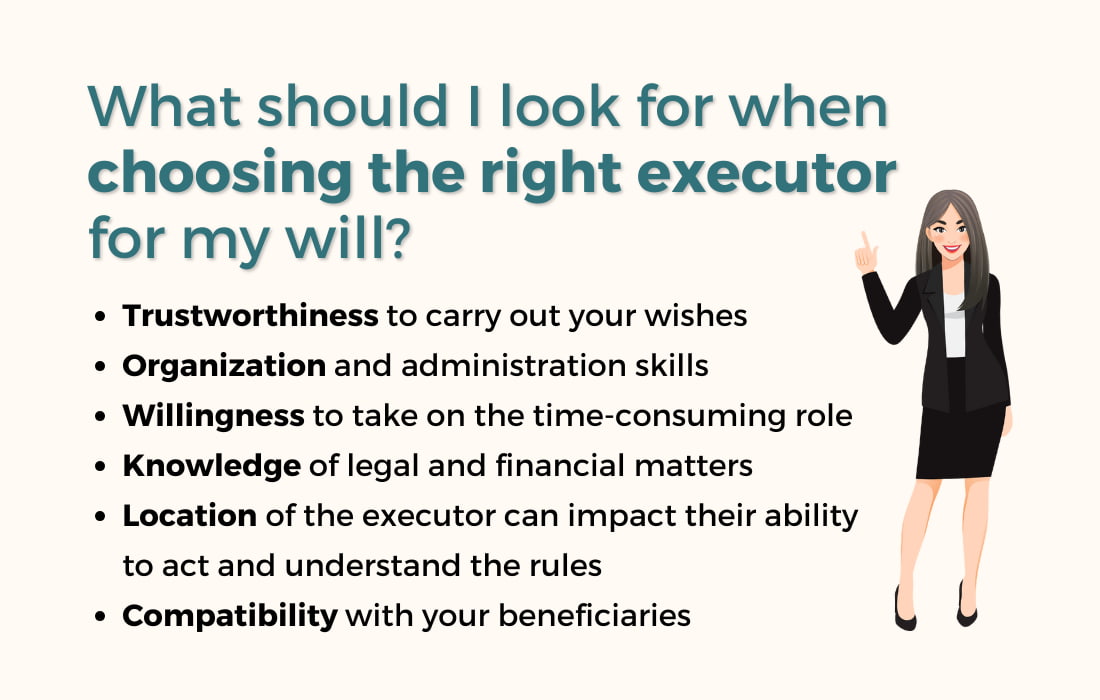

How can I choose the right executor for my will?

Choosing the right executor is essential and can significantly impact how your estate is managed.

Some of the critical factors to consider in an executor are:

- Trustworthiness to carry out your wishes

- Organization and administration skills

- Willingness to take on the time-consuming role

- Knowledge of legal and financial matters

- Location of the executor can impact their ability to act and understand the rules

- Compatibility with your beneficiaries

You’ll also want to name alternatives if the original executor is unwilling or unable to perform this role.

Summary of Key Points

- Bring essential documents: Identification, contact info for beneficiaries, wills, trusts, financial and banking documents, real estate documents, insurance info, business documents, debts, and a personal property inventory.

- Expect a detailed review: Discuss goals, family dynamics, and assets, and receive an overview of estate planning strategies and next steps.

- Update regularly: Revisit your estate plan every 3-5 years or after big life changes to ensure it aligns with your current wishes.

- Difference between wills and trusts: Wills specify asset distribution after death; trusts offer privacy, control, and avoid probate, benefiting lifetime and posthumous needs.

- Estate planning costs vary: Simple wills cost $300-$1,000; comprehensive plans, including trusts, typically range from $1,500 to $5,000+.

- Choose the right executor: Look for someone who is trustworthy, organized, willing, and has legal knowledge. Also, look for someone who is nearby so that your estate can be managed efficiently.

Final Thoughts

Organizing your estate and preparing for your planning appointment is an important step toward protecting your legacy and loved ones.

While it may seem complex, remember that you’re setting up a foundation of security for those you care about most. Each decision you make helps to ensure that your wishes will be honored and your family supported, even in life’s most uncertain moments.

Working with a professional gives you a guiding hand through the process, so you don’t have to navigate it alone. You’re making a thoughtful, empowering choice by taking action now—one that brings lasting peace of mind to you and your family.

Get the Free Guide and Audio Meditation for Manifesting Your Dreams

Pop your email address in the form below to get my easy checklist and guide to manifesting and the guided audio meditation to help you get started.

You’ll also get one or two emails per month with the latest blog posts about abundance, wealth-building, manifesting, and creating a fulfilling life.

Related Articles

💎 What Is Estate Planning in Canada?

💎 How to Establish Generational Wealth

💎 How to Build Generational Wealth Successfully

About the Author

TIFFANY WOODFIELD is a financial coach, cross-border expert, and the co-founder of SWAN Wealth based out of Kelowna, BC. As a TEP and associate portfolio manager, Tiffany has extensive experience working with successful professionals who want to leave a legacy and enjoy an adventurous, work-optional lifestyle. Tiffany combines extensive knowledge from her background as a financial professional with coaching and her passion for personal development to help her clients create a unique path that allows them to live their fullest potential. Tiffany has been a regular contributor to Bloomberg TV and has been interviewed by national and international publications, including the Globe and Mail and Barron’s.